Question: Depreciation Analysis: Straight - Line Method versus Double Declining Balance Method If your answer is zero, enter 0 . DDB method the formulas

Depreciation Analysis: StraightLine Method versus Double Declining Balance Method If your answer is zero, enter

DDB method

the formulas so that they can be copied and pasted for the subsequent years. Make sure there is a lower limit for the yearend book value so that it does not become lower than the residual value.

c For years copy year s cells and paste them in the rows for years

If your answer is zero, enter

Create two bar charts, one for depreciation expense per year and the other for book value at year end. Choose the correct graphs. Compare the straightline and the DDB methods in each chart.

The book value goes down more quickly for the method, but at the end of year the two methods have the same book value, which is the residual value.

Explain why a company would chose to use each method.

The input in the box below will not be graded, but may be reviewed and considered by your instructor.

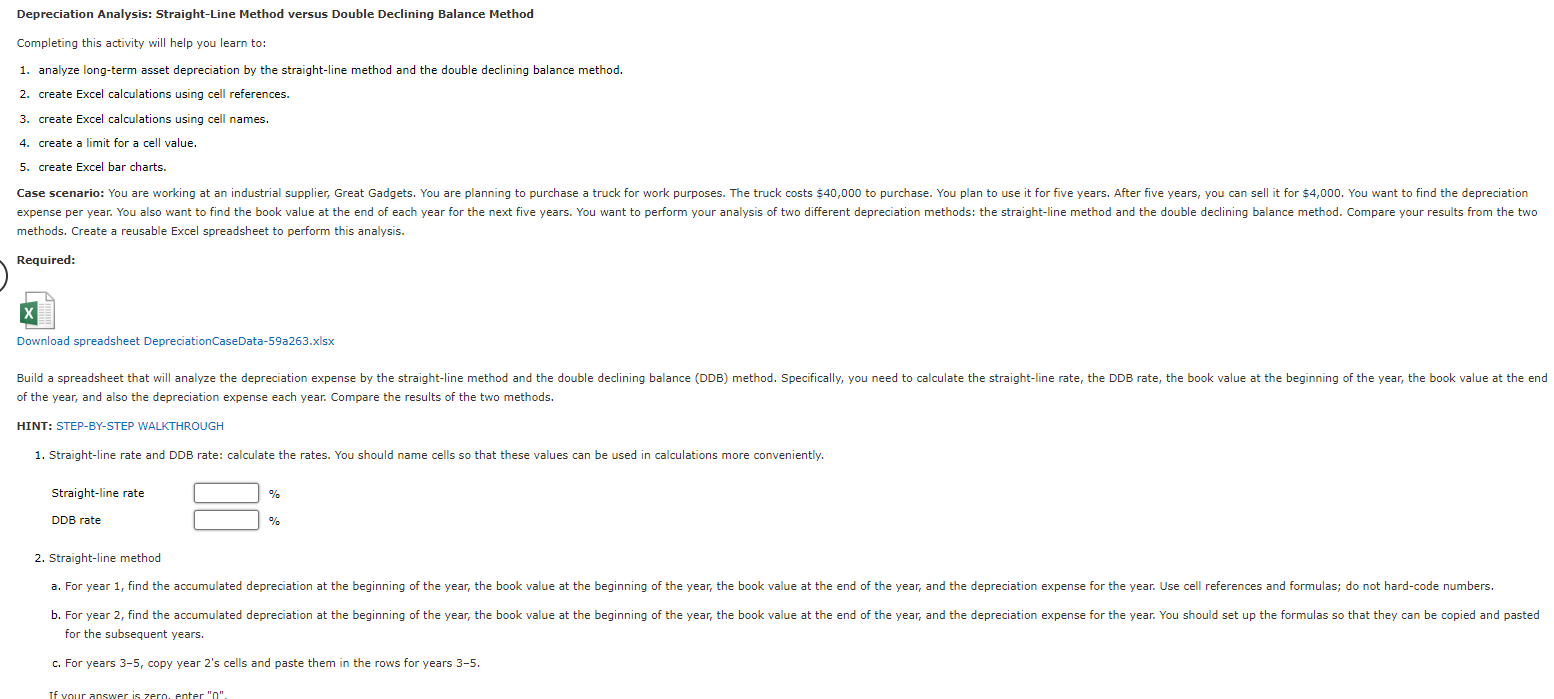

Completing this activity will help you learn to:

analyze longterm asset depreciation by the straightline method and the double declining balance method.

create Excel calculations using cell references.

create Excel calculations using cell names.

create a limit for a cell value.

create Excel bar charts.

methods. Create a reusable Excel spreadsheet to perform this analysis.

Required:

Download spreadsheet DepreciationCaseDataaxlsx

of the year, and also the depreciation expense each year. Compare the results of the two methods.

HINT: STEPBYSTEP WALKTHROUGH

Straightline rate and DDB rate: calculate the rates. You should name cells so that these values can be used in calculations more conveniently.

Straightline rate

DDB rate

Straightline method

for the subsequent years.

c For years copy year s cells and paste them in the rows for years

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock