Question: Delta Co. is considering a new inventory system that will cost $750,000. The system is expected to generate positive cash flows over the next four

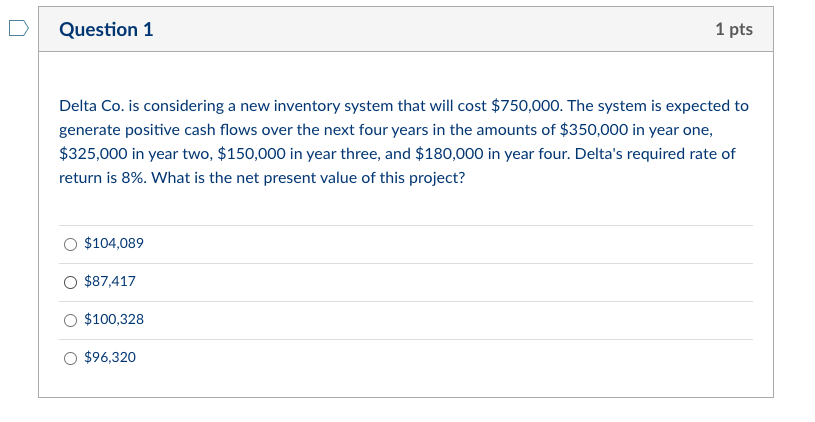

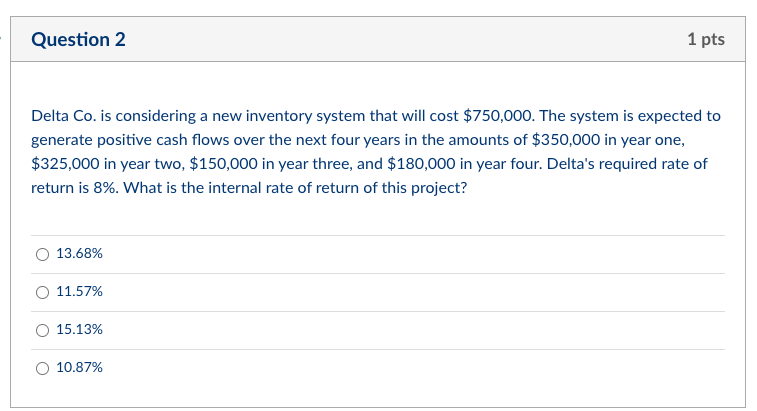

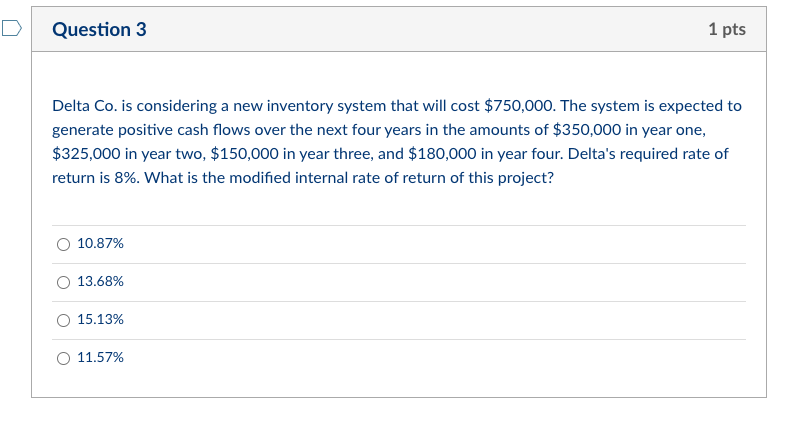

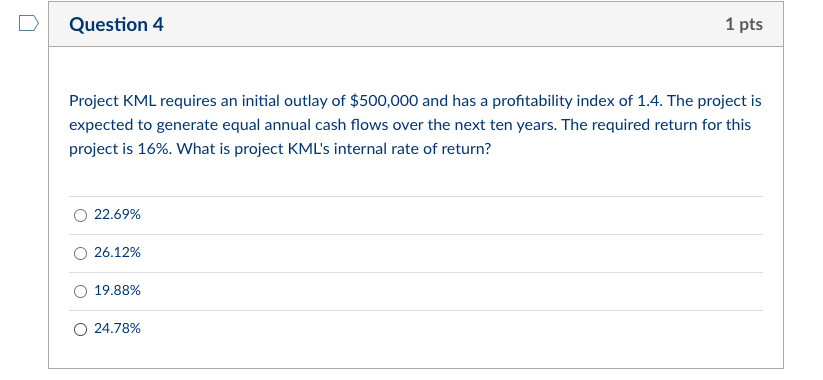

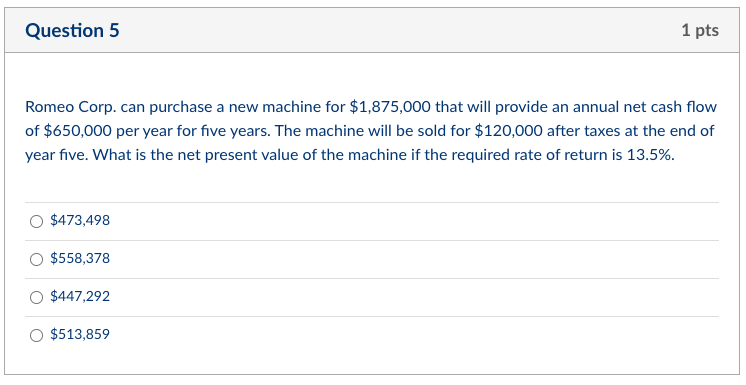

Delta Co. is considering a new inventory system that will cost $750,000. The system is expected to generate positive cash flows over the next four years in the amounts of $350,000 in year one, $325,000 in year two, $150,000 in year three, and $180,000 in year four. Delta's required rate of return is 8%. What is the net present value of this project? \begin{tabular}{c} $104,089 \\ \hline$87,417 \\ \hline$100,328 \\ \hline$96,320 \end{tabular} Delta Co. is considering a new inventory system that will cost $750,000. The system is expected to generate positive cash flows over the next four years in the amounts of $350,000 in year one, $325,000 in year two, $150,000 in year three, and $180,000 in year four. Delta's required rate of return is 8%. What is the internal rate of return of this project? 13.68%11.57%15.13%10.87% Delta Co. is considering a new inventory system that will cost $750,000. The system is expected to generate positive cash flows over the next four years in the amounts of $350,000 in year one, $325,000 in year two, $150,000 in year three, and $180,000 in year four. Delta's required rate of return is 8%. What is the modified internal rate of return of this project? 10.87%13.68%15.13%11.57% Project KML requires an initial outlay of $500,000 and has a profitability index of 1.4. The project is expected to generate equal annual cash flows over the next ten years. The required return for this project is 16%. What is project KML's internal rate of return? 22.69%26.12%19.88%24.78% Romeo Corp. can purchase a new machine for $1,875,000 that will provide an annual net cash flow of $650,000 per year for five years. The machine will be sold for $120,000 after taxes at the end of year five. What is the net present value of the machine if the required rate of return is 13.5%. $473,498$558,378$447,292$513,859

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts