Question: Deron Construction Limited currently has two construction contracts. The contracts involve the construction of a Clinic at Grange hill, Westmoreland and a new hotel

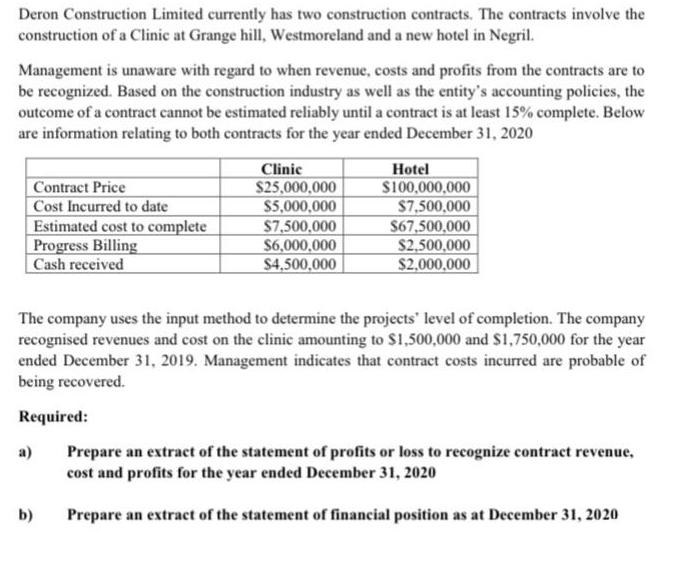

Deron Construction Limited currently has two construction contracts. The contracts involve the construction of a Clinic at Grange hill, Westmoreland and a new hotel in Negril. Management is unaware with regard to when revenue, costs and profits from the contracts are to be recognized. Based on the construction industry as well as the entity's accounting policies, the outcome of a contract cannot be estimated reliably until a contract is at least 15% complete. Below are information relating to both contracts for the year ended December 31, 2020 Clinic Contract Price Cost Incurred to date Estimated cost to complete Progress Billing Cash received $25,000,000 S5,000,000 S7,500,000 $6,000,000 $4,500,000 Hotel S100,000,000 $7,500,000 $67,500,000 $2,500,000 $2,000,000 The company uses the input method to determine the projects' level of completion. The company recognised revenues and cost on the clinic amounting to $1,500,000 and $1,750,000 for the year ended December 31, 2019. Management indicates that contract costs incurred are probable of being recovered. Required: Prepare an extract of the statement of profits or loss to recognize contract revenue, cost and profits for the year ended December 31, 2020 a) b) Prepare an extract of the statement of financial position as at December 31, 2020

Step by Step Solution

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Excel final output Clinic Hotel a Contract price 25000000 100000000 b Cost incurred till 311220 5000... View full answer

Get step-by-step solutions from verified subject matter experts