Question: Describe the put-call parity without using the formula. 15 marks Question 3 Suppose the spot price of a stock is 75 euro and the size

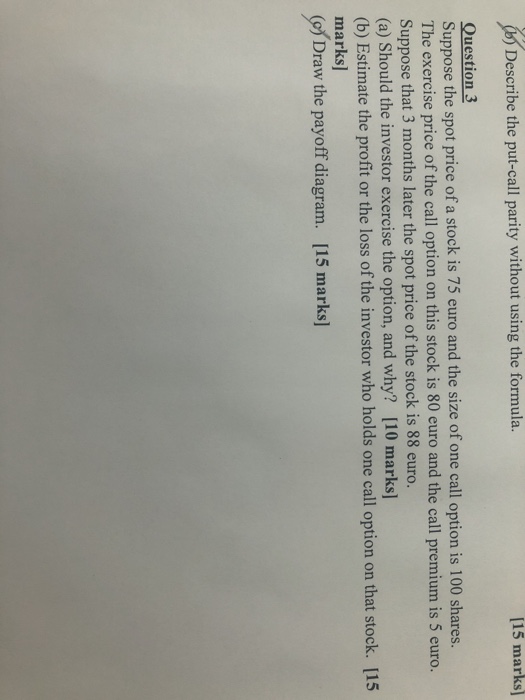

Describe the put-call parity without using the formula. 15 marks Question 3 Suppose the spot price of a stock is 75 euro and the size of one call option is 100 shares. The exercise price of the call option on this stock is 80 euro and the call premium is 5 euro. Suppose that 3 months later the spot price of the stock is 88 euro. (a) Should the investor exercise the option, and why? [10 marks] (b) Estimate the profit or the loss of the investor who holds one call option on that stock. [15 marks] (o Draw the payoff diagram. [15 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts