Question: Described below are source documents for Wayne Siebert, a professional pho- tographer. Journalize these transactions in a two-column general jour nal, using the accounts shown

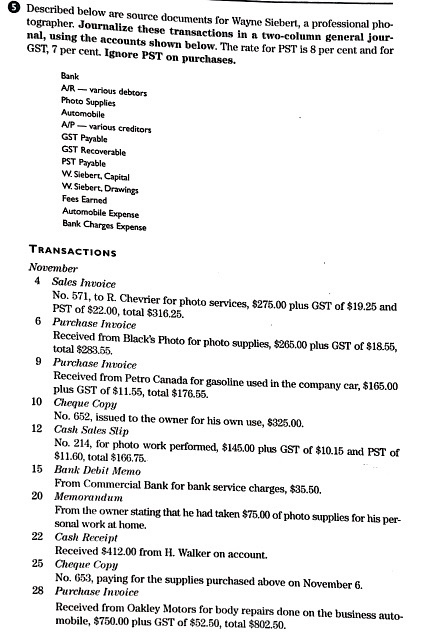

Described below are source documents for Wayne Siebert, a professional pho- tographer. Journalize these transactions in a two-column general jour nal, using the accounts shown below. The rate for PST is 8 per cent and for GST, 7 per cent. Ignore PST on purchases. Bank AR - Various debtors Photo Supplies Automobile A/P various creditors GST Payable GST Recoverable PST Payable W. Siebert, Capital W. Siebert, Drawings Fees Earned Automobile Expense Bank Charges Expense TRANSACTIONS November 4 Sales invoice No. 571, to R. Chevrier for photo services, $275.00 plus GST of $19.25 and PST of $22.00, total $316.25. 6 Purchase Invoice Received from Black's Photo for photo supplies, $265.00 plus GST of $18.55, total $283.55. 9 Purchase invoice Received from Petro Canada for gasoline used in the company car, $165.00 plus GST of $11.55, total $176.55. 10 Cheque Copy No. 652, issued to the owner for his own use, $325.00. Cash Sales Slip No. 214, for photo work performed, $145.00 plus GST of $10.15 and PST of $11.60, total $166.75. 15 Bank Debit Memo From Commercial Bank for bank service charges, $35.50. 20 Memorandum From the owner stating that he had taken $75.00 of photo supplies for his per- sonal work at home. 22 Cash Receipt Received 8412.00 from H. Walker on account. 25 Cheque Copy No, 653, paying for the supplies purchased above on November 6. 28 Purchase invoice Received from Oakley Motors for body repairs done on the business auto- mobile, $750,00 plus GST of $52.50, total $802.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts