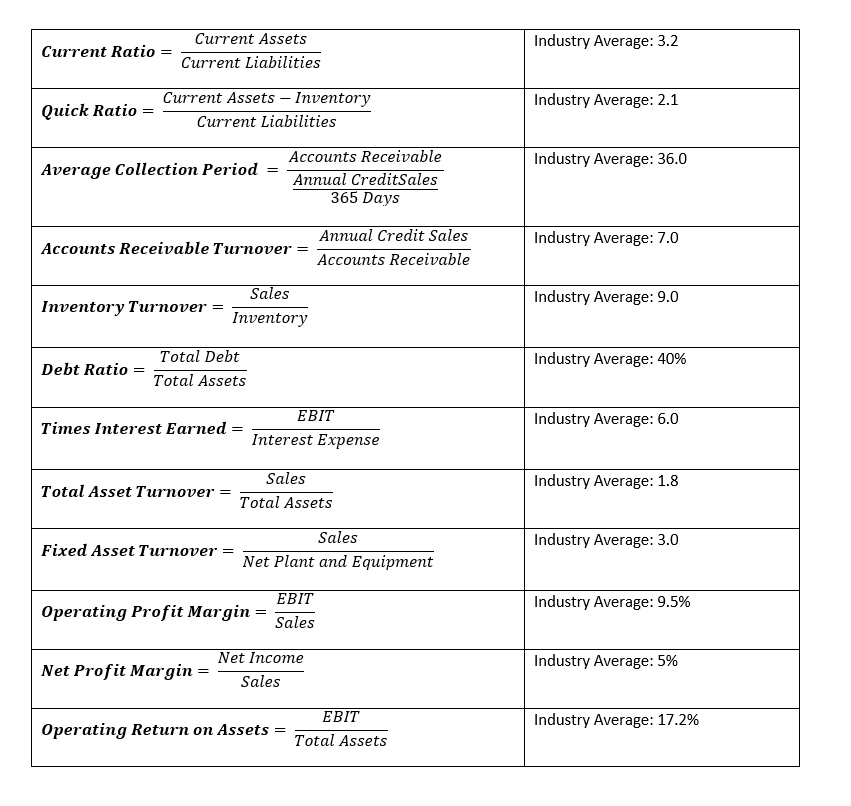

Question: Describe the solution step by step. Industry Average: 3.2 Current Ratio = Current Assets Current Liabilities Current Assets - Inventory Current Liabilities Industry Average: 2.1

Describe the solution step by step.

Describe the solution step by step.

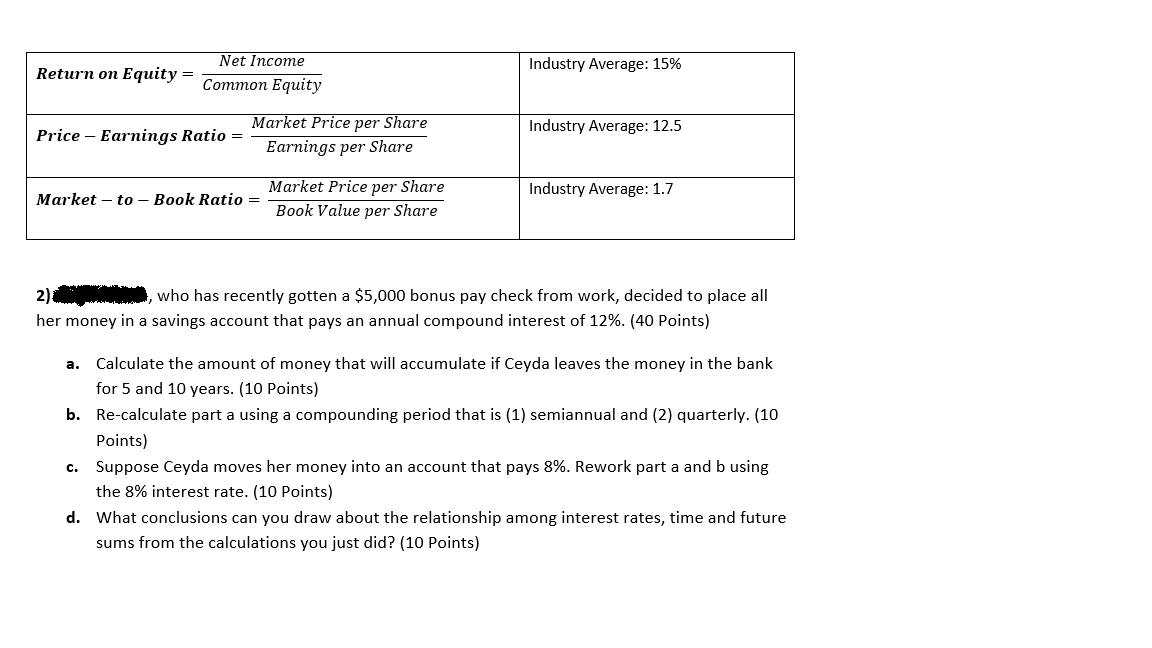

Industry Average: 3.2 Current Ratio = Current Assets Current Liabilities Current Assets - Inventory Current Liabilities Industry Average: 2.1 Quick Ratio = Industry Average: 36.0 Average Collection Period Accounts Receivable Annual CreditSales 365 Days Industry Average: 7.0 Annual Credit Sales Accounts Receivable Turnover = Accounts Receivable Sales Inventory Industry Average: 9.0 Inventory Turnover Industry Average: 40% Debt Ratio = Total Debt Total Assets Times Interest Earned EBIT Interest Expense Industry Average: 6.0 Sales Total Assets Industry Average: 1.8 Total Asset Turnover Sales Net Plant and Equipment Industry Average: 3.0 Fixed Asset Turnover EBIT Operating Profit Margin = Sales Industry Average: 9.5% Net Profit Margin= Net Income Sales Industry Average: 5% EBIT Operating Return on Assets = Total Assets Industry Average: 17.2% Net Income Return on Equity = Common Equity Industry Average: 15% Market Price per Share Price - Earnings Ratio = Earnings per Share Industry Average: 12.5 Market Price per Share Market - to - Book Ratio = Book Value per Share Industry Average: 1.7 2) who has recently gotten a $5,000 bonus pay check from work, decided to place all her money in a savings account that pays an annual compound interest of 12%. (40 Points) a. Calculate the amount of money that will accumulate if Ceyda leaves the money in the bank for 5 and 10 years. (10 Points) b. Re-calculate part a using a compounding period that is (1) semiannual and (2) quarterly. (10 Points) c. Suppose Ceyda moves her money into an account that pays 8%. Rework part a and b using the 8% interest rate. (10 Points) d. What conclusions can you draw about the relationship among interest rates, time and future sums from the calculations you just did? (10 Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts