Question: Depreciation EXERCISE Indicate the best answer for each question in the space provided Use the following data for the four independent questions which follow: On

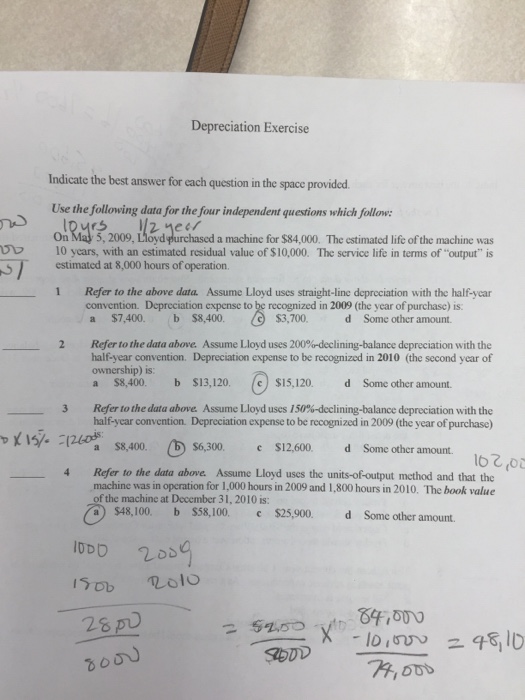

Depreciation EXERCISE Indicate the best answer for each question in the space provided Use the following data for the four independent questions which follow: On May 5, 2009. Lloyd purchased a machine for $84,000. The estimated life of the machine was 10 years, with an estimated residual value of $10,000 The service life in terms of "output" is estimated at 8,000 hours of operation Refer to the above data Assume Lloyd uses straight-line deprecation with the half-year convention Depreciation expense to be recognized in 2009 (the year of purchase) is: $7,400 $8,400 $3,700 Some other amount Refer to the data above. Assume Lloyd uses 200%-declining-balance depreciation with the half-year convention Depreciation expense to be recognized in 2010 (the second year of ownership) is $8,400 $13,120 $15,120 Some other amount Refer to the data above. Assume Lloyd uses 150% declining-balance deprecation with the half-year convention Depreciation expense to be recognized in 2009 (the year of purchase) $8,400 $6,300 $12,600 Some other amount Refer to the data above. Assume Lloyd uses the units-of output method and that the machine was in operation for 1,000 hours in 2009 and 1,800 hours in 2010 The book value of the machine at December 31, 2010 is: S48.IOO $58,100 $25,900 Some other amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts