Question: detailed solution for question 31 and 32 please Use this information about TNT Corporation for the next three questions, 31-33. Currently, TNT's balance sheet is

detailed solution for question 31 and 32 please

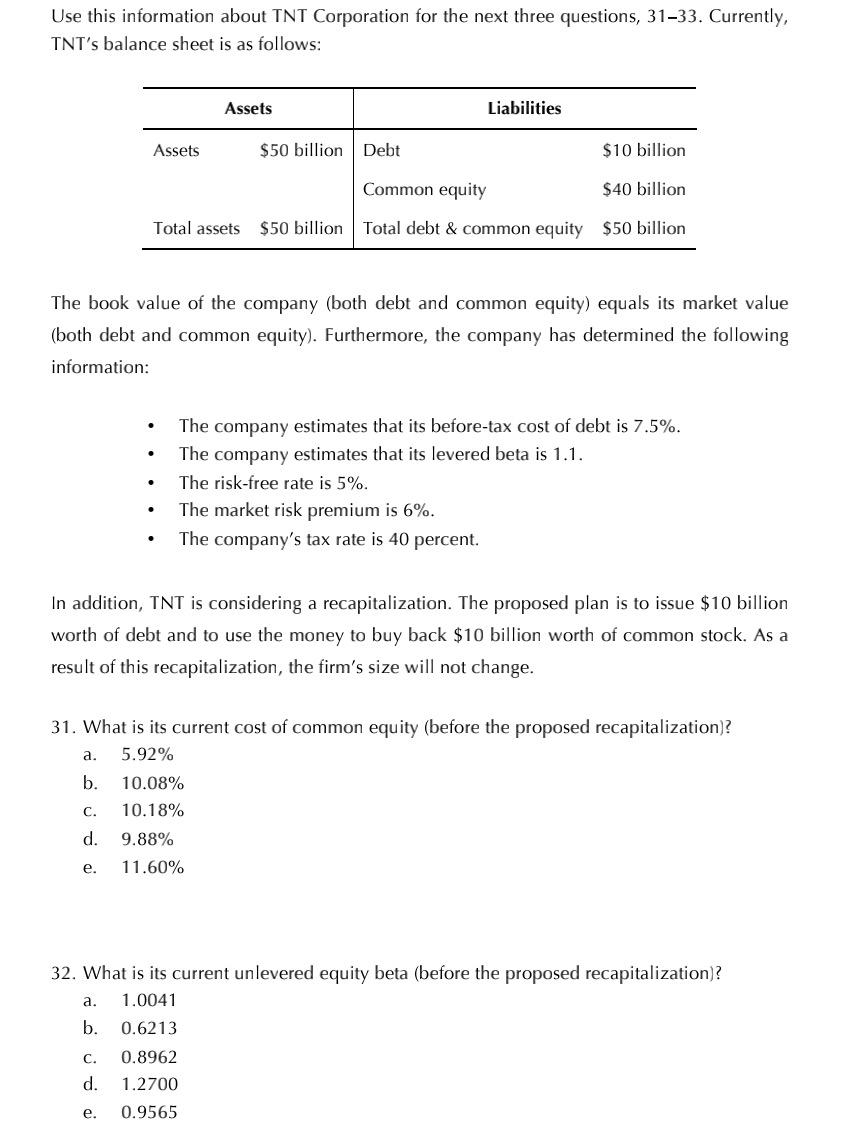

Use this information about TNT Corporation for the next three questions, 31-33. Currently, TNT's balance sheet is as follows: Assets Liabilities Assets $50 billion Debt $10 billion Common equity $40 billion Total assets $50 billion Total debt & common equity $50 billion The book value of the company (both debt and common equity) equals its market value (both debt and common equity). Furthermore, the company has determined the following information: . The company estimates that its before-tax cost of debt is 7.5%. The company estimates that its levered beta is 1.1. The risk-free rate is 5%. The market risk premium is 6%. The company's tax rate is 40 percent. In addition, TNT is considering a recapitalization. The proposed plan is to issue $10 billion worth of debt and to use the money to buy back $10 billion worth of common stock. As a result of this recapitalization, the firm's size will not change. 31. What is its current cost of common equity (before the proposed recapitalization)? a. 5.92% b. 10.08% c. 10.18% d. 9.88% 11.60% e. 32. What is its current unlevered equity beta (before the proposed recapitalization)? 1.0041 a. b. C. 0.6213 0.8962 1.2700 0.9565 d. e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts