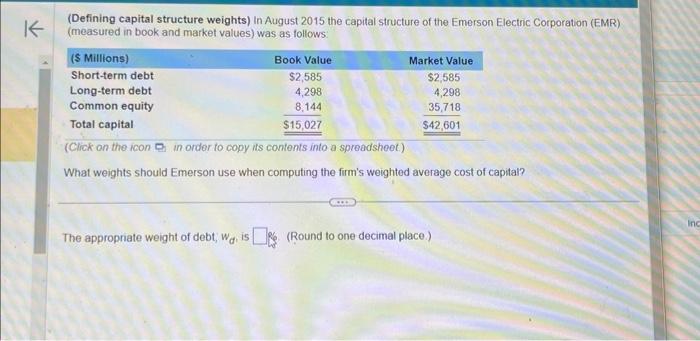

Question: (Defining capital structure weights) In August 2015 the capital structure of the Emerson Electric Corporation (EMR) (measured in book and market values) was as follows

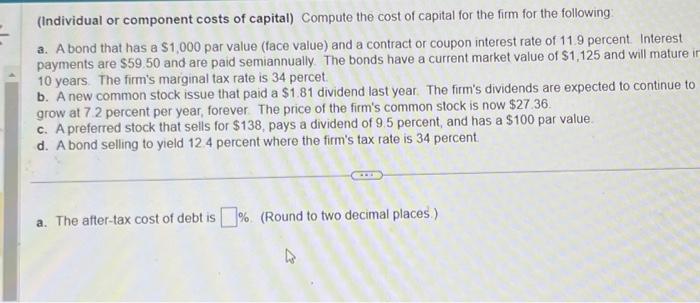

(Defining capital structure weights) In August 2015 the capital structure of the Emerson Electric Corporation (EMR) (measured in book and market values) was as follows (Click on the icon in order to copy its contents into a spreadsheot.) What weights should Emerson use when computing the firm's weighted average cost of capital? The appropriate weight of debt; wd, is (Round to one decimal place.) (Individual or component costs of capital) Compute the cost of capital for the firm for the following a. A bond that has a $1,000 par value (face value) and a contract or coupon interest rate of 11.9 percent. Interest payments are $59.50 and are paid semiannually. The bonds have a current market value of $1,125 and will mature in 10 years. The firm's marginal tax rate is 34 percet. b. A new common stock issue that paid a $1.81 dividend last year. The firm's dividends are expected to continue to grow at 7.2 percent per year, forever. The price of the firm's common stock is now $27.36. c. A preferred stock that sells for $138, pays a dividend of 9.5 percent, and has a $100 par value d. A bond selling to yield 12.4 percent where the firm's tax rate is 34 percent. a. The after-tax cost of debt is \%. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts