Question: Description of Stanleys Operations Stankus-Wolf Electronics is a midsized electronics manufacturer located in Tampa, Florida. The company president is Alison Lyons, who inherited the company.

Description of Stanleys Operations

Stankus-Wolf Electronics is a midsized electronics manufacturer located in Tampa, Florida. The company president is Alison Lyons, who inherited the company. The company originally repaired radios and other household appliances when it was founded more than 70 years ago. Over the years, the company has expanded, and it is now a reputable manufacturer of various specialty electronic items. Derek Rigsby, a recent MBA graduate, has been hired by the company in its finance department.

One of the major revenue-producing items manufactured by Stankus-Wolf Electronics is a smartphone. Stankus-Wolf Electronics currently has one smartphone model on the market and sales have been excellent. The smartphone is a unique item in that it comes in a variety of vibrant colors and is preprogrammed to play Taylor Swift music. However, as with any electronic item, technology changes rapidly, and the current smartphone has limited features in comparison with newer models. Stankus-Wolf Electronics spent $1.8 million to develop a prototype for a new smartphone that has all the features of the existing one but adds new features such as Wifi tethering. The company also spent $355,000 for a marketing study to determine the expected sales figures for the new smartphone.

Stankus-Wolf Electronics can manufacture the new smartphone for $375 each in variable costs. Fixed costs for the operation are estimated to run $6.8 million per year. The estimated sales volumes are 73,200, 86,200, 105,250, 97,300, and 67,400 per year for each of the next five years, respectively. The unit price of the new smartphone will be $855. The necessary equipment can be purchased for $42.75 million and will be depreciated on a seven-year MACRS schedule. It is believed the value of the equipment in five years will be $5.8 million.

Net working capital (NWC) for the smartphone will be 20 percent of sales and will occur with the timing of the cash flows for the year (i.e. there is no initial outlay for the NWC).

Case study3:

Your firm has audited Stanley Inc. for the past 6 years and the management letter each year has revealed several control deficiencies. While your firm has identified several errors in the financial statements in the past, management always agreed to some of the adjustments your firm identified as material and accordingly have always received an unqualified opinion.

The draft audit report is dated March 15, 2022.

Exhibit 1

Description of Stanleys Operations

Stanley Inc. is a privately held company that was founded in 2007 by Andy Summer, who is also Stanleys CEO. In 2007 Andy sold 25% of his company to a group of private investors. The investors receive quarterly dividends that are calculated based upon a combination of sales and net income. The investors, all experienced business-people, serve as Andys board of directors and give him advice on the strategic direction of the company. The Board relies on the external audit to provide them with assurance that their dividends are based on reliable figures.

Stanley buys computers and related equipment in bulk at wholesale prices and resells these items at a markup to a loyal base of corporate customers. While this is a competitive industry, demand is growing and Stanley stands out with its excellent customer service. Andy is very involved in most of the operating decisions. To ensure staff continue to provide excellent customer service and act with integrity, he plans to implement a code of ethics at some point in the future.

Stanley operates five warehouses, each carrying a mix of inventory items. In total there are three main categories of inventory, including:

- computer hardware standard

- computer parts and peripherals and

- computer software.

The first type of inventory, computer hardware, consists of specialized computer hardware, desktop computers, and laptop computers. This inventory is more costly than other types of inventories. While it generates a higher profit margin, new technology is always emerging that customers are asking for. Because the company makes inventory orders months in advance, Stanley occasionally overestimates demand. After three or four months products are usually difficult to sell, but they are kept because most can be returned to the supplier.

The second type of inventory relates to standard computer parts and peripherals, such as monitor and printers. This type of inventory generates a significant portion of Stanleys sales. The third type of inventory is software, ranging from operating systems to business applications (such as financial reporting software).

This year, Stanley implemented an integrated computer system to manage the general ledger as well as inventory, purchases, and sales. The system was developed by external consultants and is maintained by Stanleys IT department. Stanley is confident that this new system will result in more accurate financial information and statements.

To help retain the sales team and motivate and retain senior management, in April 2021 the Board approved a bonus scheme for the sales team and senior management based on sales as an added form of compensation. Help the finance team to determine Gross profit ratio for 2021 and 2020.

On May 30, 2021 Monica Fung was hired as the controller and reported to the CEO. Monica replaced the previous controller who had resigned suddenly in early February 2021 as a result of a dispute he had with the CEO. Monica is a CPA who last worked fulltime in an accounting firm in 2016 where she obtained her accounting designation. Since that time Monica has focused her efforts on staying at home and raising her children. The CEO knew Monica from his days at the business at a Canadian and decided to hire Monica as the controller as she was looking to start working fulltime again and was available immediately to start work at Stanley Inc.

Monica prepares monthly financial statements for the CEO. She also compares budget versus actual results and highlights all large variances. However, to date the CEO has not followed up with her for any explanations for any large variances between actual and budget.

The amount of damaged inventory has been gradually increasing over the past eight months. Damaged inventory has been piling up in a corner of the warehouse. The CEO suggested holding a liquidation sale to get rid of this inventory to free up space in the warehouse.

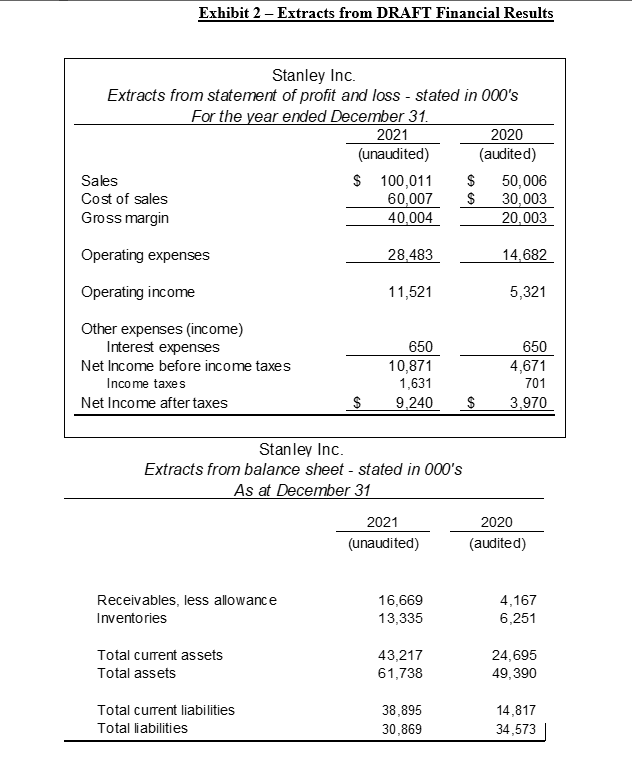

Exhibit 2 Extracts from DRAFT Financial Results

SECTIONS FROM THE AUDIT TRAINEEs AUDIT FILE

Part E

The audit procedures relating to obtaining a client representation letter, review for contingent liabilities and review for subsequent events were as follows:

Obtaining a Client Representation Letter

A client representation letter was received from the client dated February 15, 2022. The letter was signed off by Monica Fung. Andy Summer, refused to sign the letter as he said he was not familiar with the accounting standards for private enterprises (ASPE) and accordingly felt he was not in a position to state that the financial statements were fairly presented in all material respects in accordance with ASPE.

Review for Contingent Liabilities

The controller sent out a legal letter to the companys lawyers asking them to confirm as at March 5, 2022 whether there were any claims outstanding against Stanley Inc. As of March 15h, no response has been received. Based upon our review of legal expenses and discussion with management, there are no outstanding claims. No further work is necessary.

Review for Subsequent Events

In order to ensure no subsequent events took place after December 31, 2021 the trainee reviewed the draft Board minutes for January and February 2022 and didnt note anything of significance. No further work was considered necessary. Help finance team to find current ratio for 2020 and 2021.

Exhibit 2 - Extracts from DRAFT Financial Results

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts