Question: Derivative Securities Forward/Future Contract Case (Hedging using Forward and Futures) Currently May 21, 2021. You are the finance director of a securities company on the

Derivative Securities

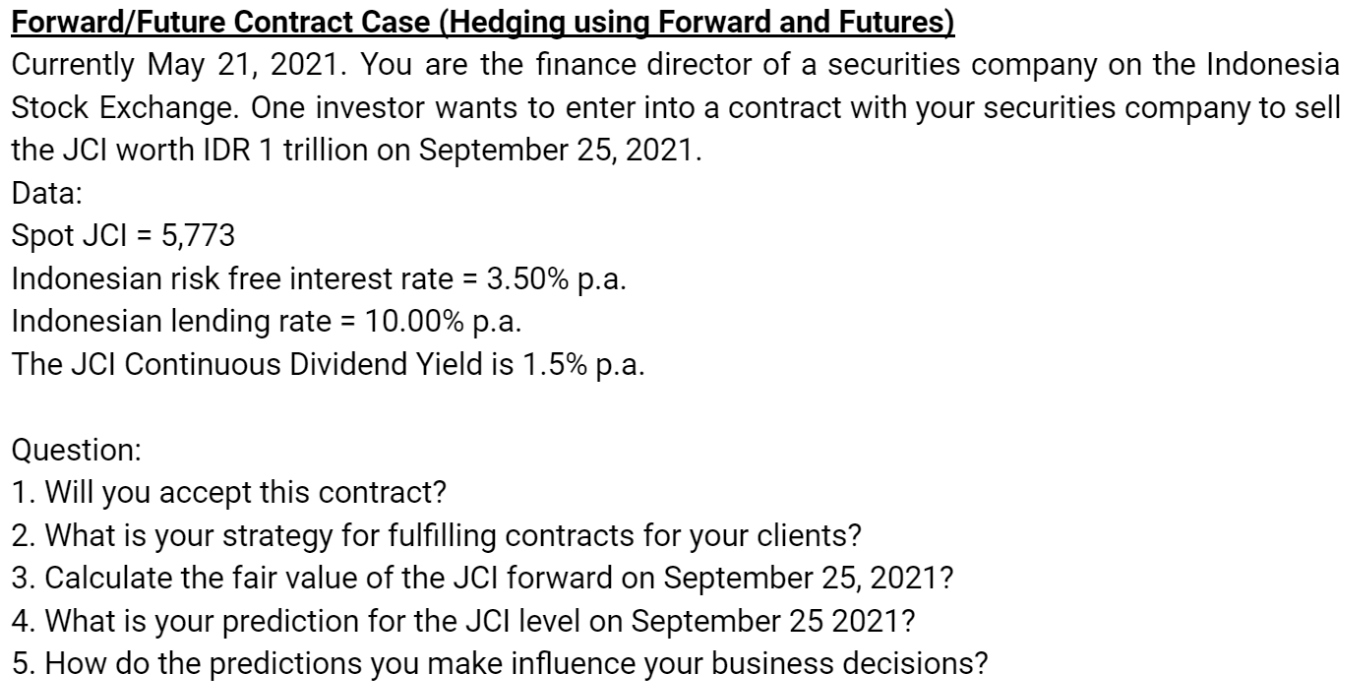

Forward/Future Contract Case (Hedging using Forward and Futures) Currently May 21, 2021. You are the finance director of a securities company on the Indonesia Stock Exchange. One investor wants to enter into a contract with your securities company to sell the JCI worth IDR 1 trillion on September 25, 2021. Data: Spot JCI=5,773 Indonesian risk free interest rate =3.50% p.a. Indonesian lending rate =10.00% p.a. The JCl Continuous Dividend Yield is 1.5% p.a. Question: 1. Will you accept this contract? 2. What is your strategy for fulfilling contracts for your clients? 3. Calculate the fair value of the JCI forward on September 25, 2021? 4. What is your prediction for the JCI level on September 252021 ? 5. How do the predictions you make influence your business decisions? Forward/Future Contract Case (Hedging using Forward and Futures) Currently May 21, 2021. You are the finance director of a securities company on the Indonesia Stock Exchange. One investor wants to enter into a contract with your securities company to sell the JCI worth IDR 1 trillion on September 25, 2021. Data: Spot JCI=5,773 Indonesian risk free interest rate =3.50% p.a. Indonesian lending rate =10.00% p.a. The JCl Continuous Dividend Yield is 1.5% p.a. Question: 1. Will you accept this contract? 2. What is your strategy for fulfilling contracts for your clients? 3. Calculate the fair value of the JCI forward on September 25, 2021? 4. What is your prediction for the JCI level on September 252021 ? 5. How do the predictions you make influence your business decisions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts