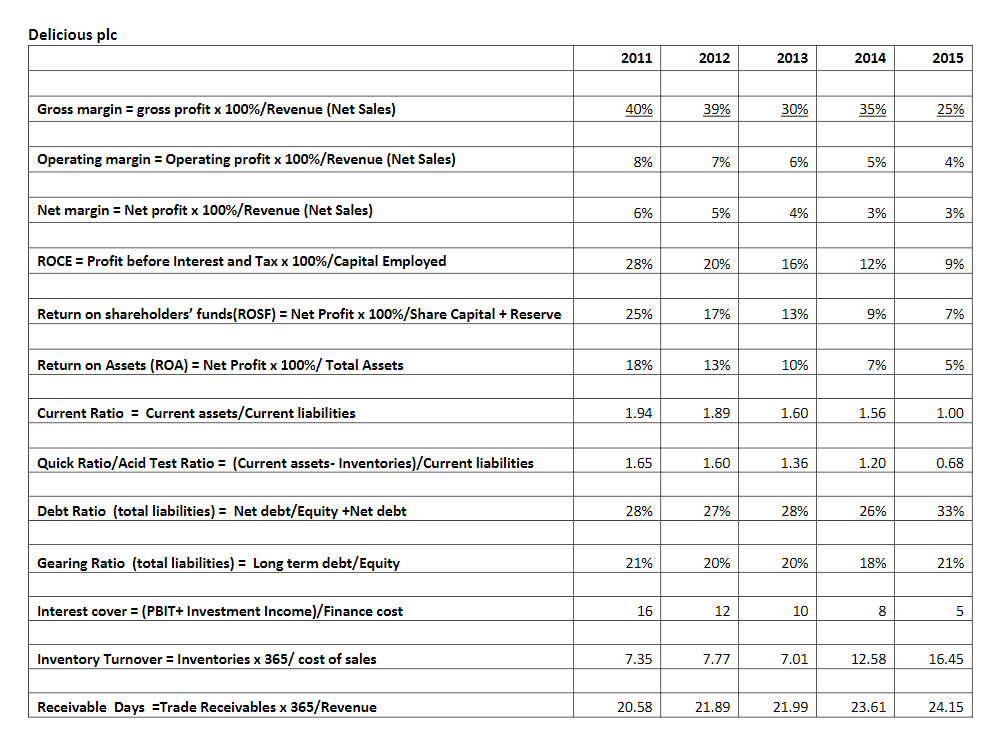

Question: Delicious plc 2011 2012 2013 2014 2015 Gross margin = gross profit x 100%/Revenue (Net Sales) 40% 39% 30% 35% 25% Operating margin = Operating

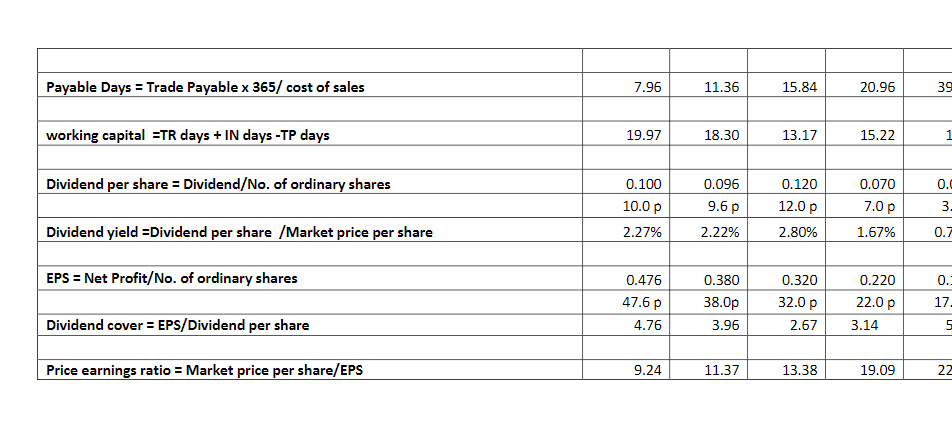

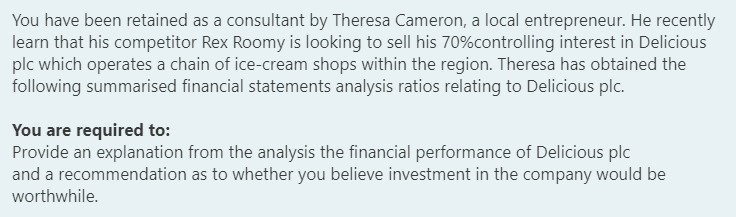

Delicious plc 2011 2012 2013 2014 2015 Gross margin = gross profit x 100%/Revenue (Net Sales) 40% 39% 30% 35% 25% Operating margin = Operating profit x 100%/Revenue (Net Sales) 8% 7% 6% 5% 4% Net margin = Net profit x 100%/Revenue (Net Sales) 6% 5% 4% 3% 3% ROCE = Profit before Interest and Tax x 100%/Capital Employed 28% 20% 16% 12% 9% Return on shareholders' funds(ROSF) = Net Profit x 100%/Share Capital + Reserve 25% 17% 13% 9% 7% Return on Assets (ROA) = Net Profit x 100%/Total Assets 18% 13% 10% 7% 5% Current Ratio = Current assets/Current liabilities 1.94 1.89 1.60 1.56 1.00 Quick Ratio/Acid Test = (Current assets- Inventories)/Current liabilities 1.65 1.60 1.20 0.68 Debt Ratio (total liabilities) = Net debt/Equity +Net debt 28% 27% 28% 26% 33% Gearing Ratio (total liabilities) = Long term debt/Equity 21% 20% 20% 18% 21% Interest cover = (PBIT+ Investment Income)/Finance cost 16 12 10 8 5 Inventory Turnover = Inventories x 365/ cost of sales 7.35 7.77 7.01 12.58 16.45 Receivable Days Trade Receivables x 365/Revenue 20.58 21.89 21.99 23.61 24.15 Payable Days = Trade Payable x 365/ cost of sales 7.96 11.36 15.84 20.96 39 working capital =TR days + IN days -TP days 19.97 18.30 13.17 15.22 1 Dividend per share = Dividend/No. of ordinary shares 0.100 10.0p 0.096 9.6 p 2.22% 0.120 12.0 p 0.070 7.0 p 0.C 3. Dividend yield =Dividend per share /Market price per share 2.27% 2.80% 1.67% 0.7 EPS = Net Profit/No. of ordinary shares 0.476 47.6 p 4.76 0.380 38.0p 3.96 0.320 32.0 p 2.67 0.220 22.0 p 3.14 0. 17 Dividend cover = EPS/Dividend per share 5 Price earnings ratio = Market price per share/EPS 9.24 11.37 13.38 19.09 22 You have been retained as a consultant by Theresa Cameron, a local entrepreneur. He recently learn that his competitor Rex Roomy is looking to sell his 70%controlling interest in Delicious plc which operates a chain of ice-cream shops within the region. Theresa has obtained the following summarised financial statements analysis ratios relating to Delicious plc. You are required to: Provide an explanation from the analysis the financial performance of Delicious plc and a recommendation as to whether you believe investment in the company would be worthwhile. Delicious plc 2011 2012 2013 2014 2015 Gross margin = gross profit x 100%/Revenue (Net Sales) 40% 39% 30% 35% 25% Operating margin = Operating profit x 100%/Revenue (Net Sales) 8% 7% 6% 5% 4% Net margin = Net profit x 100%/Revenue (Net Sales) 6% 5% 4% 3% 3% ROCE = Profit before Interest and Tax x 100%/Capital Employed 28% 20% 16% 12% 9% Return on shareholders' funds(ROSF) = Net Profit x 100%/Share Capital + Reserve 25% 17% 13% 9% 7% Return on Assets (ROA) = Net Profit x 100%/Total Assets 18% 13% 10% 7% 5% Current Ratio = Current assets/Current liabilities 1.94 1.89 1.60 1.56 1.00 Quick Ratio/Acid Test = (Current assets- Inventories)/Current liabilities 1.65 1.60 1.20 0.68 Debt Ratio (total liabilities) = Net debt/Equity +Net debt 28% 27% 28% 26% 33% Gearing Ratio (total liabilities) = Long term debt/Equity 21% 20% 20% 18% 21% Interest cover = (PBIT+ Investment Income)/Finance cost 16 12 10 8 5 Inventory Turnover = Inventories x 365/ cost of sales 7.35 7.77 7.01 12.58 16.45 Receivable Days Trade Receivables x 365/Revenue 20.58 21.89 21.99 23.61 24.15 Payable Days = Trade Payable x 365/ cost of sales 7.96 11.36 15.84 20.96 39 working capital =TR days + IN days -TP days 19.97 18.30 13.17 15.22 1 Dividend per share = Dividend/No. of ordinary shares 0.100 10.0p 0.096 9.6 p 2.22% 0.120 12.0 p 0.070 7.0 p 0.C 3. Dividend yield =Dividend per share /Market price per share 2.27% 2.80% 1.67% 0.7 EPS = Net Profit/No. of ordinary shares 0.476 47.6 p 4.76 0.380 38.0p 3.96 0.320 32.0 p 2.67 0.220 22.0 p 3.14 0. 17 Dividend cover = EPS/Dividend per share 5 Price earnings ratio = Market price per share/EPS 9.24 11.37 13.38 19.09 22 You have been retained as a consultant by Theresa Cameron, a local entrepreneur. He recently learn that his competitor Rex Roomy is looking to sell his 70%controlling interest in Delicious plc which operates a chain of ice-cream shops within the region. Theresa has obtained the following summarised financial statements analysis ratios relating to Delicious plc. You are required to: Provide an explanation from the analysis the financial performance of Delicious plc and a recommendation as to whether you believe investment in the company would be worthwhile

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts