Question: Derivatives - C ontinuous Compounding. Please, break down every step. 3(4) b) Three months ago an investor opened a short position on the 9-month forward

Derivatives - Continuous Compounding.

Please, break down every step.

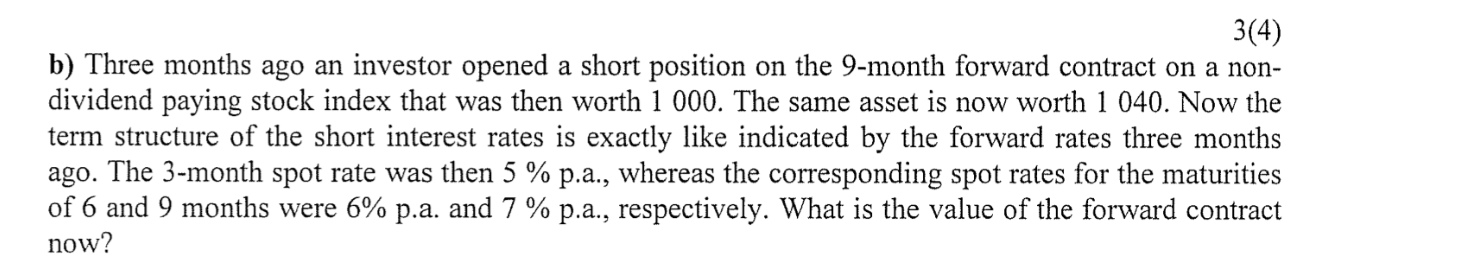

3(4) b) Three months ago an investor opened a short position on the 9-month forward contract on a non- dividend paying stock index that was then worth 1 000. The same asset is now worth 1 040. Now the term structure of the short interest rates is exactly like indicated by the forward rates three months ago. The 3-month spot rate was then 5 % p.a., whereas the corresponding spot rates for the maturities of 6 and 9 months were 6% p.a. and 7 % p.a., respectively. What is the value of the forward contract now

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts