Question: Describe the directional effect (increase, decrease, or no effect) of each transaction on the components of the book value of common shareholders' equity shown in

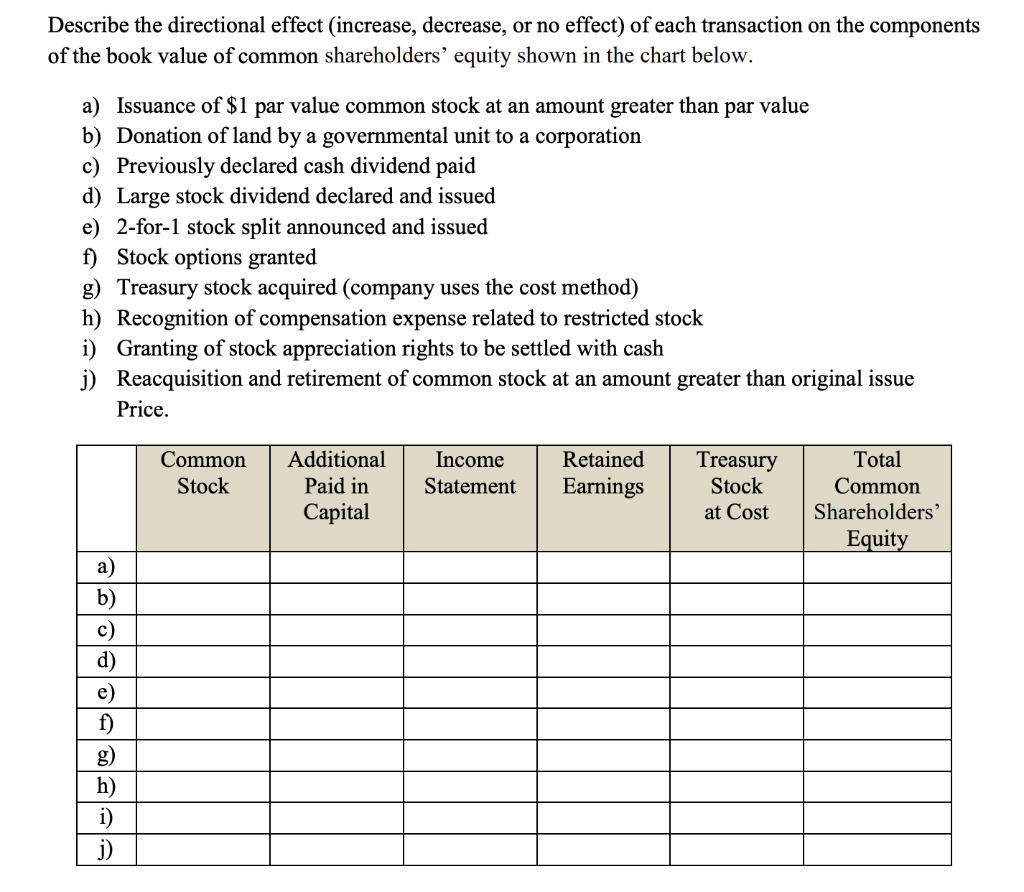

Describe the directional effect (increase, decrease, or no effect) of each transaction on the components of the book value of common shareholders' equity shown in the chart below. a) Issuance of $1 par value common stock at an amount greater than par value b) Donation of land by a governmental unit to a corporation c) Previously declared cash dividend paid d) Large stock dividend declared and issued e) 2-for-1 stock split announced and issued f) Stock options granted g) Treasury stock acquired (company uses the cost method) h) Recognition of compensation expense related to restricted stock i) Granting of stock appreciation rights to be settled with cash j) Reacquisition and retirement of common stock at an amount greater than original issue Price. Common Stock Additional Paid in Capital Income Statement Retained Earnings Treasury Stock at Cost Total Common Shareholders' Equity a) b) c) d) e) f) h) i) j) Describe the directional effect (increase, decrease, or no effect) of each transaction on the components of the book value of common shareholders' equity shown in the chart below. a) Issuance of $1 par value common stock at an amount greater than par value b) Donation of land by a governmental unit to a corporation c) Previously declared cash dividend paid d) Large stock dividend declared and issued e) 2-for-1 stock split announced and issued f) Stock options granted g) Treasury stock acquired (company uses the cost method) h) Recognition of compensation expense related to restricted stock i) Granting of stock appreciation rights to be settled with cash j) Reacquisition and retirement of common stock at an amount greater than original issue Price. Common Stock Additional Paid in Capital Income Statement Retained Earnings Treasury Stock at Cost Total Common Shareholders' Equity a) b) c) d) e) f) h) i) j)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts