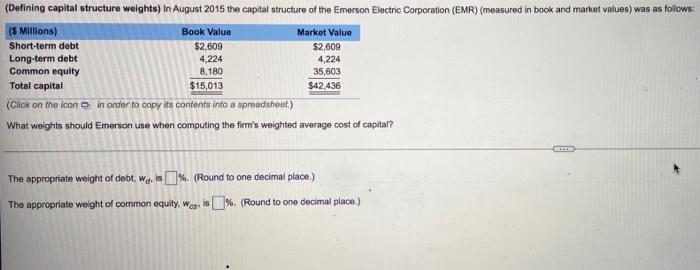

Question: (Defining capital structure weights) In August 2015 the capital structure of the Emerson Electric Corporation (EMR) (measured in book and market values) was as follows:

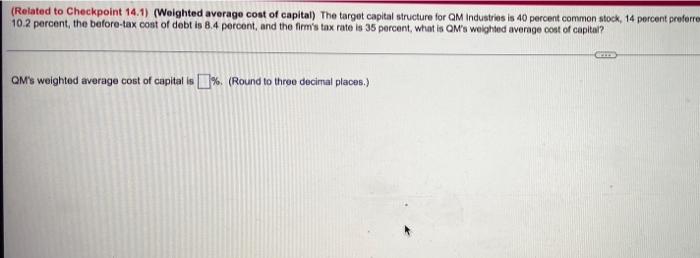

(Defining capital structure weights) In August 2015 the capital structure of the Emerson Electric Corporation (EMR) (measured in book and market values) was as follows: (5 Millions) Book Value Market Value $2,609 Short-term debt Long-term debt $2,609 4,224 4,224 Common equity 8,180 35,603 Total capital $15,013 $42,436 (Click on the icon in order to copy its contents into a spreadsheet.) What weights should Emerson use when computing the firm's weighted average cost of capital? The appropriate weight of debt. w. is%. (Round to one decimal place.) The appropriate weight of common equity. Was is%. (Round to one decimal place.) (Related to Checkpoint 14.1) (Weighted average cost of capital) The target capital structure for QM Industries is 40 percent common stock, 14 percent preferrem 10.2 percent, the before-tax cost of debt is 8.4 percent, and the firm's tax rate is 35 percent, what is QM's weighted average cost of capital? QM's weighted average cost of capital is%. (Round to three decimal places.) industries is 40 percent common stock, 14 percent preferred stock, and 46 percent debt. If the cost of common equity for the firm is 18.6 percent, the cost of preferred stock is weighted average cost of capital? amma

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts