Question: Dell Ltd is considering replacing an old machine with a new one. The old one cost $100,000; the new one will cost $70,000. The new

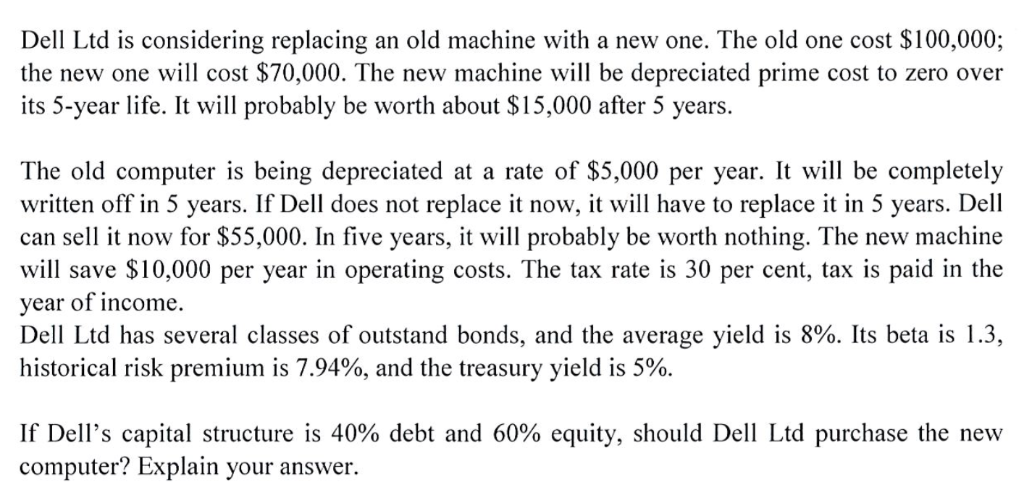

Dell Ltd is considering replacing an old machine with a new one. The old one cost $100,000; the new one will cost $70,000. The new machine will be depreciated prime cost to zero over its 5-year life. It will probably be worth about $15,000 after 5 years. The old computer is being depreciated at a rate of $5,000 per year. It will be completely written off in 5 years. If Dell does not replace it now, it wi have to replace it in 5 years. Dell can sell it now for $55,000. In five years, it will probably be worth nothing. The new machine will save $10,000 per year in operating costs. The tax rate is 30 per cent, tax is paid in the year of income. Dell Ltd has several classes of outstand bonds, and the average yield is 8%. Its beta is 1.3, historical risk premium is 7.94%, and the treasury yield is 5%. If Dell's capital structure is 40% debt and 60% equity, should Dell Ltd purchase the new computer? Explain your answer. Dell Ltd is considering replacing an old machine with a new one. The old one cost $100,000; the new one will cost $70,000. The new machine will be depreciated prime cost to zero over its 5-year life. It will probably be worth about $15,000 after 5 years. The old computer is being depreciated at a rate of $5,000 per year. It will be completely written off in 5 years. If Dell does not replace it now, it wi have to replace it in 5 years. Dell can sell it now for $55,000. In five years, it will probably be worth nothing. The new machine will save $10,000 per year in operating costs. The tax rate is 30 per cent, tax is paid in the year of income. Dell Ltd has several classes of outstand bonds, and the average yield is 8%. Its beta is 1.3, historical risk premium is 7.94%, and the treasury yield is 5%. If Dell's capital structure is 40% debt and 60% equity, should Dell Ltd purchase the new computer? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts