Question: derivatives securities, please provide correct answer. correct answer, plz. Construct a portfolio consisting of risk-free bonds, European call and put options to replicate the payoff

derivatives securities, please provide correct answer. correct answer, plz.

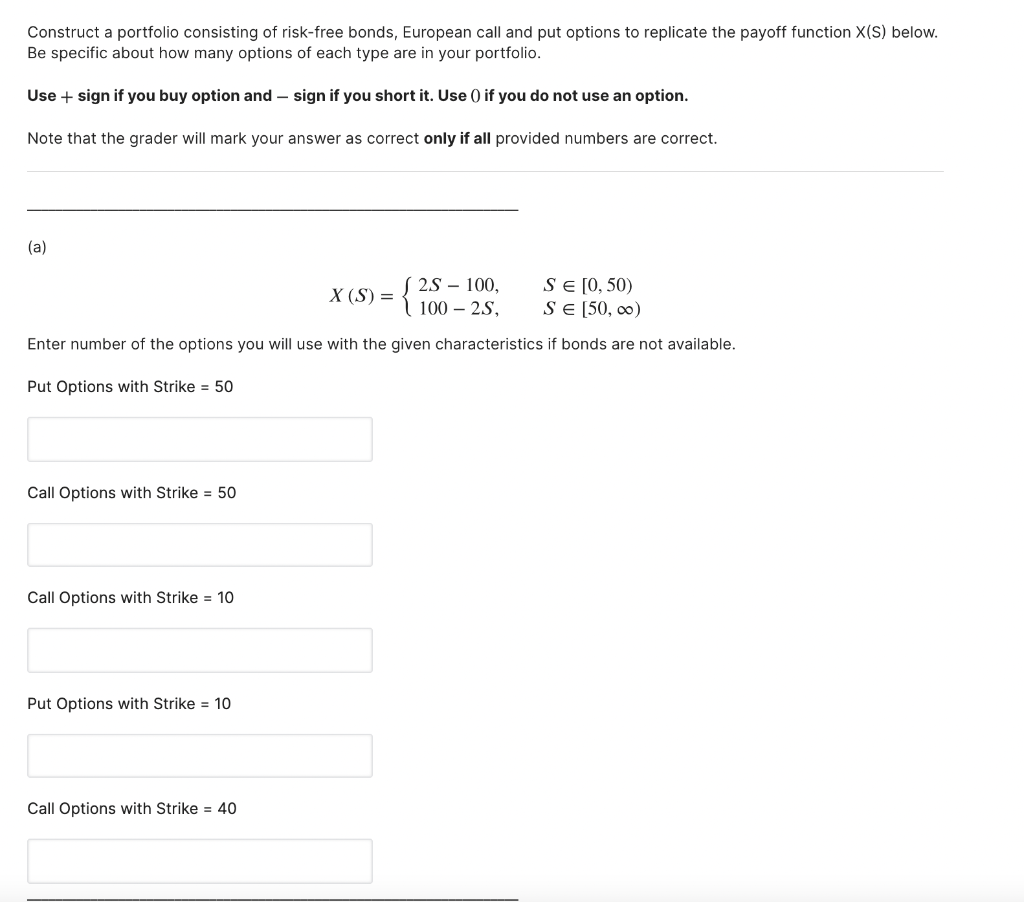

Construct a portfolio consisting of risk-free bonds, European call and put options to replicate the payoff function X(S) below. Be specific about how many options of each type are in your portfolio. Use + sign if you buy option and - sign if you short it. Use () if you do not use an option. Note that the grader will mark your answer as correct only if all provided numbers are correct. (a) 25 100, X (S) = { 100-28 SE [0,50) SE [50, 0) Enter number of the options you will use with the given characteristics if bonds are not available. Put Options with Strike = 50 Call Options with Strike = 50 Call Options with Strike = 10 Put Options with Strike = 10 Call Options with Strike = 40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts