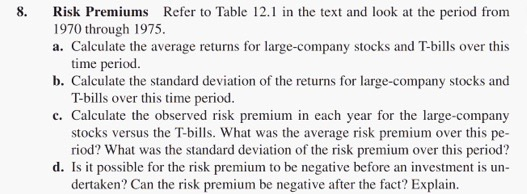

Question: Detailed problem solving steps are required 8. Risk Premiums Refer to Table 12.1 in the text and look at the period from 1970 through 1975.

Detailed problem solving steps are required

Detailed problem solving steps are required8. Risk Premiums Refer to Table 12.1 in the text and look at the period from 1970 through 1975. a. Calculate the average returns for large-company stocks and T-bills over this time period. b. Calculate the standard deviation of the returns for large-company stocks and T-bills over this time period. c. Calculate the observed risk premium in each year for the large-company stocks versus the T-bills. What was the average risk premium over this pe- riod? What was the standard deviation of the risk premium over this period? d. Is it possible for the risk premium to be negative before an investment is un- dertaken? Can the risk premium be negative after the fact? Explain. 8. Risk Premiums Refer to Table 12.1 in the text and look at the period from 1970 through 1975. a. Calculate the average returns for large-company stocks and T-bills over this time period. b. Calculate the standard deviation of the returns for large-company stocks and T-bills over this time period. c. Calculate the observed risk premium in each year for the large-company stocks versus the T-bills. What was the average risk premium over this pe- riod? What was the standard deviation of the risk premium over this period? d. Is it possible for the risk premium to be negative before an investment is un- dertaken? Can the risk premium be negative after the fact? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts