Question: DEPRECIATION METHODS - Straight Line (note: this is the same asset information as before, here is a reminder if you need it) Keeping Kids Active

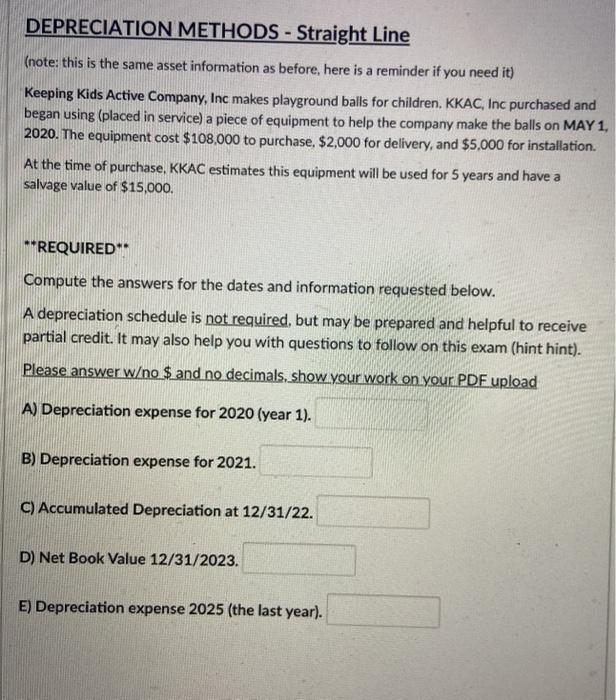

DEPRECIATION METHODS - Straight Line (note: this is the same asset information as before, here is a reminder if you need it) Keeping Kids Active Company, Inc makes playground balls for children. KKAC, Inc purchased and began using (placed in service) a piece of equipment to help the company make the balls on MAY 1, 2020. The equipment cost $108,000 to purchase, $2,000 for delivery, and $5,000 for installation. At the time of purchase, KKAC estimates this equipment will be used for 5 years and have a salvage value of $15,000. *** REQUIRED": Compute the answers for the dates and information requested below. A depreciation schedule is not required, but may be prepared and helpful to receive partial credit. It may also help you with questions to follow on this exam (hint hint). Please answer wo $ and no decimals, show your work on your PDF upload A) Depreciation expense for 2020 (year 1). B) Depreciation expense for 2021. C) Accumulated Depreciation at 12/31/22. D) Net Book Value 12/31/2023. E) Depreciation expense 2025 (the last year)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts