Question: Description Using the Casa Felix proforma (JLL report from week #1 page 25 ) make the following assumptions: - Loan to cost (LTC) =80% -

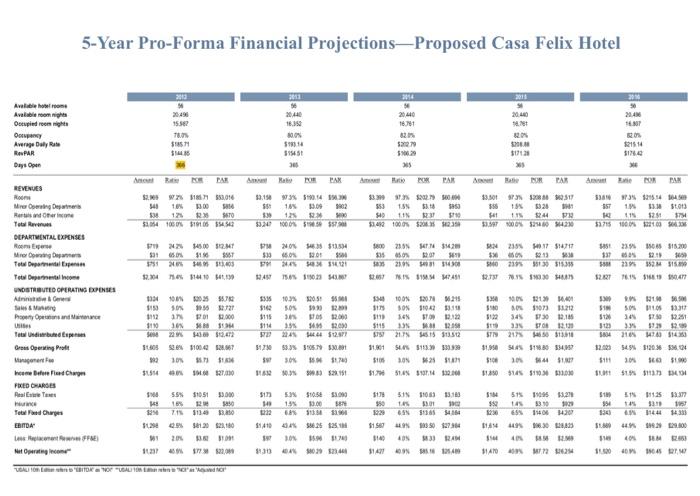

Description Using the Casa Felix proforma (JLL report from week \#1 page 25 ) make the following assumptions: - Loan to cost (LTC) =80% - Stabilization year =2016 - Total project cost =$900 per square feet - Construction time =3 years Calculate the profit at the deal level, equity multiple, and annualized rate of return for the following three scenarios: 1. Pessimistic Case: gross sellout =5 times 2016 NOI, 2. Base Case: gross sellout =7 times 2016NOI 3. Optimistic Case: gross sellout =10 times 2016 NOI. 5-Year Pro-Forma Financial Projections-Proposed Casa Felix Hotel Description Using the Casa Felix proforma (JLL report from week \#1 page 25 ) make the following assumptions: - Loan to cost (LTC) =80% - Stabilization year =2016 - Total project cost =$900 per square feet - Construction time =3 years Calculate the profit at the deal level, equity multiple, and annualized rate of return for the following three scenarios: 1. Pessimistic Case: gross sellout =5 times 2016 NOI, 2. Base Case: gross sellout =7 times 2016NOI 3. Optimistic Case: gross sellout =10 times 2016 NOI. 5-Year Pro-Forma Financial Projections-Proposed Casa Felix Hotel

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts