Question: DERIVATIVES Question 3 Agricultural Commodities (a) Cross hedging is often used by producers and buyers in the agricultural markets to hedge risk. What are the

DERIVATIVES

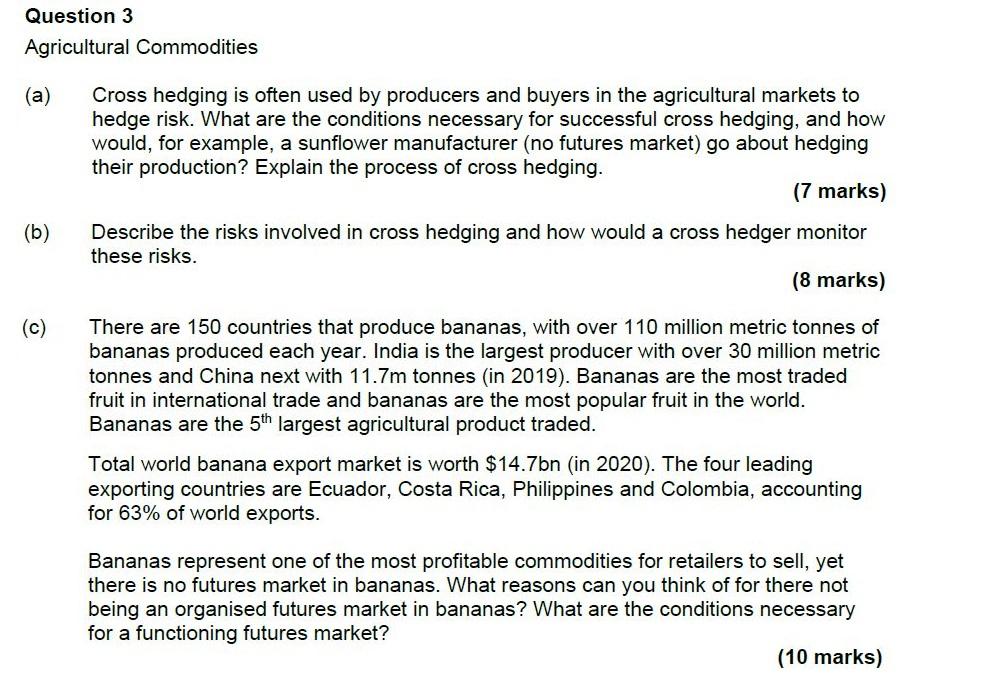

Question 3 Agricultural Commodities (a) Cross hedging is often used by producers and buyers in the agricultural markets to hedge risk. What are the conditions necessary for successful cross hedging, and how would, for example, a sunflower manufacturer (no futures market) go about hedging their production? Explain the process of cross hedging. (7 marks) Describe the risks involved in cross hedging and how would a cross hedger monitor these risks. (8 marks) (b) (c) There are 150 countries that produce bananas, with over 110 million metric tonnes of bananas produced each year. India is the largest producer with over 30 million metric tonnes and China next with 11.7m tonnes (in 2019). Bananas are the most traded fruit in international trade and bananas are the most popular fruit in the world. Bananas are the 5th largest agricultural product traded. Total world banana export market is worth $14.7bn (in 2020). The four leading exporting countries are Ecuador, Costa Rica, Philippines and Colombia, accounting for 63% of world exports. Bananas represent one of the most profitable commodities for retailers to sell, yet there is no futures market in bananas. What reasons can you think of for there not being an organised futures market in bananas? What are the conditions necessary for a functioning futures market? (10 marks) Question 3 Agricultural Commodities (a) Cross hedging is often used by producers and buyers in the agricultural markets to hedge risk. What are the conditions necessary for successful cross hedging, and how would, for example, a sunflower manufacturer (no futures market) go about hedging their production? Explain the process of cross hedging. (7 marks) Describe the risks involved in cross hedging and how would a cross hedger monitor these risks. (8 marks) (b) (c) There are 150 countries that produce bananas, with over 110 million metric tonnes of bananas produced each year. India is the largest producer with over 30 million metric tonnes and China next with 11.7m tonnes (in 2019). Bananas are the most traded fruit in international trade and bananas are the most popular fruit in the world. Bananas are the 5th largest agricultural product traded. Total world banana export market is worth $14.7bn (in 2020). The four leading exporting countries are Ecuador, Costa Rica, Philippines and Colombia, accounting for 63% of world exports. Bananas represent one of the most profitable commodities for retailers to sell, yet there is no futures market in bananas. What reasons can you think of for there not being an organised futures market in bananas? What are the conditions necessary for a functioning futures market? (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts