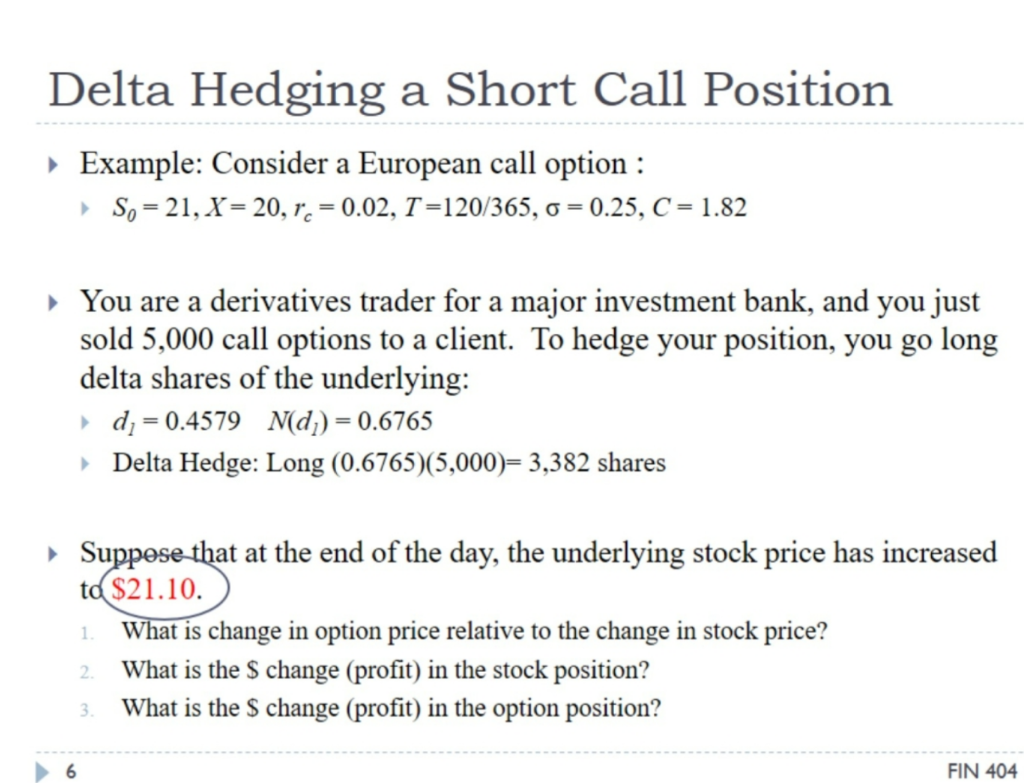

Question: Delta Hedging a Short Call Position > Example: Consider a European call option: So = 21, x= 20.= 0.02. T=120/365, = 0.25, C = 1.82

Delta Hedging a Short Call Position > Example: Consider a European call option: So = 21, x= 20.= 0.02. T=120/365, = 0.25, C = 1.82 You are a derivatives trader for a major investment bank, and you just sold 5,000 call options to a client. To hedge your position, you go long delta shares of the underlying: d 0.4579 N(d 0.6765 Delta Hedge: Long (0.6765)(5,000)- 3,382 shares at at the end of the day, the underlying stock price has increased Su td $21.10. What is change in option price relative to the change in stock price? What is the S change (profit) in the stock position? 2 What is the S change (profit) in the option position? FIN 404

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts