Question: Details and Rubric Prepare this Assignment responding to the problems as a Word document. Number each question, followed by your answer. Problems: 1. Complete problem:

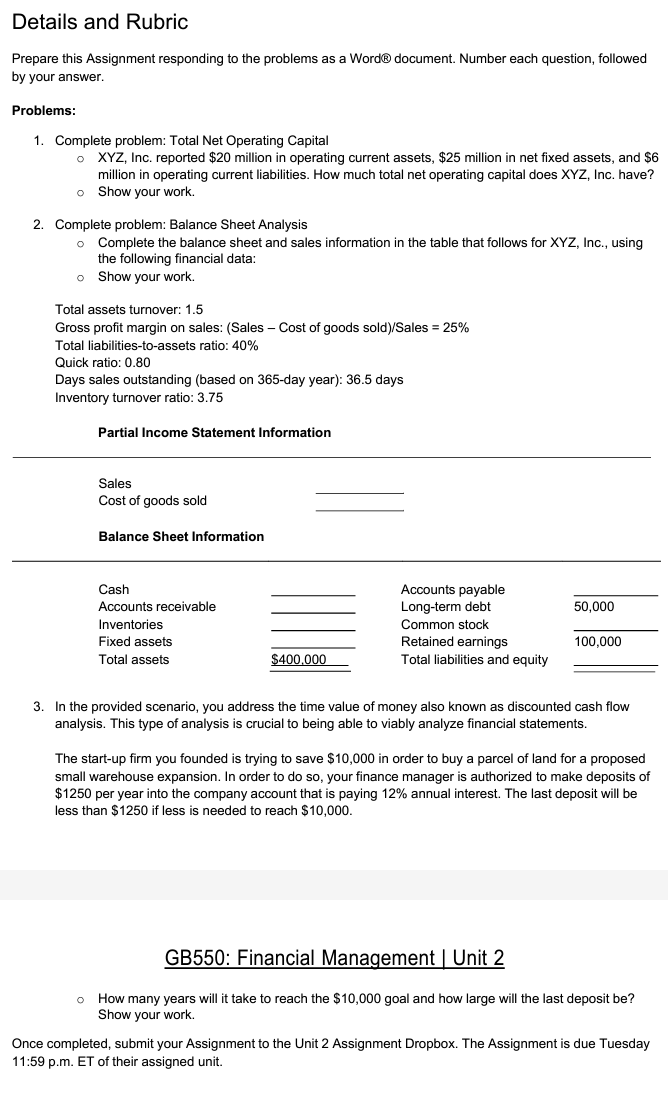

Details and Rubric Prepare this Assignment responding to the problems as a Word document. Number each question, followed by your answer. Problems: 1. Complete problem: Total Net Operating Capital XYZ, Inc. reported $20 million in operating current assets, $25 million in net fixed assets, and $6 million in operating current liabilities. How much total net operating capital does XYZ, Inc. have? Show your work. 2. Complete problem: Balance Sheet Analysis - Complete the balance sheet and sales information in the table that follows for XYZ, Inc., using the following financial data: Show your work. Total assets turnover: 1.5 Gross profit margin on sales: (Sales - Cost of goods sold) / Sales =25% Total liabilities-to-assets ratio: 40% Quick ratio: 0.80 Days sales outstanding (based on 365-day year): 36.5 days Inventory turnover ratio: 3.75 Dartial Inrnma Gtatomant lnfinmatinn - 3. In the provided scenario, you address the time value of money also known as discounted cash flow analysis. This type of analysis is crucial to being able to viably analyze financial statements. The start-up firm you founded is trying to save $10,000 in order to buy a parcel of land for a proposed small warehouse expansion. In order to do so, your finance manager is authorized to make deposits of $1250 per year into the company account that is paying 12% annual interest. The last deposit will be less than $1250 if less is needed to reach $10,000. GB550: Financial Management | Unit 2 How many years will it take to reach the $10,000 goal and how large will the last deposit be? Show your work. Once completed, submit your Assignment to the Unit 2 Assignment Dropbox. The Assignment is due Tuesday 11:59 p.m. ET of their assigned unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts