Question: detailed solution please Firm X is considering two projects with different levels of risk. Project A is a low- risk project with an estimated beta

detailed solution please

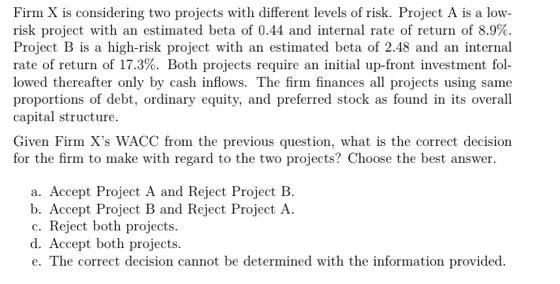

Firm X is considering two projects with different levels of risk. Project A is a low- risk project with an estimated beta of 0.44 and internal rate of return of 8.9%. Project B is a high-risk project with an estimated beta of 2.48 and an internal rate of return of 17.3%. Both projects require an initial up-front investment fol- lowed thereafter only by cash inflows. The firm finances all projects using same proportions of debt, ordinary equity, and preferred stock as found in its overall capital structure. Given Firm X's WACC from the previous question, what is the correct decision for the firm to make with regard to the two projects? Choose the best answer. a. Accept Project A and Reject Project B. b. Accept Project B and Reject Project A. c. Reject both projects. d. Accept both projects. e. The correct decision cannot be determined with the information provided. Firm X is considering two projects with different levels of risk. Project A is a low- risk project with an estimated beta of 0.44 and internal rate of return of 8.9%. Project B is a high-risk project with an estimated beta of 2.48 and an internal rate of return of 17.3%. Both projects require an initial up-front investment fol- lowed thereafter only by cash inflows. The firm finances all projects using same proportions of debt, ordinary equity, and preferred stock as found in its overall capital structure. Given Firm X's WACC from the previous question, what is the correct decision for the firm to make with regard to the two projects? Choose the best answer. a. Accept Project A and Reject Project B. b. Accept Project B and Reject Project A. c. Reject both projects. d. Accept both projects. e. The correct decision cannot be determined with the information provided

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts