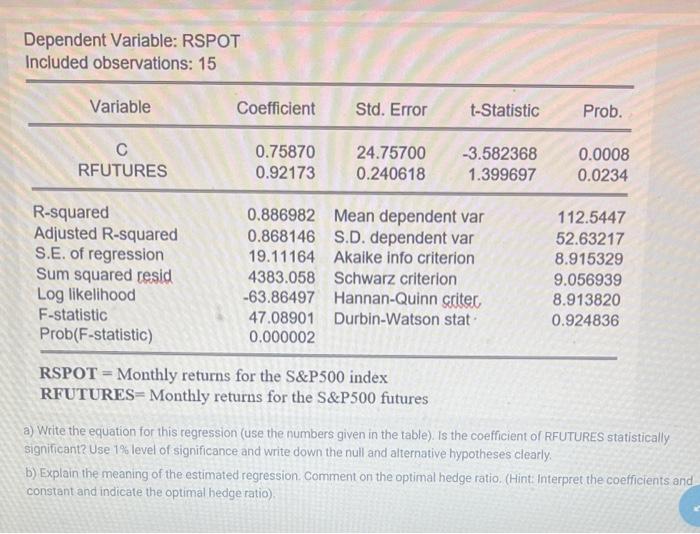

Question: Dependent Variable: RSPOT Included observations: 15 Variable Coefficient Std. Error t-Statistic Prob. RFUTURES 0.75870 0.92173 24.75700 0.240618 -3.582368 1.399697 0.0008 0.0234 R-squared Adjusted R-squared S.E.

Dependent Variable: RSPOT Included observations: 15 Variable Coefficient Std. Error t-Statistic Prob. RFUTURES 0.75870 0.92173 24.75700 0.240618 -3.582368 1.399697 0.0008 0.0234 R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood F-statistic Prob(F-statistic) 0.886982 Mean dependent var 0.868146 S.D. dependent var 19.11164 Akalke info criterion 4383.058 Schwarz criterion -63.86497 Hannan-Quinn criter 47.08901 Durbin-Watson stat 0.000002 112.5447 52.63217 8.915329 9.056939 8.913820 0.924836 RSPOT = Monthly returns for the S&P500 index RFUTURES- Monthly returns for the S&P500 futures a) Write the equation for this regression (use the numbers given in the table). Is the coefficient of RFUTURES statistically significant? Use 1% level of significance and write down the null and alternative hypotheses clearly b) Explain the meaning of the estimated regression. Comment on the optimal hedge ratio. (Hint: Interpret the coefficients and constant and indicate the optimal hedge ratio)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts