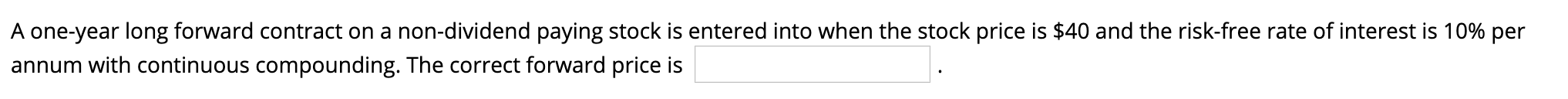

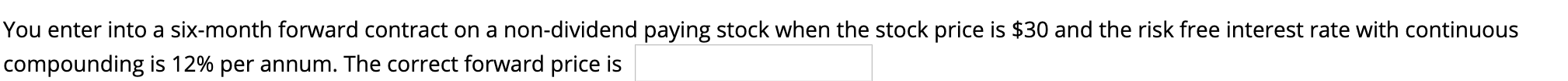

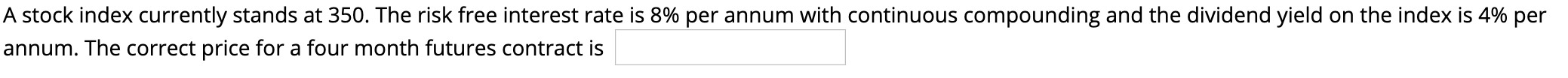

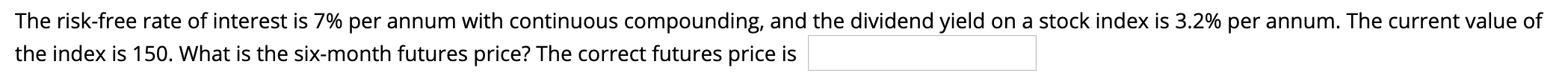

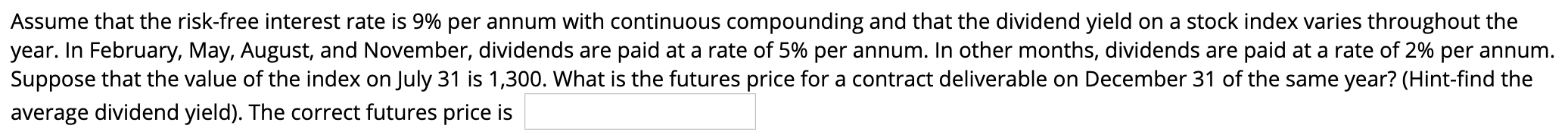

Question: derivative questions be quick this is urgent A one-year long forward contract on a non-dividend paying stock is entered into when the stock price is

derivative questions be quick this is urgent

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock