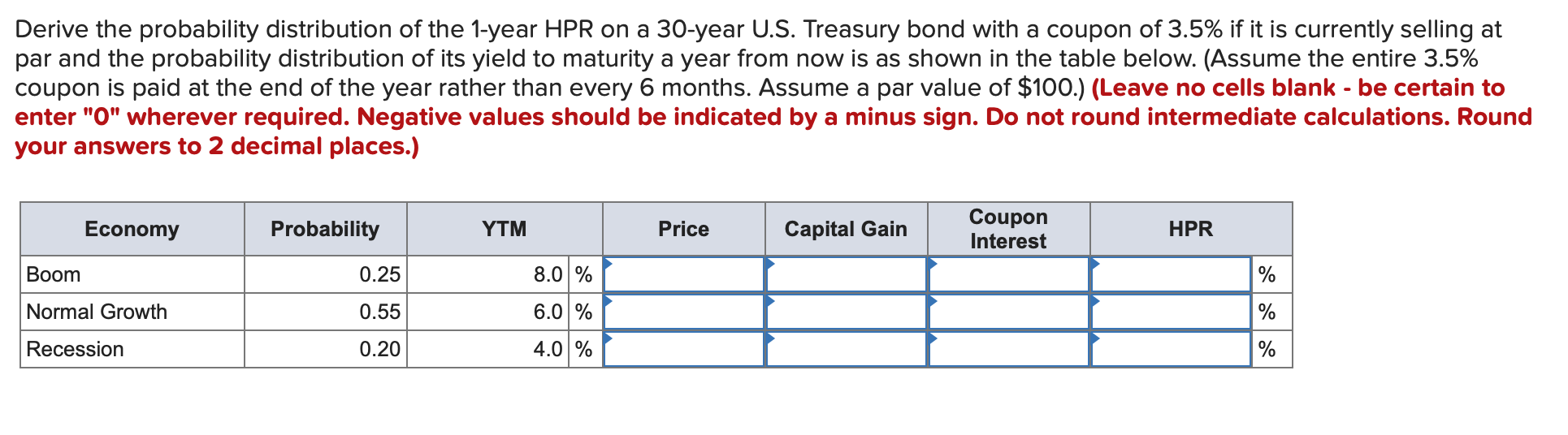

Question: Derive the probability distribution ofthe 1-year HPR on a 30-year US. Treasury bond with a coupon of 3.5% if it is currently selling at par

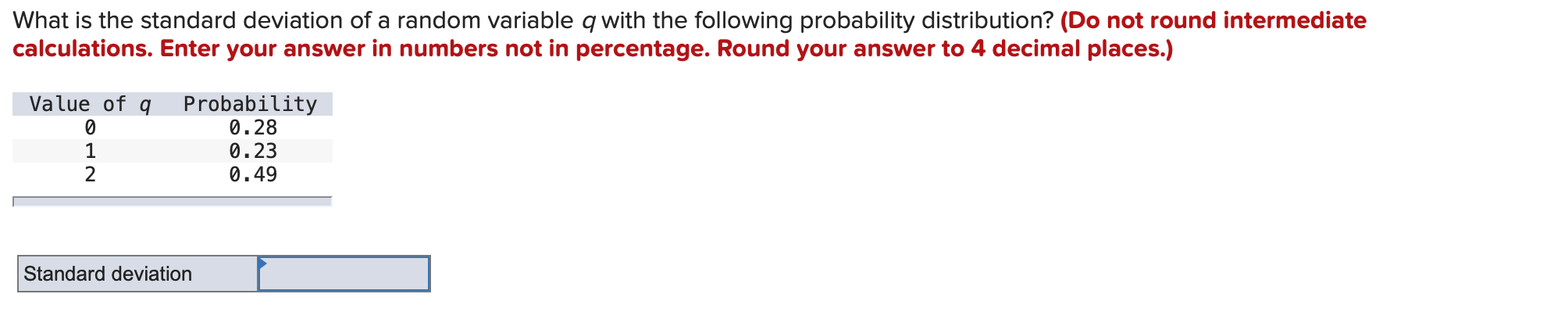

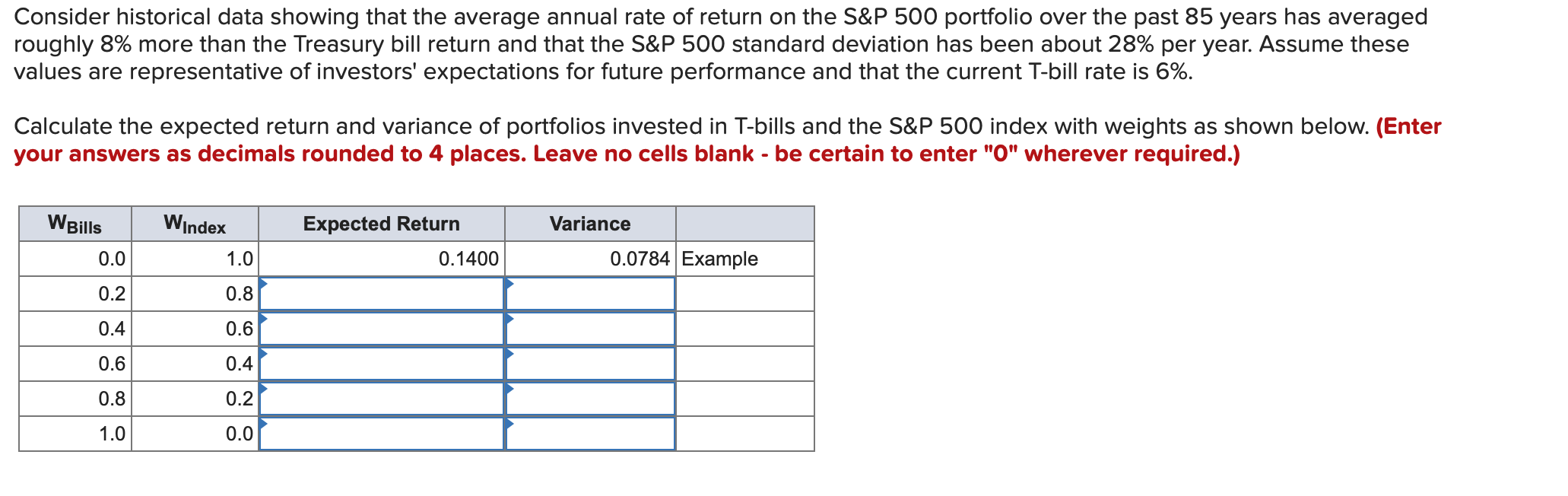

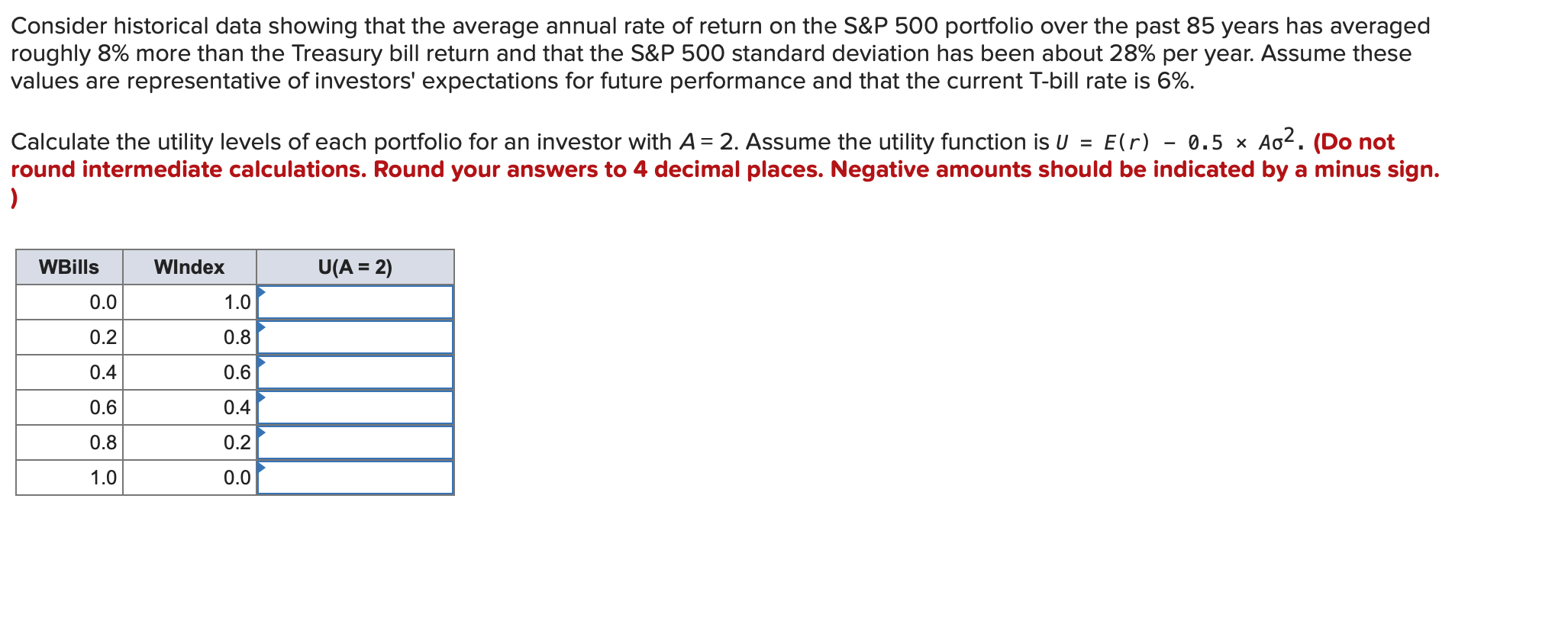

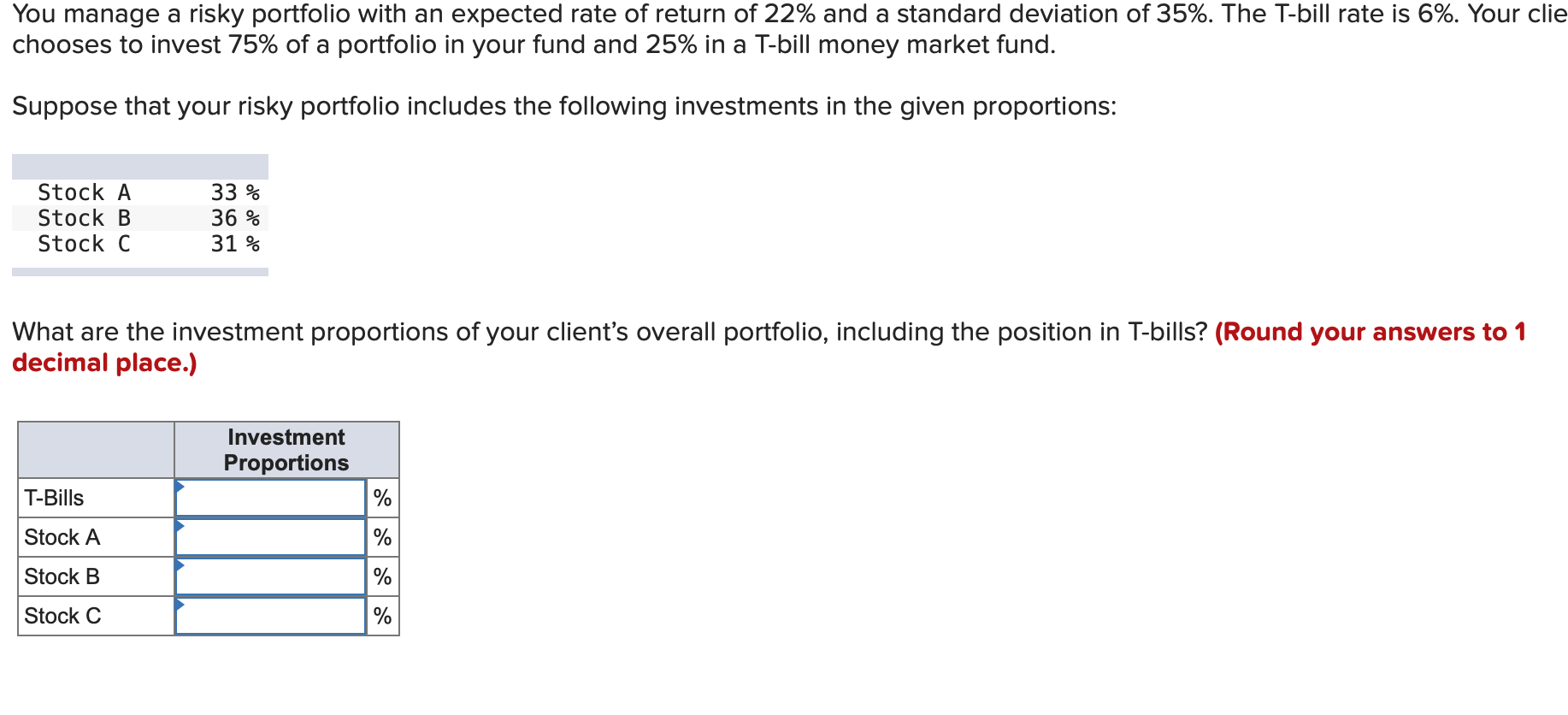

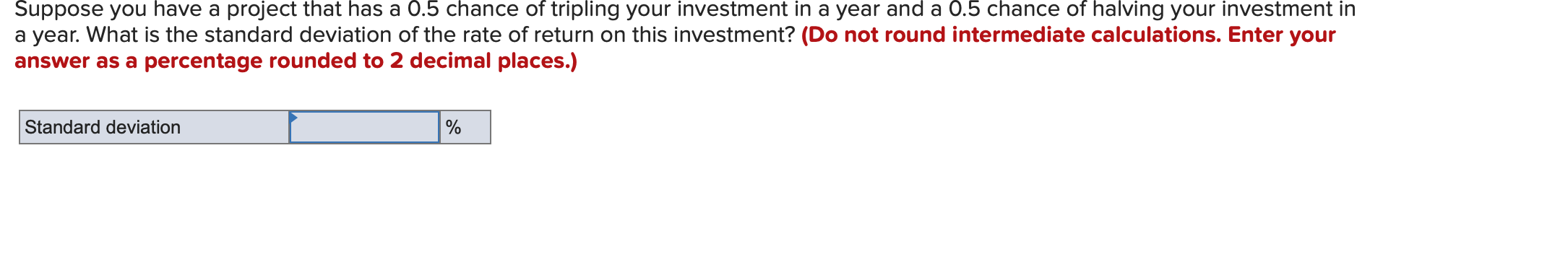

Derive the probability distribution ofthe 1-year HPR on a 30-year US. Treasury bond with a coupon of 3.5% if it is currently selling at par and the probability distribution of its yield to maturity a year from now is as shown in the table below. (Assume the entire 3.5% coupon is paid at the end of the year rather than every 6 months. Assume a par value of $100.) (Leave no cells blank - be certain to enter "0" wherever required. Negative values should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal places.) Economy Probability YTM Price Capital Gain $33.2: "PR Boom 0.25 Normal Growth 0.55 Recession 0.20 What is the standard deviation of a random variable q with the following probability distribution? (Do not round intermediate calculations. Enter your answer in numbers not in percentage. Round your answer to 4 decimal places.) Value of q Probability 0 0.28 1 0.23 2 0.49 I Standard deviation During a period of severe inflation, a bond offered a nominal HPR of 78% per year. The inflation rate was 68% per year. a. What was the real HPR on the bond over the year? (Round your answer to 2 decimal places.) Consider historical data showing that the average annual rate of return on the S&P 500 portfolio over the past 85 years has averaged roughly 8% more than the Treasury bill return and that the S&P 500 standard deviation has been about 28% per year. Assume these values are representative of investors' expectations for future performance and that the current Tbill rate is 6%. Calculate the expected return and variance of portfolios invested in T-bills and the S&P 500 index with weights as shown below. (Enter your answers as decimals rounded to 4 places. Leave no cells blank - be certain to enter "0" wherever required.) wBiIIs Wlndex Expected Return Variance 0.0 1.0 0.1400 0.0784 Example 0.2 0.4 0.6 0.8 1.0 Consider historical data showing that the average annual rate of return on the S&P 500 portfolio over the past 85 years has averaged roughly 8% more than the Treasury bill return and that the S&P 500 standard deviation has been about 28% per year. Assume these values are representative of investors\" expectations for future performance and that the current T-bill rate is 6%. Calculate the utility levels of each portfolio for an investor with A = 2. Assume the utility function is U = E(r) 0.5 x A02. (Do not round intermediate calculations. Round your answers to 4 decimal places. Negative amounts should be indicated by a minus sign. ) You manage a risky portfolio with an expected rate of return of 22% and a standard deviation of 35%. The T-bill rate is 6%. Your clie chooses to invest 75% of a portfolio in your fund and 25% in a T-bill money market fund. Suppose that your risky portfolio includes the following investments in the given proportions: Stock A 33 96 Stock B 36 96 Stock C 31 96 What are the investment proportions of your client's overall portfolio, including the position in T-bills? (Round your answers to 1 decimal place.) Investment Proportions Suppose you have a project that has a 0.5 chance of tripling your investment in a year and a 0.5 chance of halving your investment in a year. What is the standard deviation of the rate of return on this investment? (Do not round intermediate calculations. Enter your answer as a percentage rounded to 2 decimal places.) Standard deviation %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts