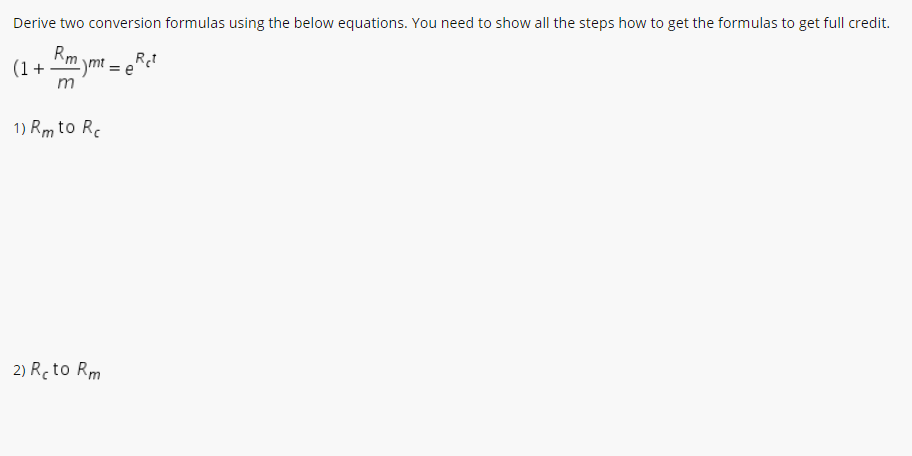

Question: Derive two conversion formulas using the below equations. You need to show all the steps how to get the formulas to get full credit. (1+Rm

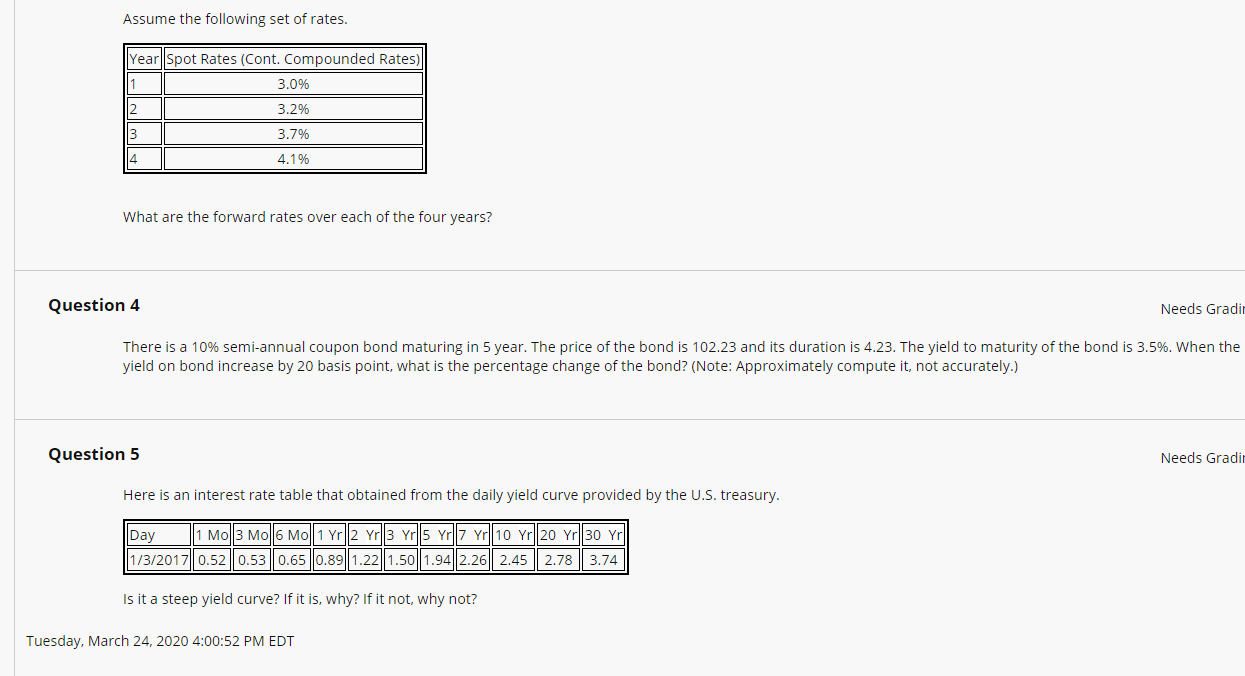

Derive two conversion formulas using the below equations. You need to show all the steps how to get the formulas to get full credit. (1+Rm ym z pias m 1) Rm to Re 2) R, to Rm Assume the following set of rates. Year Spot Rates (Cont. Compounded Rates) 3.0% 3.2% 3.7% 4.1% What are the forward rates over each of the four years? Question 4 Needs Gradit There is a 10% semi-annual coupon bond maturing in 5 year. The price of the bond is 102.23 and its duration is 4.23. The yield to maturity of the bond is 3.5%. When the yield on bond increase by 20 basis point, what is the percentage change of the bond? (Note: Approximately compute it, not accurately.) Question 5 Needs Gradir Here is an interest rate table that obtained from the daily yield curve provided by the U.S. treasury. ||Day |1 MO13 MO 6 Mo 1 yr ||2 yr ||3 Yr ||5yr|7 yil 10 yr||20 Yr ||30 Yr |1/3/2017 0.52 0.53 0.65 0.89 1.221.50 1.94 2.26 2.45 2.78 3.74 Is it a steep yield curve? If it is, why? If it not, why not? Tuesday, March 24, 2020 4:00:52 PM EDT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts