Question: Design a program that calculates and prints the payroll amounts for an employee. It accepts the hourly rate and number of hours worked. It calculates

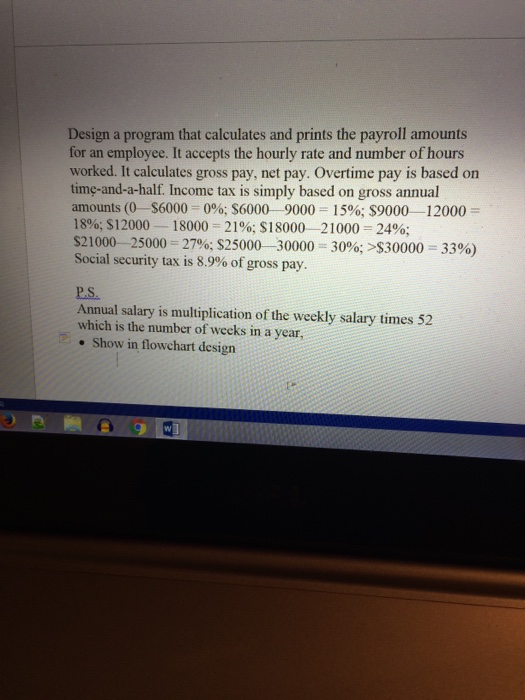

Design a program that calculates and prints the payroll amounts for an employee. It accepts the hourly rate and number of hours worked. It calculates gross pay, net pay. Overtime pay is based on time-and-a-half. Income tax is simply based on gross annual amounts (0-$6000-0%; $6000-9000-15%; $9000-12000 = 18%; $12000-18000-21%; $18000-21000 24%; S21000-25000 = 27%:S25000-30000-30002530000-3300) Social security tax is 8.9% of gross pay. P.S. Annual salary is multiplication of the weekly salary times 52 which is the number of weeks in a year, . Show in flowchart design

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts