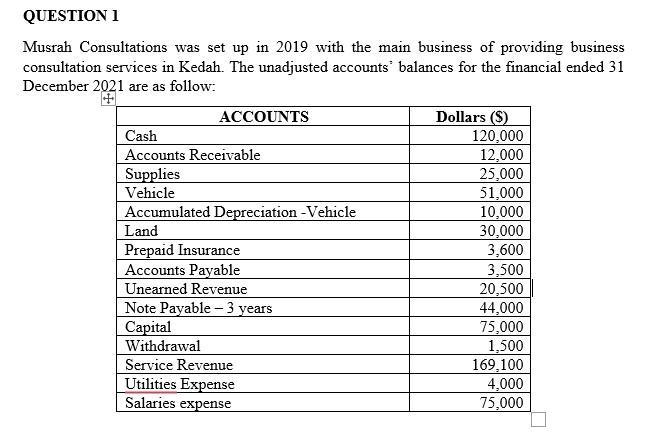

Question: QUESTION 1 Musrah Consultations was set up in 2019 with the main business of providing business consultation services in Kedah. The unadjusted accounts balances

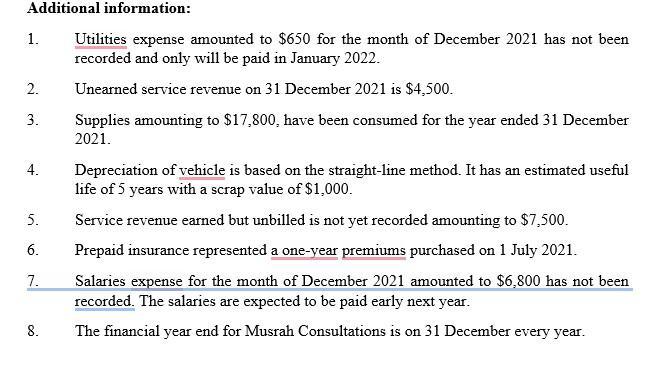

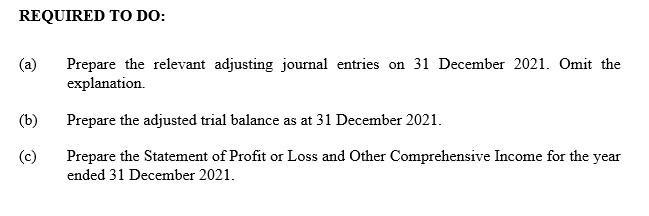

QUESTION 1 Musrah Consultations was set up in 2019 with the main business of providing business consultation services in Kedah. The unadjusted accounts balances for the financial ended 31 December 2021 are as follow: ACCOUNTS Cash Accounts Receivable Supplies Vehicle Accumulated Depreciation -Vehicle Land Prepaid Insurance Accounts Payable Unearned Revenue Note Payable - 3 years Capital Withdrawal Service Revenue Utilities Expense Salaries expense Dollars (S) 120,000 12,000 25,000 51,000 10,000 30,000 3,600 3,500 20,500 44,000 75,000 1,500 169,100 4,000 75,000 Additional information: Utilities expense amounted to $650 for the month of December 2021 has not been recorded and only will be paid in January 2022. Unearned service revenue on 31 December 2021 is $4,500. 1. 2. 3. 4. 5. 6. 7. 8. Supplies amounting to $17,800, have been consumed for the year ended 31 December 2021. Depreciation of vehicle is based on the straight-line method. It has an estimated useful life of 5 years with a scrap value of $1,000. Service revenue earned but unbilled is not yet recorded amounting to $7,500. Prepaid insurance represented a one-year premiums purchased on 1 July 2021. Salaries expense for the month of December 2021 amounted to $6,800 has not been recorded. The salaries are expected to be paid early next year. The financial year end for Musrah Consultations is on 31 December every year. REQUIRED TO DO: (a) (b) (c) Prepare the relevant adjusting journal entries on 31 December 2021. Omit the explanation. Prepare the adjusted trial balance as at 31 December 2021. Prepare the Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2021.

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

1 The difference between relief in a Contract action and relief given by the Courts in Equity As a r... View full answer

Get step-by-step solutions from verified subject matter experts