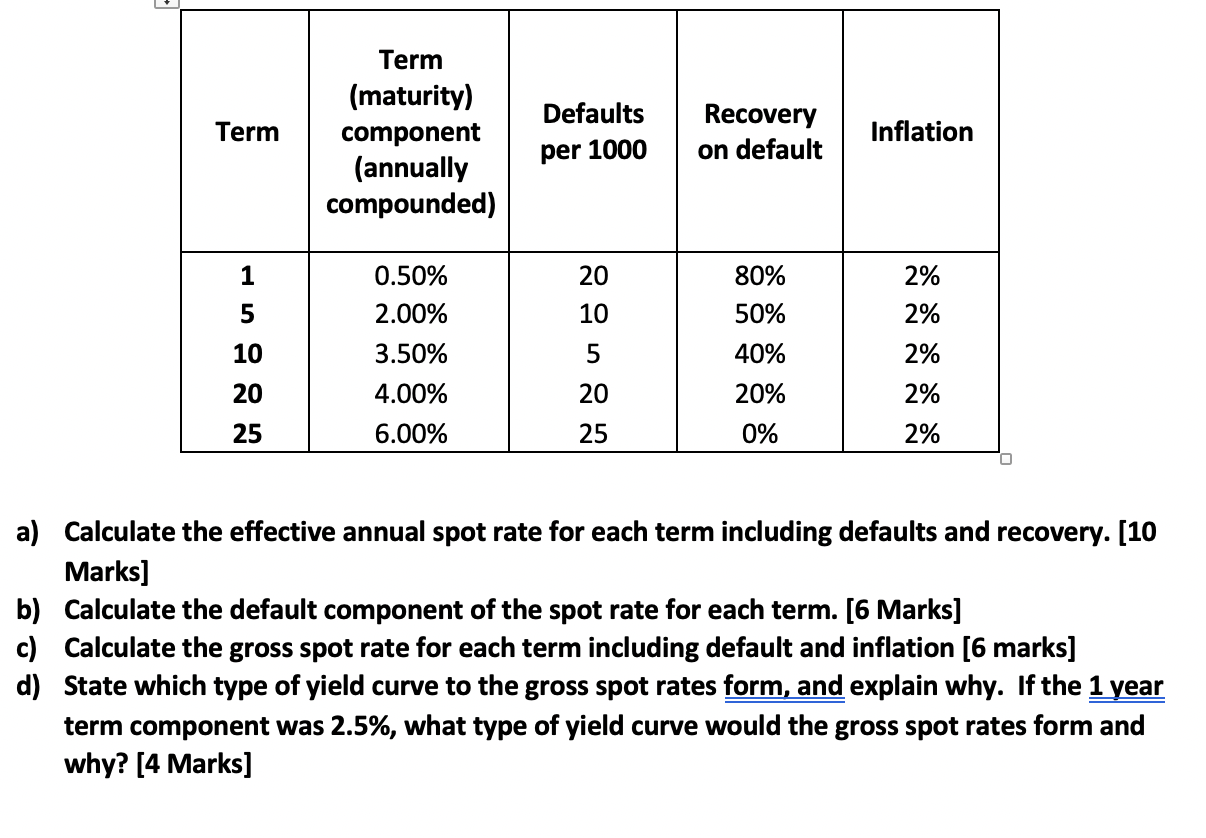

Question: Defaults Term Term (maturity) component (annually compounded) Recovery on default Inflation per 1000 20 2% 10 2% 0.50% 2.00% 3.50% 4.00% 6.00% 80% 50% 40%

Defaults Term Term (maturity) component (annually compounded) Recovery on default Inflation per 1000 20 2% 10 2% 0.50% 2.00% 3.50% 4.00% 6.00% 80% 50% 40% 20% 20 2% 2% 2% 25 0% a) Calculate the effective annual spot rate for each term including defaults and recovery. [10 Marks] b) Calculate the default component of the spot rate for each term. [6 Marks] c) Calculate the gross spot rate for each term including default and inflation [6 marks] d) State which type of yield curve to the gross spot rates form, and explain why. If the 1 year term component was 2.5%, what type of yield curve would the gross spot rates form and why? [4 Marks] Defaults Term Term (maturity) component (annually compounded) Recovery on default Inflation per 1000 20 2% 10 2% 0.50% 2.00% 3.50% 4.00% 6.00% 80% 50% 40% 20% 20 2% 2% 2% 25 0% a) Calculate the effective annual spot rate for each term including defaults and recovery. [10 Marks] b) Calculate the default component of the spot rate for each term. [6 Marks] c) Calculate the gross spot rate for each term including default and inflation [6 marks] d) State which type of yield curve to the gross spot rates form, and explain why. If the 1 year term component was 2.5%, what type of yield curve would the gross spot rates form and why? [4 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts