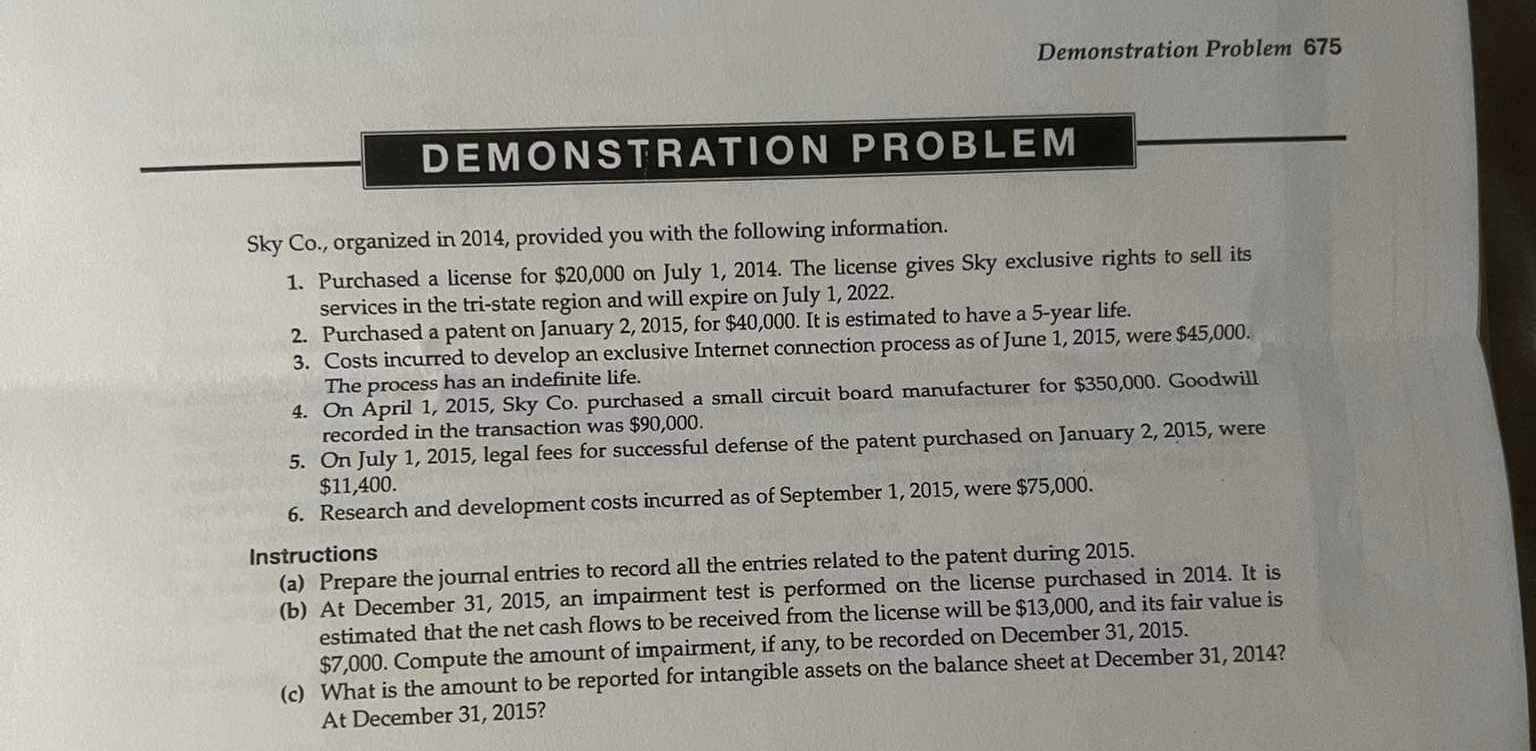

Question: Demonstration Problem 6 7 5 DEMONSTRATION PROBLEM Sky Co . , organized in 2 0 1 4 , provided you with the following information. Purchased

Demonstration Problem

DEMONSTRATION PROBLEM

Sky Co organized in provided you with the following information.

Purchased a license for $ on July The license gives Sky exclusive rights to sell its services in the tristate region and will expire on July

Purchased a patent on January for $ It is estimated to have a year life.

Costs incurred to develop an exclusive Internet connection process as of June were $ The process has an indefinite life.

On April Sky Co purchased a small circuit board manufacturer for $ Goodwill recorded in the transaction was $

On July legal fees for successful defense of the patent purchased on January were $

Research and development costs incurred as of September were $

Instructions

a Prepare the joumal entries to record all the entries related to the patent during

b At December an impairment test is performed on the license purchased in It is estimated that the net cash flows to be received from the license will be $ and its fair value is $ Compute the amount of impairment, if any, to be recorded on December

c What is the amount to be reported for intangible assets on the balance sheet at December At December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock