Question: Demonstrate how you get the total cost and NPV value. Present Location ? Premises: 13,393 usable square feet with a 12% add-on factor Term: 10

Demonstrate how you get the total cost and NPV value.

Present Location ?

Premises: 13,393 usable square feet with a 12% add-on factor

Term: 10 years

Base Rent: $24.00 per rentable square foot for years 1-3; $25.00 per rentable square foot for years 4-7; $27.00 per rentable square foot for years 8-10

Electricity: Included in Base Rent

Additional Rent: Tenant will reimburse Landlord for increases in Taxes and Operating Expenses over the first lease year. First Year Taxes are $2.25 per rentable square foot and initial Operating Expenses are $4.14 per rentable square foot for the first lease year.

Rent Abatement: Base Rent is abated for the first eight (8) months

Work Allowance: The Landlord?s contribution is calculated at $52.00 per usable square foot. The Tenant?s total cost of construction, architects and engineer?s fees, communications, furniture and equipment investment will be $920,200

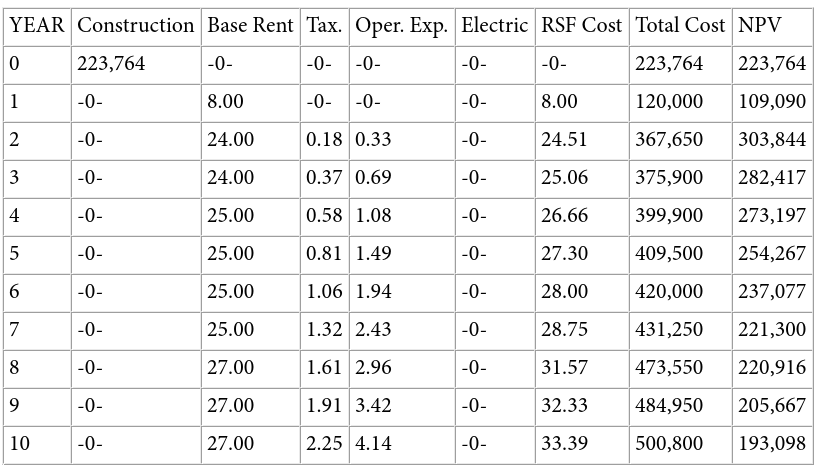

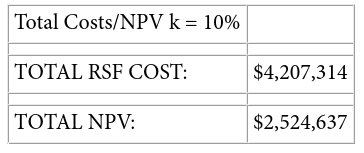

NPV Comparison Analysis Table:

Demonstrate how you get the total cost and NPV value.

YEAR Construction Base Rent Tax. Oper. Exp. Electric RSF Cost Total Cost NPV 0 223,764 -0- -0--0- -0- 223,764 223,764 1 8.00 -0--0- 8.00 120,000 109,090 2 24.00 24.51 367,650 303,844 3 24.00 25.06 375,900 282,417 4 25.00 26.66 399,900 273,197 5 25.00 27.30 409,500 254,267 6 25.00 28.00 420,000 237,077 7 25.00 28.75 431,250 221,300 8 27.00 31.57 473,550 220,916 9 27.00 32.33 484,950 205,667 10 27.00 33.39 500,800 193,098 -0- -0- -0- -0- -0- -0- -0- -0- -0- -0- 0.18 0.33 0.37 0.69 0.58 1.08 0.81 1.49 1.06 1.94 1.32 2.43 1.61 2.96 1.91 3.42 2.25 4.14 -0- -0- -0- -0- -0- -0- -0- -0- -0- -0- -0-

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

To calculate the total cost and Net Present Value NPV we need to consider several elements including base rent operating expenses taxes and initial co... View full answer

Get step-by-step solutions from verified subject matter experts