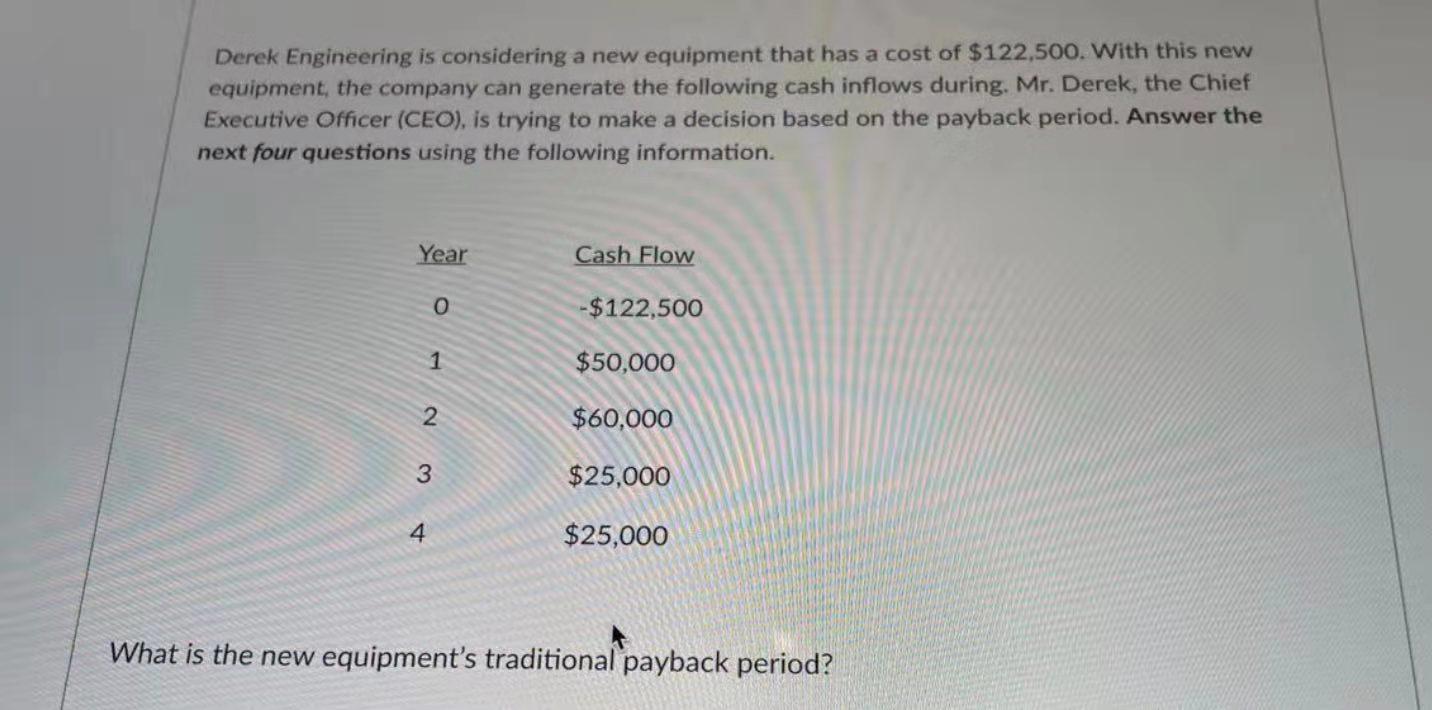

Question: Derek Engineering is considering a new equipment that has a cost of $122.500. With this new equipment, the company can generate the following cash inflows

Derek Engineering is considering a new equipment that has a cost of $122.500. With this new equipment, the company can generate the following cash inflows during. Mr. Derek, the Chief Executive Officer (CEO), is trying to make a decision based on the payback period. Answer the next four questions using the following information Year Cash Flow -$122,500 1 $50,000 2 $60,000 3 $25,000 4 $25,000 What is the new equipment's traditional payback period? Based on the analysis of traditional payback period in the previous question, do you think Mr. Derek should purchase the equipment? Edit View Insert Format Tools Table 12pt Paragraph BIU A 2 T2 O words 2 pts Question 25 Based on the analysis of traditional payback period in the previous question, do you think Mr. Derek should purchase the equipment? Edit View Insert Format Tools Table 12pt Paragraph B I U 16 T2 : MacBook Pro Question 26 Mr. Derek also considers the discount rate in his calculation. Assuming that the discount rate over the investment period is 10%, what decision does Mr. Derek make based on the discounted payback period? Edit View Insert Format Tools Table 12pt IU Paragraph : Tv 1 MacBook Pro Q 4 pts Question 27 If Mr. Derek uses the net present value, does he need to change his decision? Use the same discount rate (10%) Edit View Insert Format Tools Table 12pt Paragraph | B I U Av & T2 MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts