Question: Depreciation commences or continues when a . The asset has been paid for. b . The asset is available for use. c . The asset's

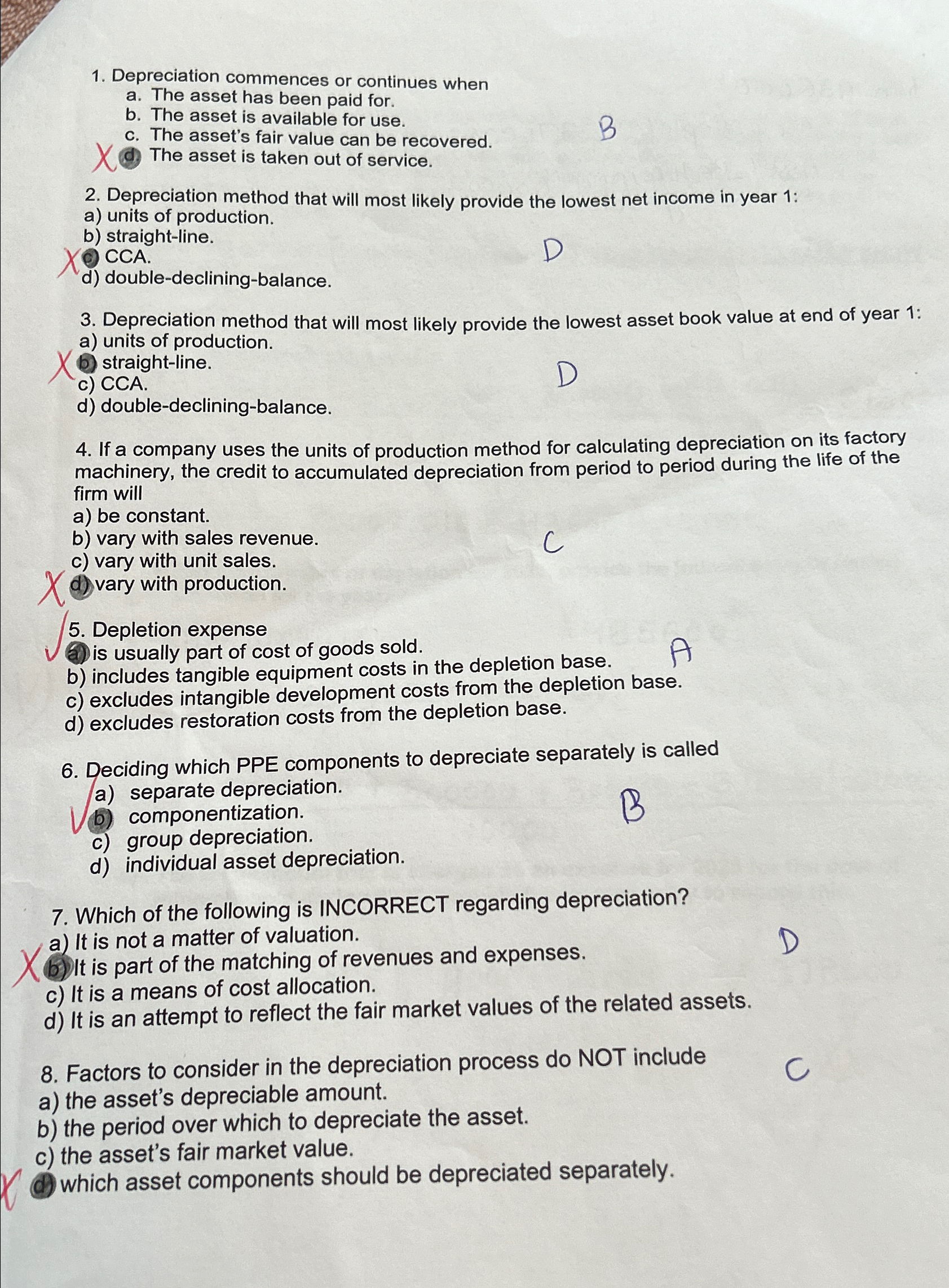

Depreciation commences or continues when

a The asset has been paid for.

b The asset is available for use.

c The asset's fair value can be recovered.

d The asset is taken out of service.

Depreciation method that will most likely provide the lowest net income in year :

a units of production.

b straightline.

c CCA.

d doubledecliningbalance.

Depreciation method that will most likely provide the lowest asset book value at end of year :

a units of production.

b straightline.

c CCA.

d doubledecliningbalance.

If a company uses the units of production method for calculating depreciation on its factory machinery, the credit to accumulated depreciation from period to period during the life of the firm will

a be constant.

b vary with sales revenue.

c vary with unit sales.

d vary with production.

Depletion expense

a is usually part of cost of goods sold.

b includes tangible equipment costs in the depletion base.

c excludes intangible development costs from the depletion base.

d excludes restoration costs from the depletion base.

Deciding which PPE components to depreciate separately is called

a separate depreciation.

b componentization.

c group depreciation.

d individual asset depreciation.

Which of the following is INCORRECT regarding depreciation?

a It is not a matter of valuation.

b It is part of the matching of revenues and expenses.

c It is a means of cost allocation.

d It is an attempt to reflect the fair market values of the related assets.

Factors to consider in the depreciation process do NOT include

a the asset's depreciable amount.

b the period over which to depreciate the asset.

c the asset's fair market value.

d which asset components should be depreciated separately.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock