Question: Description: Develop an amortization schedule for a car loan and see how changing the terms of the loan (length, interest rate) will affect how much

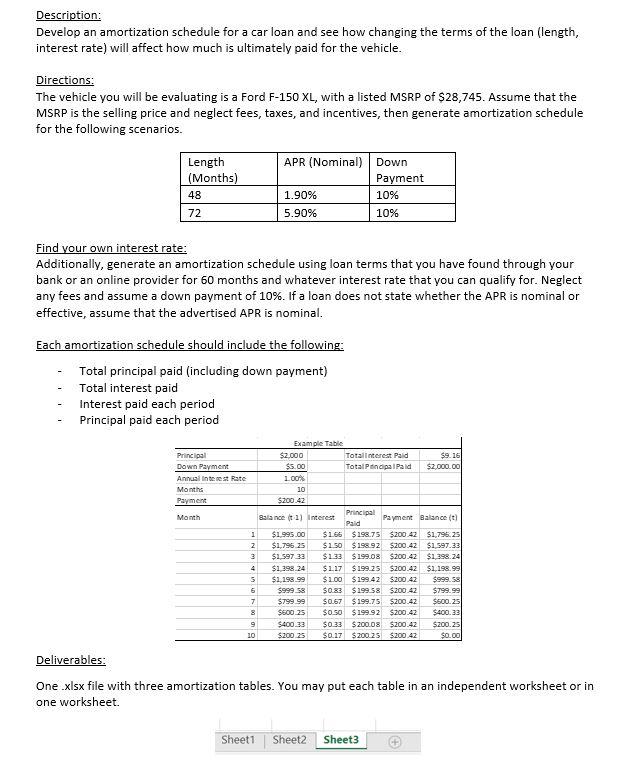

Description: Develop an amortization schedule for a car loan and see how changing the terms of the loan (length, interest rate) will affect how much is ultimately paid for the vehicle. Directions: The vehicle you will be evaluating is a Ford F-150 XL, with a listed MSRP of $28,745. Assume that the MSRP is the selling price and neglect fees, taxes, and incentives, then generate amortization schedule for the following scenarios. Length (Months) 48 APR (Nominal) Down Payment 1.90% 10% 5.90% 10% 72 Find your own interest rate: Additionally, generate an amortization schedule using loan terms that you have found through your bank or an online provider for 60 months and whatever interest rate that you can qualify for. Neglect any fees and assume a down payment of 10%. If a loan does not state whether the APR is nominal or effective, assume that the advertised APR is nominal. Each amortization schedule should include the following: Total principal paid (including down payment) Total interest paid Interest paid each period Principal paid each period Example Table Principal $2.000 TotalInterest Paid $9.16 Down Payment $5.00 Total Principal Paid $2.000,00 Annual interest Rate 1.00 Months 10 Payment $200.42 Principal Month Balance (1) Interest Payment Balance (t Paid 1 $1,995.00 $1.66 $198.75 $200.42 $1.79.25 Z $1,796 25 $2.50 $198.92 $200.42 $1.597.33 3 $1,597 33 $1.33 $199.08 $200.42 $1.398.24 4 $1.298.24 $1.27 $199.25 $200.42 $1,198.991 5 $1.198.99 $1.00 $199.42 $200.42 $999.58 6 $999.58 $0.33 $199.58 $200.42 $799.99 7 $799.99 $0.57 $199.75 $200.42 $500.25 8 $500 25 $0.50 $199.92 $200.42 $400.33 9 $400.33 $0.33 $200.08 $200.42 $200.251 20 $200 25 $0.27 $200.25 $200.42 $0.00 Deliverables: One .xlsx file with three amortization tables. You may put each table in an independent worksheet or in one worksheet Sheet1 Sheet2 Sheet3 Description: Develop an amortization schedule for a car loan and see how changing the terms of the loan (length, interest rate) will affect how much is ultimately paid for the vehicle. Directions: The vehicle you will be evaluating is a Ford F-150 XL, with a listed MSRP of $28,745. Assume that the MSRP is the selling price and neglect fees, taxes, and incentives, then generate amortization schedule for the following scenarios. Length (Months) 48 APR (Nominal) Down Payment 1.90% 10% 5.90% 10% 72 Find your own interest rate: Additionally, generate an amortization schedule using loan terms that you have found through your bank or an online provider for 60 months and whatever interest rate that you can qualify for. Neglect any fees and assume a down payment of 10%. If a loan does not state whether the APR is nominal or effective, assume that the advertised APR is nominal. Each amortization schedule should include the following: Total principal paid (including down payment) Total interest paid Interest paid each period Principal paid each period Example Table Principal $2.000 TotalInterest Paid $9.16 Down Payment $5.00 Total Principal Paid $2.000,00 Annual interest Rate 1.00 Months 10 Payment $200.42 Principal Month Balance (1) Interest Payment Balance (t Paid 1 $1,995.00 $1.66 $198.75 $200.42 $1.79.25 Z $1,796 25 $2.50 $198.92 $200.42 $1.597.33 3 $1,597 33 $1.33 $199.08 $200.42 $1.398.24 4 $1.298.24 $1.27 $199.25 $200.42 $1,198.991 5 $1.198.99 $1.00 $199.42 $200.42 $999.58 6 $999.58 $0.33 $199.58 $200.42 $799.99 7 $799.99 $0.57 $199.75 $200.42 $500.25 8 $500 25 $0.50 $199.92 $200.42 $400.33 9 $400.33 $0.33 $200.08 $200.42 $200.251 20 $200 25 $0.27 $200.25 $200.42 $0.00 Deliverables: One .xlsx file with three amortization tables. You may put each table in an independent worksheet or in one worksheet Sheet1 Sheet2 Sheet3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts