Question: Dee's Bakery sold $ 1 0 , 0 0 0 worth of cakes on credit to a customer. The cost of goods sold for

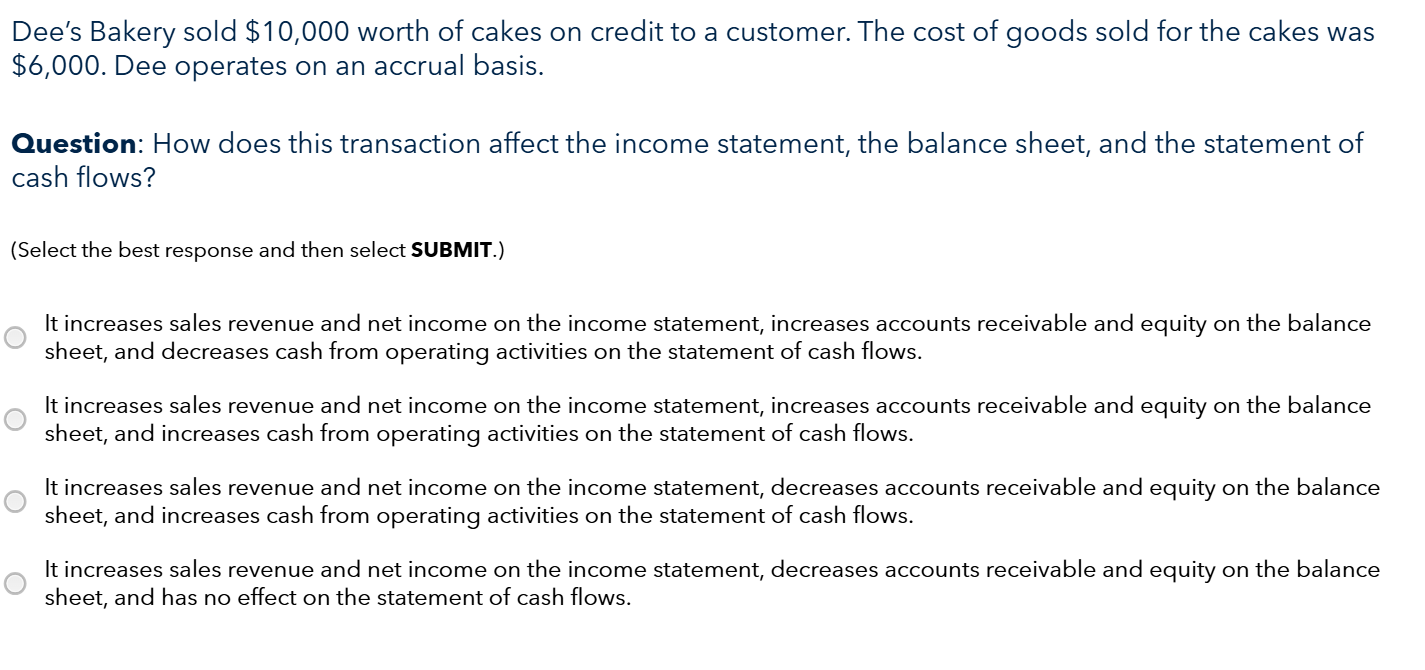

Dee's Bakery sold $ worth of cakes on credit to a customer. The cost of goods sold for the cakes was $ Dee operates on an accrual basis.

Question: How does this transaction affect the income statement, the balance sheet, and the statement of cash flows?

Select the best response and then select SUBMIT.

It increases sales revenue and net income on the income statement, increases accounts receivable and equity on the balance sheet, and decreases cash from operating activities on the statement of cash flows.

It increases sales revenue and net income on the income statement, increases accounts receivable and equity on the balance sheet, and increases cash from operating activities on the statement of cash flows.

It increases sales revenue and net income on the income statement, decreases accounts receivable and equity on the balance sheet, and increases cash from operating activities on the statement of cash flows.

It increases sales revenue and net income on the income statement, decreases accounts receivable and equity on the balance sheet, and has no effect on the statement of cash flows.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock