Question: Delicious Ltd bakes and sells bread. It is December 2018 and they are planning on baking and selling cupcakes to three types of customers: supermarkets,

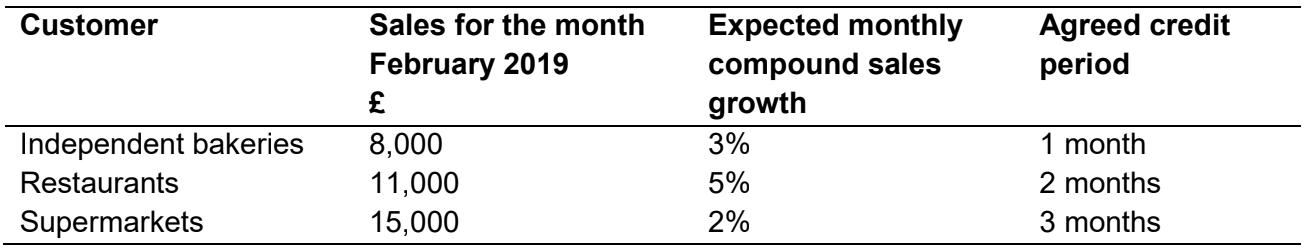

Delicious Ltd bakes and sells bread. It is December 2018 and they are planning on baking and selling cupcakes to three types of customers: supermarkets, independent bakeries, and restaurants. The sales expectations are outlined below:

REQUIRED:

(a) Prepare an aging schedule of receivables (debtors) for February to April. Your schedule should analyze the expected debts outstanding according to customer type and detail the amount (and percentage of total debt outstanding) for each type of customer on a monthly

basis.

(b) Explain what a working capital cycle is in general and then apply it to Delicious Ltd. Give three examples of reasons why Delicious Ltd. would like to hold more or less cash.

(c) Which strategies, in general, could Delicious Ltd undertake to position its business? Analyze each position strategy in light of the product that they are selling.

Customer Independent bakeries Restaurants Supermarkets Sales for the month February 2019 8,000 11,000 15,000 Expected monthly compound sales growth 3% 5% 2% Agreed credit period 1 month 2 months 3 months

Step by Step Solution

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Answer a Aging Schedule of Receivables Customer type Month 1 Month 2 Month 3 Independent bakeries 80... View full answer

Get step-by-step solutions from verified subject matter experts