Question: - Depreciation adjustment results from a difference between the GAAP basis and tax basis of depreciable equipment. - Bad debt expense adjustment results from a

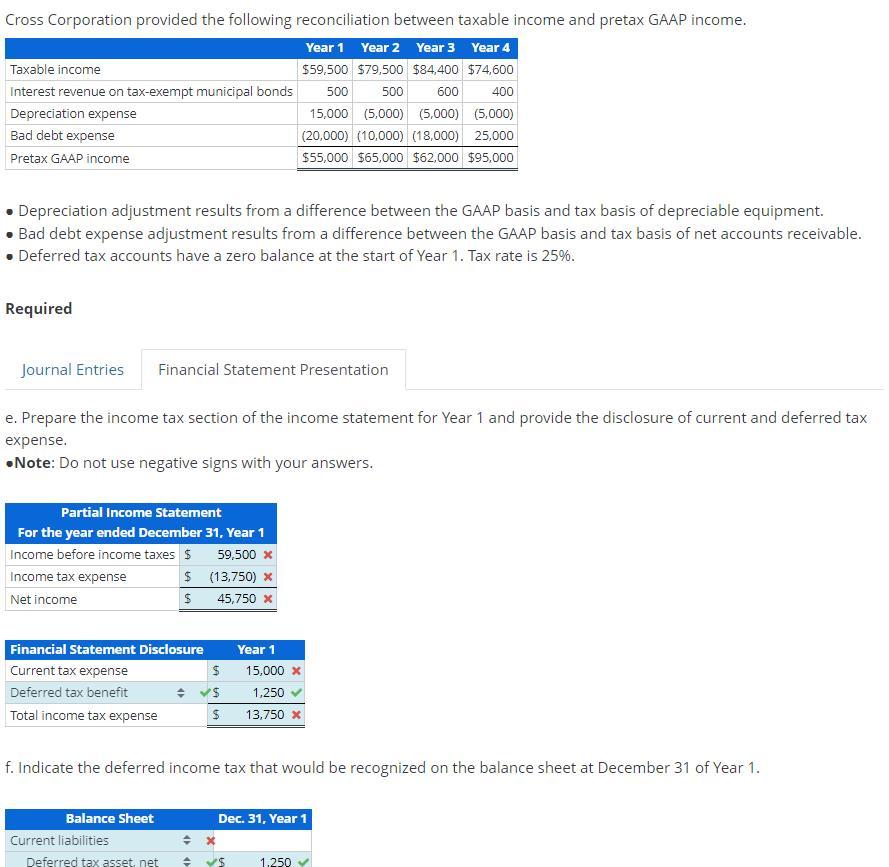

- Depreciation adjustment results from a difference between the GAAP basis and tax basis of depreciable equipment. - Bad debt expense adjustment results from a difference between the GAAP basis and tax basis of net accounts receivable. - Deferred tax accounts have a zero balance at the start of Year 1 . Tax rate is 25%. Required e. Prepare the income tax section of the income statement for Year 1 and provide the disclosure of current and deferred tax expense. - Note: Do not use negative signs with your answers. f. Indicate the deferred income tax that would be recognized on the balance sheet at December 31 of Year 1. - Depreciation adjustment results from a difference between the GAAP basis and tax basis of depreciable equipment. - Bad debt expense adjustment results from a difference between the GAAP basis and tax basis of net accounts receivable. - Deferred tax accounts have a zero balance at the start of Year 1 . Tax rate is 25%. Required e. Prepare the income tax section of the income statement for Year 1 and provide the disclosure of current and deferred tax expense. - Note: Do not use negative signs with your answers. f. Indicate the deferred income tax that would be recognized on the balance sheet at December 31 of Year 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts