Question: describe at least five helpful guidelines from the text checklist about repatriating employees from an oversees assignment. The process of transition for an employee home

describe at least five helpful guidelines from the text checklist about repatriating employees from an oversees assignment.

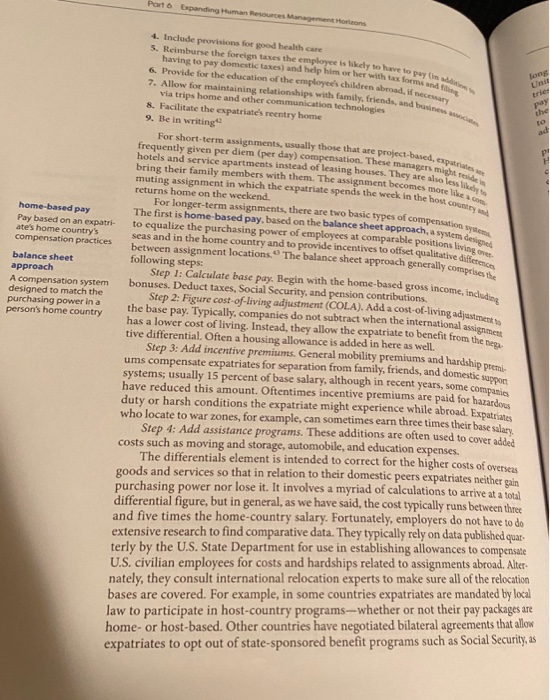

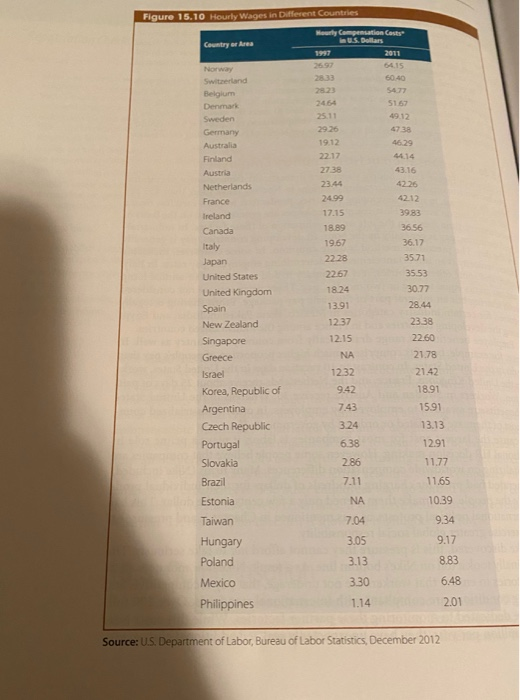

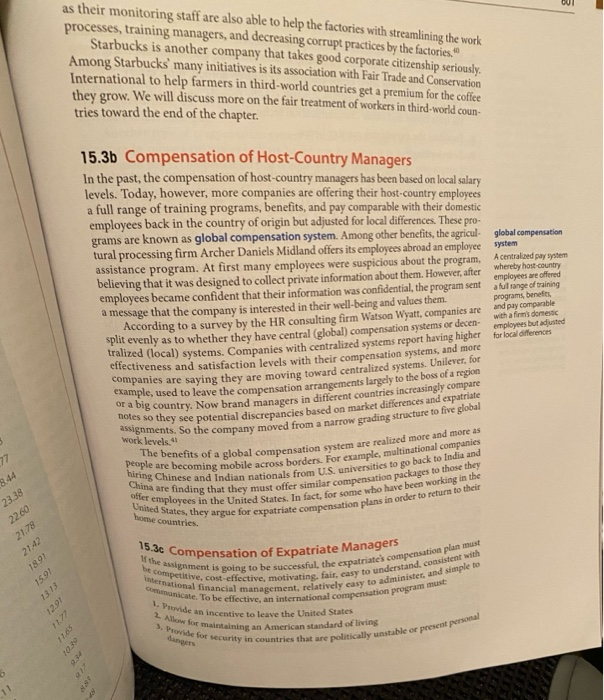

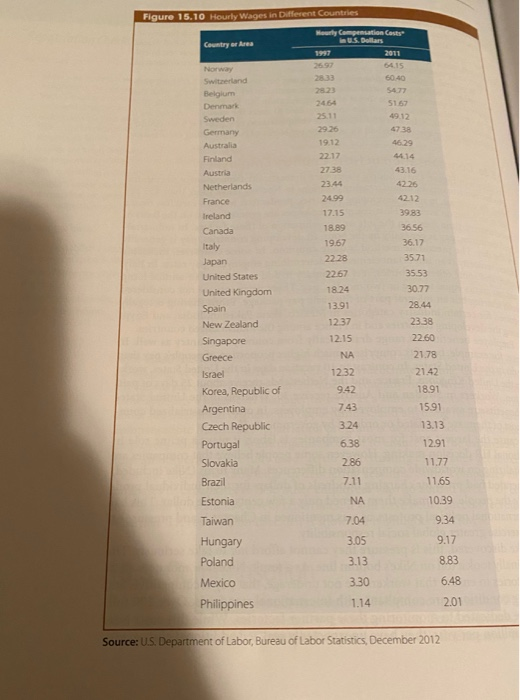

The process of transition for an employee home rom an international signment Repatriation An increasing number of companies such as Monsanto, 3M, EDS, and Verin developing programs specifically designed to facilitate repatriation--that is, helmin trai h langu differen practic IM w Stock/Alamy employees make the transitio pare employees for adjustin the transition back home. Repatriation programs are designed to pre- for adjusting to life at home (which at times can be more difficult than a foreign assignment). ExxonMobil employees are given a general idea of an expect following a foreign assignment even before they leave home. unately, not all companies have career development programs designed for ng employees or do not do an effective job of it. Employees often lament that Com -a dis- verseas cienting what they can expect followin Unfortunately, not all companies in repatriating employees o organizations are vague about repatriation, their new roles within the company, od their career progression. In many cases, employees abroad have learned how to run an entire international operation--or at least significant parts of it. When they return home however, their responsibilities are often significantly diminished. Some surveys have found that up to 60 percent of expatriates believed their careers had not advanced after returning home.36 It is also not at all uncommon for employees to return home after a few years to find that there is no position for them in the firm and that they no longer know anyone who can help them--their longtime colleagues have moved to different departments or even different companies. This frequently leaves the repatriated employee feeling alienated. Wondering about their future also creates stress for them and their families while they are abroad. Elephone matters ic events TWO-career accommo This hurts the employee, of co fe planning openings in vork permis Even when employees are successfully repatriated, their companies often do not utilize the knowledge. understanding, and skills developed on their assignments s the employee, of course, but it also hurts the firm's chances of utilizing the cmployee's expertise to gain a competitive ad Tuise to gain a competitive advantage. Not surprisingly expatriates free air companies within a year or two of coming home. Some studies say Chumber of expatriates who do so is as quently leave their companies with the num though this is At companies with go out how much the expatriate ex come firms introduce former expat atriates who do so is as high as 50 percent. les with good repatriation processes, employees are given guidance expatriate experience may have changed them and their families ormer expatriates and their spouses to other former expatriates and more companies are making an effort to keep in touch at special social events, a and Verizona that is helping as their monitoring staff are also able to help the factories with streamlining the work processes, training managers, and decreasing corrupt practices by the factories Starbucks is another company that takes good corporate citizenship seriously. Among Starbucks many initiatives is its association with Fair Trade and Conservation International to help farmers in third-world countries get a premium for the coffee they grow. We will discuss more on the fair treatment of workers in third-world coun- tries toward the end of the chapter. 15.3b Compensation of Host-Country Managers In the past, the compensation of host-country managers has been based on local salary levels. Today, however, more companies are offering their host country employees a full range of training programs, benefits, and pay comparable with their domestic employees back in the country of origin but adjusted for local differences. These pro. grams are known as global compensation system. Among other benefits, the agricul global compensation tural processing firm Archer Daniels Midland offers its employees abroad an employee system assistance program. At first many employees were suspicious about the programAcentraland pay item believing that it was designed to collect private information about them. However, after whereby host country employees are offered employees became confident that their information was confidential, the program sent a fulange of training a message that the company is interested in their well-being and values them. programs, benefits According to a survey by the HR consulting firm Watson Wyatt, companies are with a firm's domestic split evenly as to whether they have central (global) compensation systems or decen- employees but adusted tralized (local) systems. Companies with centralized systems report having higher for local differences elfectiveness and satisfaction levels with their compensation systems, and more mpanies are saying they are moving toward centralized systems. Unilever, for ample, used to leave the compensation arrangements largely to the boss of a regkod big country. Now brand managers in different countries increasingly compare so they see potential discrepancies based on market differences and expatriate work levels. S. So the company moved from a narrow grading structure to five global the benefits of a global compensation system are a becoming mobile across borders. For cample, multinational companies or a big country. Now b assignments. So the co global compensation system are realized more and more as people are becoming hiring Chinese and in China are fin are finding that they must offer similar compensation pas offer employees in the United States, they argue home countries 23.38 22.60 21.78 m US. universities to go back to India and in the United States. In fact for come who have been working in the compensation packages to those they e compensation plans in order to return to their 15.30 Compe the assignme become 21:42 1891 1591 International financial m Comunicate. To be effect he expatriate's compensation plan must easy to understand, consistent with to administer, and simple to compensation of Expatriate Managers ument is going to be successful the expatriates compare intePetitive, cost-effective motivating fair, easy to und inancial management relatively easy to administer elective, an international compensation program de an incentive to leave the United States ning an American standard of living curity in countries that are politically unstable or 1. Provide an ince Allow for maintaining an American stan 3. Pode for security ble or present personal Porto Expanding Human Resource Management Hortons Una be boston home-based pay Pay based on an expatri ate's home country's compensation practices tienen balance sheet approach A compensation system designed to match the purchasing power in a person's home country vacing 4. Include provisions for good health care 5. Reimburse the foreign taxes the employee is likely to have to put having to pay domestic taxes) and help him or her with tax som 100 6. Provide for the education of the employees children abroad. If neces 7. Allow for maintaining relationships with family, friends, and basin via trips home and other communication technologies 8. Facilitate the expatriate's reentry home 9. Be in writing For short-term assignments, usually those that are project-based frequently given per diem (per day) compensation. These managers hotels and service apartments instead of leasing houses. They are also a les bring their family members with them. The assignment becomes more de muting assignment in which the expatriate spends the week in the hosto returns home on the weekend For longer-term assignments, there are two basic types of compensation The first is home-based pay, based on the balance sheet approach, a system to equalize the purchasing power of employees at comparable positions liv ed seas and in the home country and to provide incentives to offset qualitative de between assignment locations. The balance sheet approach generally compris following steps: Step 1: Calculate base pay. Begin with the home-based gross income, inclus bonuses. Deduct taxes, Social Security, and pension contributions, Step 2: Figure cost-of-living adjustment (COLA). Add a cost-of-living adjustme the base pay. Typically, companies do not subtract when the international assie has a lower cost of living. Instead, they allow the expatriate to benefit from the tive differential. Often a housing allowance is added in here as well. Step 3: Add incentive premiums. General mobility premiums and hardship premi ums compensate expatriates for separation from family, friends, and domestic systems; usually 15 percent of base salary, although in recent years, some comparar have reduced this amount. Oftentimes incentive premiums are paid for hazard duty or harsh conditions the expatriate might experience while abroad. Expatriates who locate to war zones, for example, can sometimes earn three times their base salary Step 4: Add assistance programs. These additions are often used to cover ada costs such as moving and storage, automobile, and education expenses. The differentials element is intended to correct for the higher costs of overseas goods and services so that in relation to their domestic peers expatriates neither in purchasing power nor lose it. It involves a myriad of calculations to arrive at a total differential figure, but in general, as we have said, the cost typically runs between three and five times the home-country salary. Fortunately, employers do not have to do extensive research to find comparative data. They typically rely on data published quar terly by the U.S. State Department for use in establishing allowances to compensate U.S. civilian employees for costs and hardships related to assignments abroad. Alter nately, they consult international relocation experts to make sure all of the relocation bases are covered. For example, in some countries expatriates are mandated by local law to participate in host-country programs--whether or not their pay packages are home or host-based. Other countries have negotiated bilateral agreements that allow expatriates to opt out of state-sponsored benefit programs such as Social Security, as Figure 15.10 Hourly wages in Different countries Country or Area Norway Switzerland Belgium Denmark Sweden Germany Australia Finland Austria Netherlands France Ireland Canada Italy Japan United States United Kingdom Spain New Zealand Singapore Greece Israel Korea, Republic of Argentina Czech Republic Portugal Slovakia Brazil Estonia Taiwan Hungary Poland Mexico Philippines Mourly Compensation Cost US Dollars 2011 26.97 64.15 28.33 6040 28.23 5477 5167 25.11 49.12 29 26 4738 19.12 46.29 22.17 2738 43.16 23.44 42.26 24.99 42.12 17.15 39.83 18.89 36.56 19.67 36.17 22.28 3571 2267 3553 1824 30.77 13.91 28.44 12.37 2338 12.15 22.60 NA 21.78 1232 21.42 9.42 18.91 1591 3.24 13.13 638 12.91 11.77 7.11 11.65 NA 10.39 7.04 9.34 3.05 9.17 8.83 3.30 6.48 7.43 286 3.13 1.14 2.01 Source: U.S. Department of Labor, Bureau of Labor Statistics, December 2012

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock