Question: Denim Industries can borrow its needed financing for expansion using one of two foreign lending facilities. It can borrow at a nominal annual interest rate

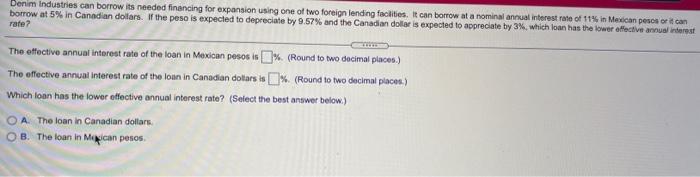

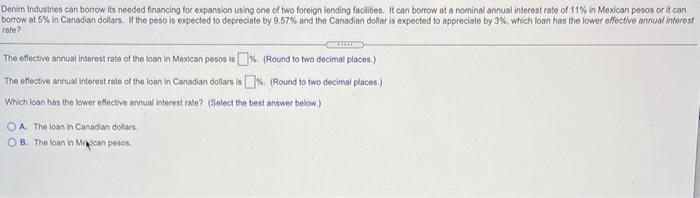

Denim Industries can borrow its needed financing for expansion using one of two foreign lending facilities. It can borrow at a nominal annual interest rate of 115 in Mexican pesos or it can borrow at 5% in Canadian dollars. If the peso is expected to depreciate by 9.57% and the Canadian dollar is expected to appreciate by 3%, which loan has the lower effective annual interest rate? The effective annual interest rate of the loan in Mexican pesos is % (Round to two decimal places.) The effective annual interest rate of the loan in Canadian dollars is []% (Round to two decimal places) Which loan has the lower effective annual interest rate? (Select the best answer below.) OA. The loan in Canadian dollars. OB. The loan in Mexican pesos Denim Industries can borrow its needed financing for expansion using one of two foreign lending facilities. It can borrow at a nominal annual interest rate of 11% in Mexican pesos or it can borrow at 5% in Canadian dollars. If the peso is expected to depreciate by 9.57% and the Canadian dollar is expected to appreciate by 3%, which loan has the lower effective annual interest rate The effective annual interest rate of the loan in Maxican pesos is 11% (Round to two decimal places) The elective annual interest rate of the loan in Canadian dollars is (% (Round to two decimat places.) Which loon has the lower effective annual interest rate? (Select the best answer below) O A The loan in Canadian dollars OB. The loan in Mexican pesos

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts