Question: Desperately need help Problem - Cash dividends, treasury stock, and statement of ratained earnings - XYZ Corporation operates it Tampa, Florida and reports the following

Desperately need help

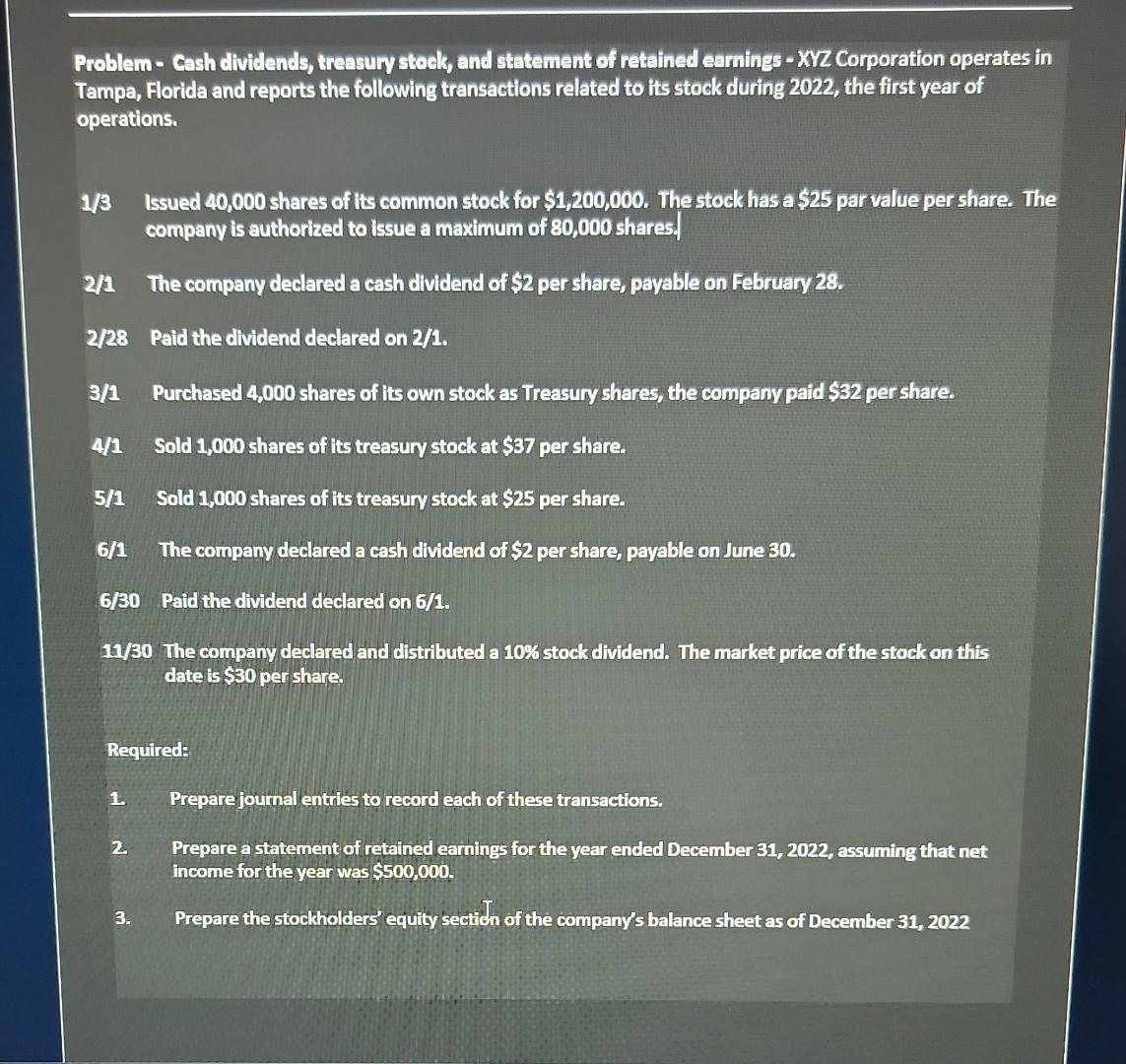

Problem - Cash dividends, treasury stock, and statement of ratained earnings - XYZ Corporation operates it Tampa, Florida and reports the following transactions related to its stock during 2022, the first year of operations. 1/3 Issued 40,000 shares of its common stock for $1,200,000. The stock has a $25 par value per share. Th company is authorized to issue a maximum of 80,000 shares. 2/1 The company declared a cash dividend of $2 per share, payable on February 28. 2/28 Paid the dividend declared on 2/1. 3/1 Purchased 4,000 shares of its own stock as Treasury shares, the company paid $32 per share. 4/1 Sold 1,000 shares of its treasury stock at $37 per share. 5/1 Sold 1,000 shares of its treasury stock at $25 per share. 6/1 The company declared a cash dividend of $2 per share, payable on June 30. 6/30 Paid the dividend declared on 6/1. 11/30 The company declared and distributed a 10\% stock dividend. The market price of the stock on this date is $30 per share. Required: 1. Prepare journal entries to record each of these transactions. 2. Prepare a statement of retained earnings for the year ended December 31, 2022, assuming that net income for the year was $500,000. 3. Prepare the stockholders' equity section of the company's balance sheet as of December 31, 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts