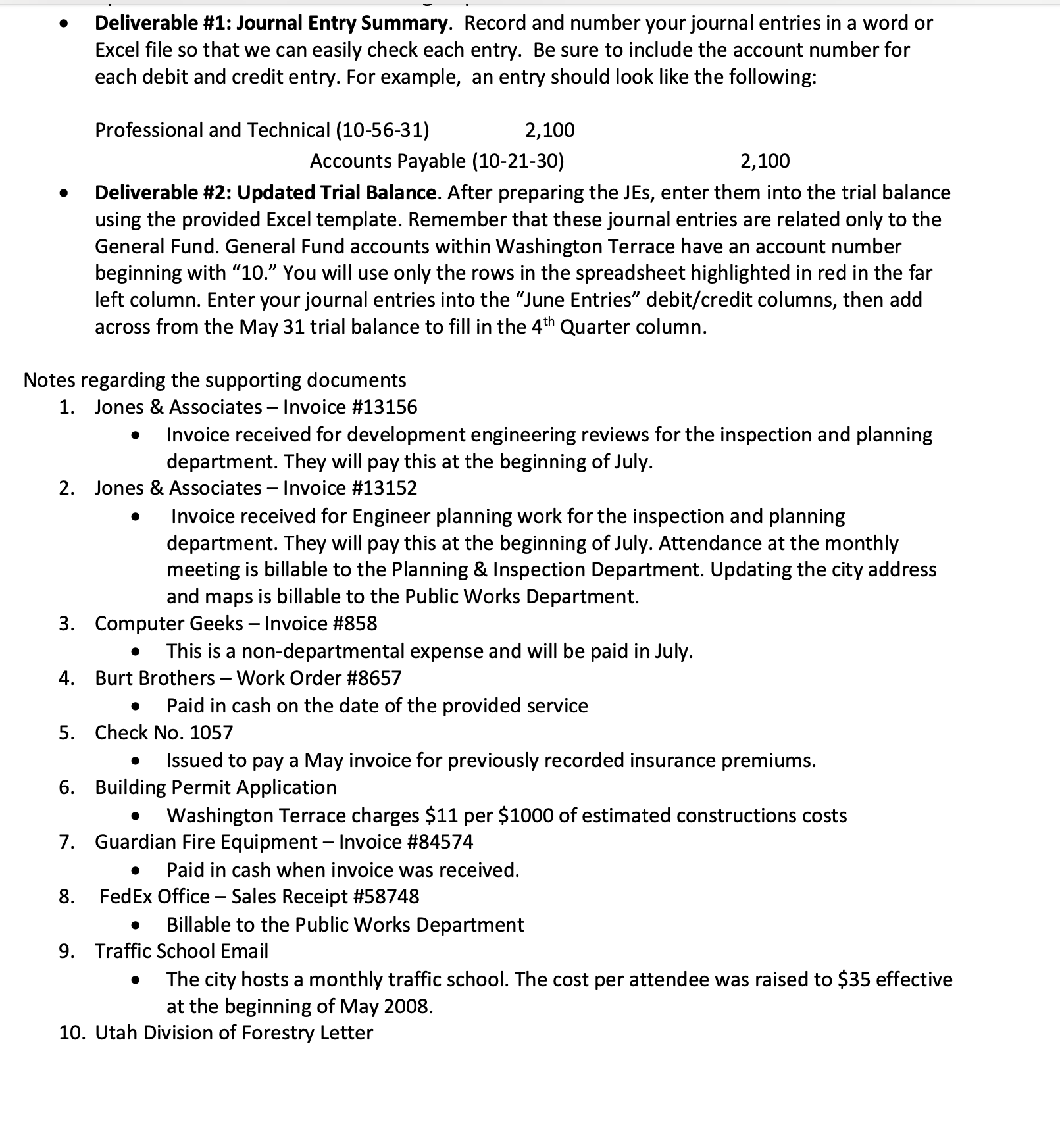

Question: Deliverable # 1 : Journal Entry Summary. Record and number your journal entries in a word or Deliverable # 1 : Journal Entry Summary. Record

Deliverable #: Journal Entry Summary. Record and number your journal entries in a word or Deliverable #: Journal Entry Summary. Record and number your journal entries in a word or

Excel file so that we can easily check each entry. Be sure to include the account number for

each debit and credit entry. For example, an entry should look like the following:

Professional and Technical

Accounts Payable

Deliverable #: Updated Trial Balance. After preparing the JEs, enter them into the trial balance

using the provided Excel template. Remember that these journal entries are related only to the

General Fund. General Fund accounts within Washington Terrace have an account number

beginning with You will use only the rows in the spreadsheet highlighted in red in the far

left column. Enter your journal entries into the "June Entries" debitcredit columns, then add

across from the May trial balance to fill in the Quarter column.

Notes regarding the supporting documents

Jones & Associates Invoice #

Invoice received for development engineering reviews for the inspection and planning

department. They will pay this at the beginning of July.

Jones & Associates Invoice #

Invoice received for Engineer planning work for the inspection and planning

department. They will pay this at the beginning of July. Attendance at the monthly

meeting is billable to the Planning & Inspection Department. Updating the city address

and maps is billable to the Public Works Department.

Computer Geeks Invoice #

This is a nondepartmental expense and will be paid in July.

Burt Brothers Work Order #

Paid in cash on the date of the provided service

Check No

Issued to pay a May invoice for previously recorded insurance premiums.

Building Permit Application

Washington Terrace charges $ per $ of estimated constructions costs

Guardian Fire Equipment Invoice #

Paid in cash when invoice was received.

FedEx Office Sales Receipt #

Billable to the Public Works Department

Traffic School Email

The city hosts a monthly traffic school. The cost per attendee was raised to $ effective

at the beginning of May

Utah Division of Forestry Letter Received cash transfer upon receipt of letter

State of Utah Invoice #

Several city council members attended a two day training session in Salt Lake City. Along

with the invoiced training costs, hotel and food costs were $ and transportation

costs were $ The costs associated with this training are to be paid for on the city

credit card which will be paid off within the next few weeks.

Funds Transfer Email

Interest Payments Email

The city earns interest on state sponsored bonds that pay quarterly payments at an

annual rate of The city charges the residents who are delinquent in tax payments

annually due quarterly. The city received the full amount of interest due on the

principal during the last month of June. Record the two sources of interest in one

consolidated journal entry.

Tax Collection Summary Email

This email will result in journal entries as regarding the following

Real Estate Taxes In order to calculate the property taxes, Washington Terrace

charges $ for every $ of net assessed value. The building permit but

not the check is included in the supporting documents.

Delinquent Property Taxes

General Sales Tax The state pays each city a portion of the state sales tax

earned on consumer purchases. In Washington Terrace, the state charges

sales tax. The state pays Washington Terrace of the sales tax earned within

the city boundaries. The amount due from the state is based on the sales within

the city, which totaled $

Vehicle Taxes

Wasatch Telephone Company Invoice #

of the telephone bill is allocated to the Administration Department. They won't pay

the bill until July. Record only the journal entry to account for the Administration

portion.

America First Credit Union Invoice #

The billed amount is chargeable to the treasurer and is automatically withdrawn from

the cash account at the credit union.

Ogden Power Invoice #

Paid upon receipt of invoice

Weber County Sheriff's Office Invoice #

Paid upon receipt of invoice

Ogden City Invoice #

Paid upon receipt of in

Excel file so that we can easily check each entry. Be sure to include the account number for

each debit and credit entry. For example, an entry should look like the following:

Professional

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock