Question: Describe the major differences in preparing the income statement for a service business and a merchandising business. During the year, merchandise is sold for $175,500

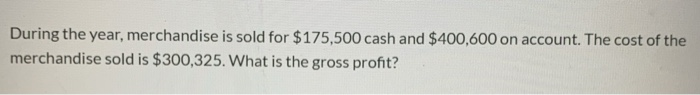

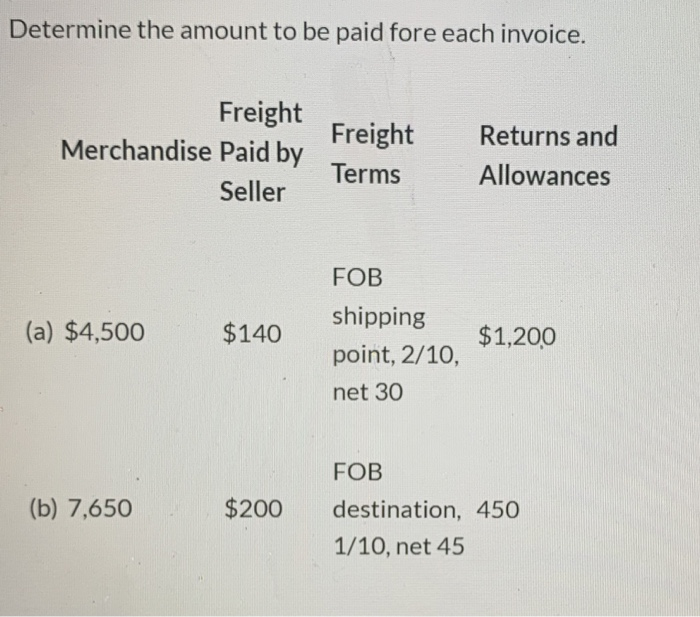

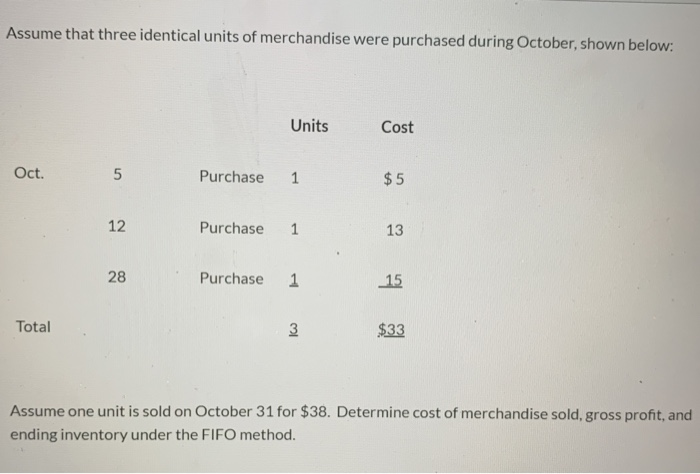

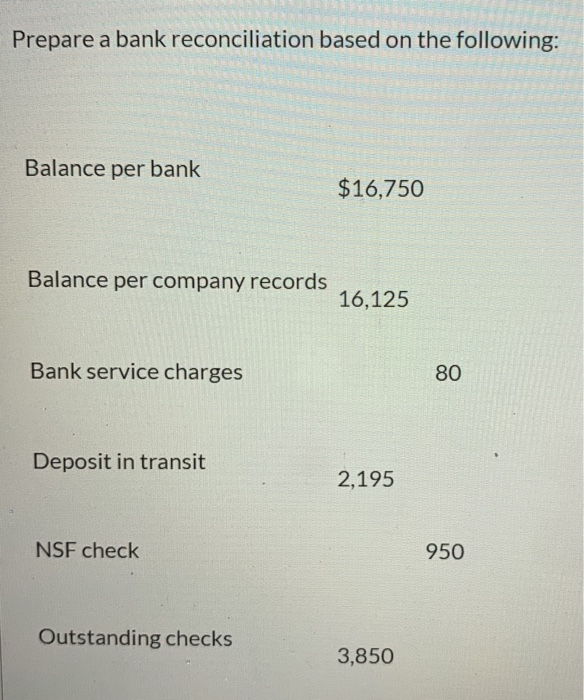

Describe the major differences in preparing the income statement for a service business and a merchandising business. During the year, merchandise is sold for $175,500 cash and $400,600 on account. The cost of the merchandise sold is $300,325. What is the gross profit? Determine the amount to be paid fore each invoice. Freight Merchandise Paid by Seller Freight Terms Returns and Allowances FOB (a) $4,500 $140 $1,200 shipping point, 2/10, net 30 FOB (b) 7,650 $200 destination, 450 1/10, net 45 Assume that three identical units of merchandise were purchased during October, shown below: Units Cost Oct. 5 Purchase 1 $ 5 Purchase 1 13 12 28 Purchase 1 15 Total 3 $33 Assume one unit is sold on October 31 for $38. Determine cost of merchandise sold, gross profit, and ending inventory under the FIFO method. Prepare a bank reconciliation based on the following: Balance per bank $16,750 Balance per company records 16,125 Bank service charges 80 Deposit in transit 2,195 NSF check 950 Outstanding checks 3,850

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts