Question: detailed solution Case study 2 - Mortgages Mr. and Mrs. Cavern and their three children live in their own home at 25 Selvac Ave, on

detailed solution

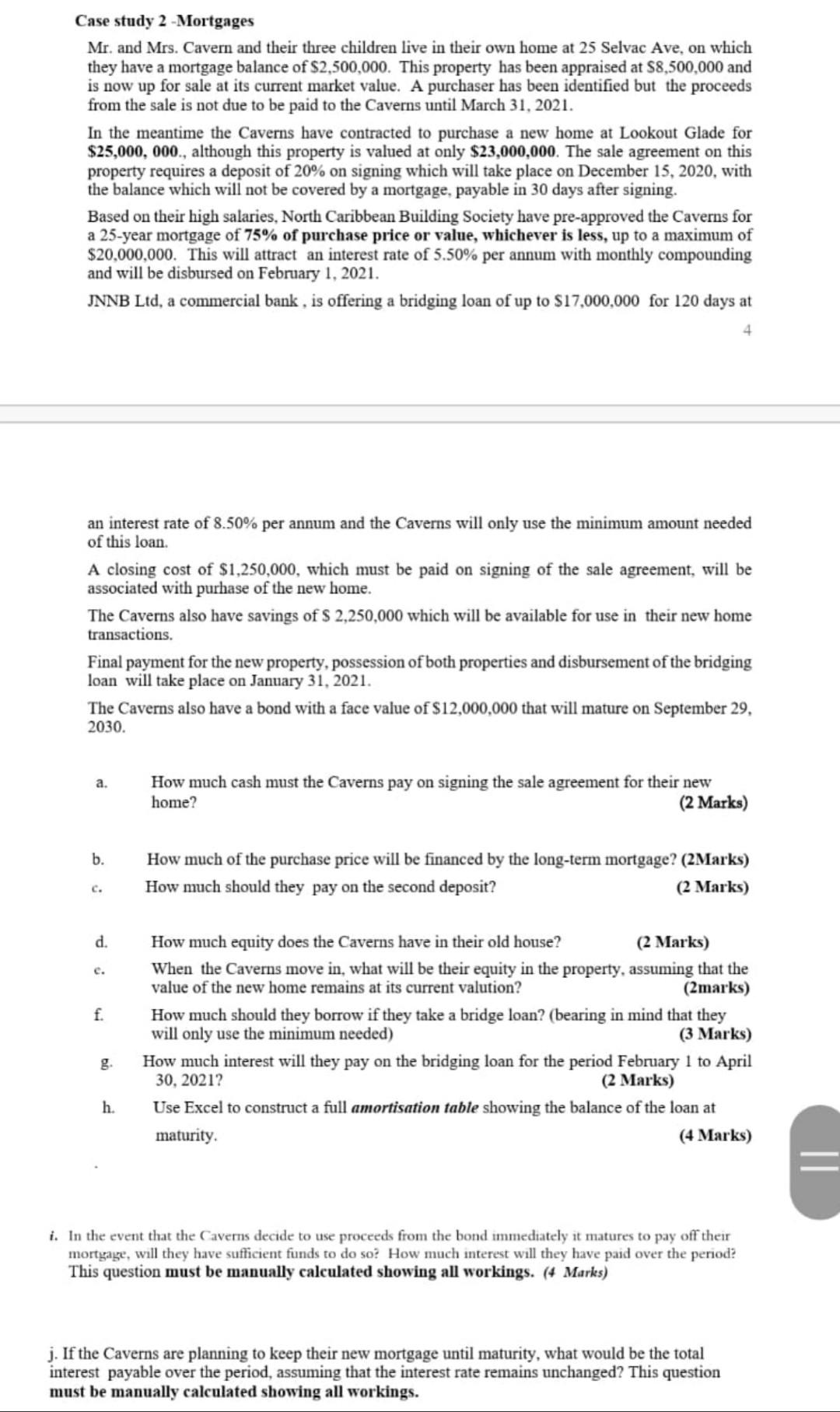

Case study 2 - Mortgages Mr. and Mrs. Cavern and their three children live in their own home at 25 Selvac Ave, on which they have a mortgage balance of $2,500,000. This property has been appraised at 88,500,000 and is now up for sale at its current market value. A purchaser has been identified but the proceeds from the sale is not due to be paid to the Caverns until March 31, 2021. In the meantime the Caverns have contracted to purchase a new home at Lookout Glade for $25,000,000., although this property is valued at only $23,000,000. The sale agreement on this property requires a deposit of 20% on signing which will take place on December 15, 2020, with the balance which will not be covered by a mortgage payable in 30 days after signing. Based on their high salaries, North Caribbean Building Society have pre-approved the Caverns for a 25-year mortgage of 75% of purchase price or value, whichever is less, up to a maximum of $20,000,000. This will attract an interest rate of 5.50% per annum with monthly compounding and will be disbursed on February 1, 2021. JNNB Ltd, a commercial bank, is offering a bridging loan of up to $17,000,000 for 120 days at 4 an interest rate of 8.50% per annum and the Caverns will only use the minimum amount needed of this loan A closing cost of $1,250,000, which must be paid on signing of the sale agreement, will be associated with purhase of the new home. The Caverns also have savings of $ 2,250,000 which will be available for use in their new home transactions. Final payment for the new property, possession of both properties and disbursement of the bridging loan will take place on January 31, 2021. The Caverns also have a bond with a face value of $12,000,000 that will mature on September 29, 2030. a. How much cash must the Caverns pay on signing the sale agreement for their new home? (2 Marks) b. How much of the purchase price will be financed by the long-term mortgage? (2Marks) How much should they pay on the second deposit? (2 Marks) C. d. C. f. How much equity does the Caverns have in their old house? (2 Marks) When the Caverns move in, what will be their equity in the property, assuming that the value of the new home remains at its current valution? (2 marks) How much should they borrow if they take a bridge loan? (bearing in mind that they will only use the minimum needed) (3 Marks) How much interest will they pay on the bridging loan for the period February 1 to April 30, 2021? (2 Marks) Use Excel to construct a full amortisation table showing the balance of the loan at maturity (4 Marks) h. i. In the event that the Caverns decide to use proceeds from the bond immediately it matures to pay off their mortgage, will they have sufficient funds to do so? How much interest will they have paid over the period This question must be manually calculated showing all workings. (4 Marks) j. If the Caverns are planning to keep their new mortgage until maturity, what would be the total interest payable over the period, assuming that the interest rate remains unchanged? This question must be manually calculated showing all workings. Case study 2 - Mortgages Mr. and Mrs. Cavern and their three children live in their own home at 25 Selvac Ave, on which they have a mortgage balance of $2,500,000. This property has been appraised at 88,500,000 and is now up for sale at its current market value. A purchaser has been identified but the proceeds from the sale is not due to be paid to the Caverns until March 31, 2021. In the meantime the Caverns have contracted to purchase a new home at Lookout Glade for $25,000,000., although this property is valued at only $23,000,000. The sale agreement on this property requires a deposit of 20% on signing which will take place on December 15, 2020, with the balance which will not be covered by a mortgage payable in 30 days after signing. Based on their high salaries, North Caribbean Building Society have pre-approved the Caverns for a 25-year mortgage of 75% of purchase price or value, whichever is less, up to a maximum of $20,000,000. This will attract an interest rate of 5.50% per annum with monthly compounding and will be disbursed on February 1, 2021. JNNB Ltd, a commercial bank, is offering a bridging loan of up to $17,000,000 for 120 days at 4 an interest rate of 8.50% per annum and the Caverns will only use the minimum amount needed of this loan A closing cost of $1,250,000, which must be paid on signing of the sale agreement, will be associated with purhase of the new home. The Caverns also have savings of $ 2,250,000 which will be available for use in their new home transactions. Final payment for the new property, possession of both properties and disbursement of the bridging loan will take place on January 31, 2021. The Caverns also have a bond with a face value of $12,000,000 that will mature on September 29, 2030. a. How much cash must the Caverns pay on signing the sale agreement for their new home? (2 Marks) b. How much of the purchase price will be financed by the long-term mortgage? (2Marks) How much should they pay on the second deposit? (2 Marks) C. d. C. f. How much equity does the Caverns have in their old house? (2 Marks) When the Caverns move in, what will be their equity in the property, assuming that the value of the new home remains at its current valution? (2 marks) How much should they borrow if they take a bridge loan? (bearing in mind that they will only use the minimum needed) (3 Marks) How much interest will they pay on the bridging loan for the period February 1 to April 30, 2021? (2 Marks) Use Excel to construct a full amortisation table showing the balance of the loan at maturity (4 Marks) h. i. In the event that the Caverns decide to use proceeds from the bond immediately it matures to pay off their mortgage, will they have sufficient funds to do so? How much interest will they have paid over the period This question must be manually calculated showing all workings. (4 Marks) j. If the Caverns are planning to keep their new mortgage until maturity, what would be the total interest payable over the period, assuming that the interest rate remains unchanged? This question must be manually calculated showing all workings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts