Question: DEFERRED ANNUITY Whose term does not begin until the expiration of a specified time to say that an annuity is deferred for a certain period

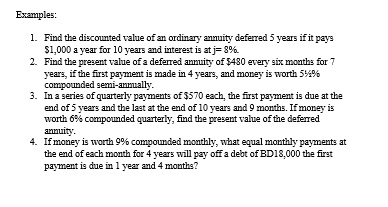

DEFERRED ANNUITY Whose term does not begin until the expiration of a specified time to say that an annuity is deferred for a certain period of time means that the term of the annuity commences at the end of this time. An annuity whose first payment is due sometime after the end of the first interest period. | Fomulas: 1 Present Value of an Ordinary Annuity (1)*" Ad = R(4-1+4) +1) ** 2 Periodic Payment of Ad 20 II A(1-1) 1-(1+i)" 1+ 3 Amount of an Ordinary Deferred Annuity +i)" SER =) =R(4+ Where: A = present value of an ordinary deferred annuity S=amount of an ordinary deferred annuity R=periodic payment i= periodic payment n=number of paying periods d= number of deferred periods Examples: 1. Find the discounted value of an ordinary annuity deferred 5 years if it pays 5 $1,000 a year for 10 years and interest is atj=8%. 2. Find the present value of a deferred annuity of $480 every six months for 7 years, if the first payment is made in 4 years, and money is worth 5%:% compounded semi-annually. 3. In a series of quarterly payments of $570 each, the first payment is due at the end of 5 years and the last at the end of 10 years and 9 months. If money is worth 6% compounded quarterly, find the present value of the deferred annuity. 4. If money is worth 9% compounded monthly, what equal monthly payments at the end of each month for 4 years will pay off a debt of BD18,000 the first payment is due in 1 year and 4 months? DEFERRED ANNUITY Whose term does not begin until the expiration of a specified time to say that an annuity is deferred for a certain period of time means that the term of the annuity commences at the end of this time. An annuity whose first payment is due sometime after the end of the first interest period. | Fomulas: 1 Present Value of an Ordinary Annuity (1)*" Ad = R(4-1+4) +1) ** 2 Periodic Payment of Ad 20 II A(1-1) 1-(1+i)" 1+ 3 Amount of an Ordinary Deferred Annuity +i)" SER =) =R(4+ Where: A = present value of an ordinary deferred annuity S=amount of an ordinary deferred annuity R=periodic payment i= periodic payment n=number of paying periods d= number of deferred periods Examples: 1. Find the discounted value of an ordinary annuity deferred 5 years if it pays 5 $1,000 a year for 10 years and interest is atj=8%. 2. Find the present value of a deferred annuity of $480 every six months for 7 years, if the first payment is made in 4 years, and money is worth 5%:% compounded semi-annually. 3. In a series of quarterly payments of $570 each, the first payment is due at the end of 5 years and the last at the end of 10 years and 9 months. If money is worth 6% compounded quarterly, find the present value of the deferred annuity. 4. If money is worth 9% compounded monthly, what equal monthly payments at the end of each month for 4 years will pay off a debt of BD18,000 the first payment is due in 1 year and 4 months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts