Question: Describe why sometimes Delta hedging is not sufficient in cancelling a port- folio's risk exposure. (Your answer cannot be more than 50 words. Answers

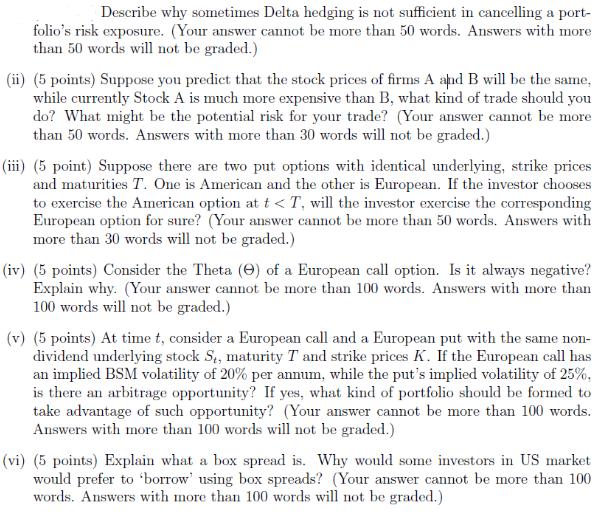

Describe why sometimes Delta hedging is not sufficient in cancelling a port- folio's risk exposure. (Your answer cannot be more than 50 words. Answers with more than 50 words will not be graded.) (ii) (5 points) Suppose you predict that the stock prices of firms A and B will be the same, while currently Stock A is much more expensive than B, what kind of trade should you do? What might be the potential risk for your trade? (Your answer cannot be more than 50 words. Answers with more than 30 words will not be graded.) (iii) (5 point) Suppose there are two put options with identical underlying, strike prices and maturities T. One is American and the other is European. If the investor chooses to exercise the American option at t

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

i Delta hedging may not be sufficient in cancelling a portfolios risk exposure because it assumes co... View full answer

Get step-by-step solutions from verified subject matter experts