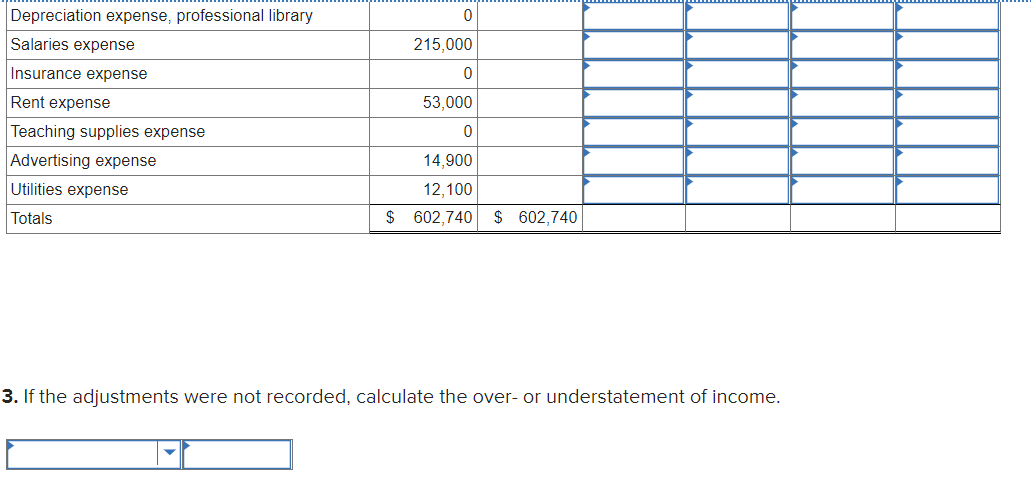

Question: Depreciation expense, professional library Salaries expense Insurance expense Rent expense Teaching supplies expense Advertising expense Utilities expense Totals 0 215,000 0 53,000 0 14,900

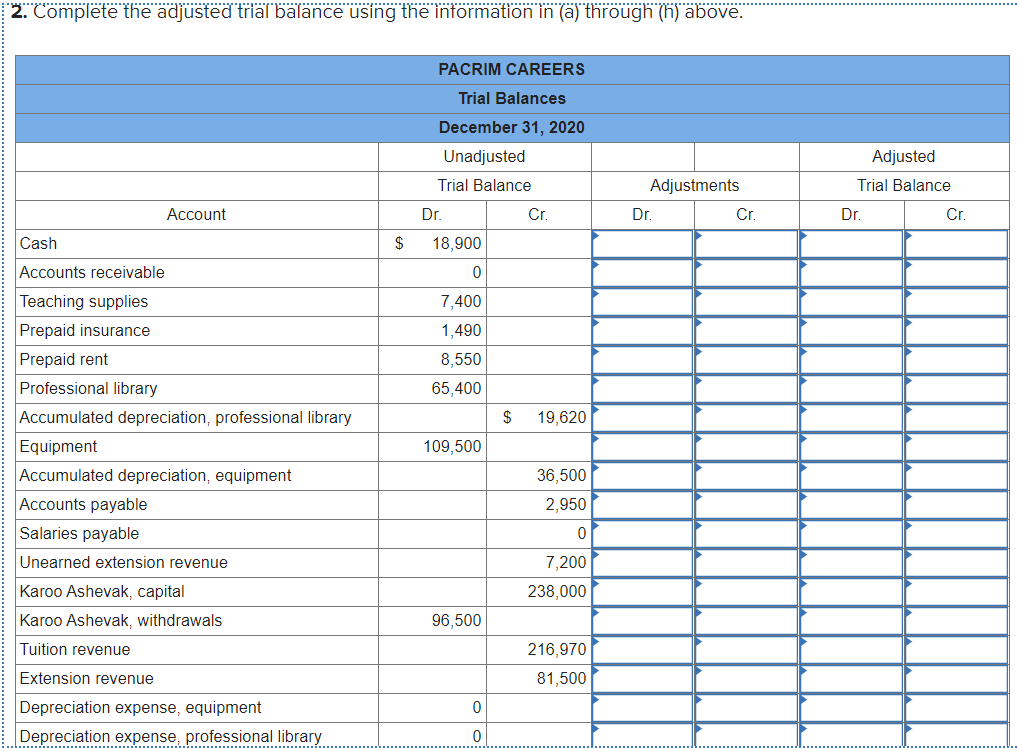

Depreciation expense, professional library Salaries expense Insurance expense Rent expense Teaching supplies expense Advertising expense Utilities expense Totals 0 215,000 0 53,000 0 14,900 12,100 $ 602,740 $ 602,740 3. If the adjustments were not recorded, calculate the over- or understatement of income. 2. Complete the adjusted trial balance using the information in (a) through (h) above. Cash Accounts receivable Teaching supplies Prepaid insurance Prepaid rent Account Professional library Accumulated depreciation, professional library Equipment Accumulated depreciation, equipment Accounts payable Salaries payable Unearned extension revenue Karoo Ashevak, capital Karoo Ashevak, withdrawals Tuition revenue Extension revenue Depreciation expense, equipment Depreciation expense, professional library $ PACRIM CAREERS Trial Balances December 31, 2020 Unadjusted Trial Balance Dr. 18,900 0 7,400 1,490 8,550 65,400 109,500 96,500 0 0 $ Cr. 19,620 36,500 2,950 0 7,200 238,000 216,970 81,500 Adjustments Dr. Cr. Adjusted Trial Balance Dr. Cr.

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Pacrim Careers Adjusted Trial Balance Assuming StraightLine Depreciation Account Unadjusted Trial Balance Adjustments Adjusted Trial Balance Cash 1890... View full answer

Get step-by-step solutions from verified subject matter experts