Question: definately confused on this problem... Challenge Problem - Service Industry: woke CPA is trying to determine the billing rates for tax return preparation. Average number

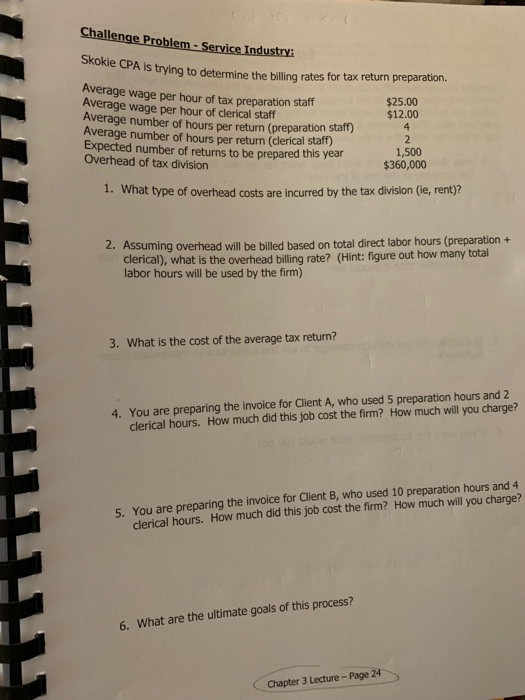

Challenge Problem - Service Industry: woke CPA is trying to determine the billing rates for tax return preparation. Average number of $25.00 $12.00 Average wage per hour of tax preparation staff Average wage per hour of clerical staff Average number of hours per return (preparation staff) Average number of hours per return (clerical staff) Expected number of returns to be prepared this year Overhead of tax division 1,500 $360,000 1. What type of overhead costs are incurred by the tax division (ie, rent)? 2. Assuming overhead will be billed based on total direct labor hours (preparation + clerical), what is the overhead billing rate? (Hint: figure out how many total labor hours will be used by the firm) 3. What is the cost of the average tax return? 4. You are preparing the invoice for Client A, who used 5 preparation hours and 2 clerical hours. How much did this job cost the firm? How much will you charge? 5. You are preparing the invoice for Client B, who used 10 preparation hours and 4 clerical hours. How much did this job cost the firm? How much will you charge? 6. What are the ultimate goals of this process? Chapter 3 Lecture - Page 24

Step by Step Solution

There are 3 Steps involved in it

Lets solve the problem step by step 1 Type of Overhead Costs Overhead costs in the tax division can include rent utilities office supplies software li... View full answer

Get step-by-step solutions from verified subject matter experts