Question: Determine Chemcos expected operating income based on the static budget. Determine Chemcos actual operating income for the period. Determine what Chemcos operating income should have

- Determine Chemcos expected operating income based on the static budget.

- Determine Chemcos actual operating income for the period.

- Determine what Chemcos operating income should have been for the period. (i.e. prepare the flexible budget)

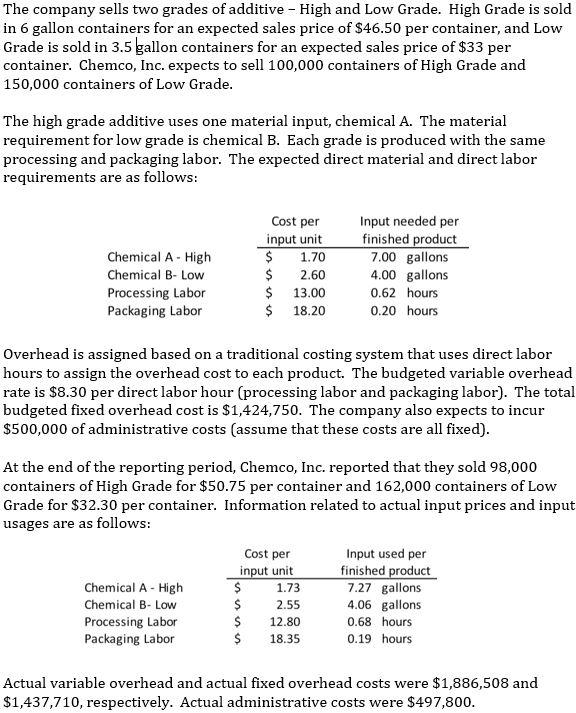

The company sells two grades of additive - High and Low Grade. High Grade is sold in 6 gallon containers for an expected sales price of $46.50 per container, and Low Grade is sold in 3.5 gallon containers for an expected sales price of $33 per container. Chemco, Inc. expects to sell 100,000 containers of High Grade and 150,000 containers of Low Grade. The high grade additive uses one material input, chemical A. The material requirement for low grade is chemical B. Each grade is produced with the same processing and packaging labor. The expected direct material and direct labor requirements are as follows: Chemical A - High Chemical B- Low Processing Labor Packaging Labor Cost per input unit $ 1.70 $ 2.60 $ 13.00 $ 18.20 Input needed per finished product 7.00 gallons 4.00 gallons 0.62 hours 0.20 hours Overhead is assigned based on a traditional costing system that uses direct labor hours to assign the overhead cost to each product. The budgeted variable overhead rate is $8.30 per direct labor hour (processing labor and packaging labor). The total budgeted fixed overhead cost is $1,424,750. The company also expects to incur $500,000 of administrative costs (assume that these costs are all fixed). At the end of the reporting period, Chemco, Inc. reported that they sold 98,000 containers of High Grade for $50.75 per container and 162,000 containers of Low Grade for $32.30 per container. Information related to actual input prices and input usages are as follows: Cost per Input used per input unit finished product Chemical A - High $ 1.73 7.27 gallons Chemical B-Low $ 2.55 4.06 gallons Processing Labor $ 0.68 hours Packaging Labor $ 0.19 hours 12.80 18.35 Actual variable overhead and actual fixed overhead costs were $1,886,508 and $1,437,710, respectively. Actual administrative costs were $497,800. The company sells two grades of additive - High and Low Grade. High Grade is sold in 6 gallon containers for an expected sales price of $46.50 per container, and Low Grade is sold in 3.5 gallon containers for an expected sales price of $33 per container. Chemco, Inc. expects to sell 100,000 containers of High Grade and 150,000 containers of Low Grade. The high grade additive uses one material input, chemical A. The material requirement for low grade is chemical B. Each grade is produced with the same processing and packaging labor. The expected direct material and direct labor requirements are as follows: Chemical A - High Chemical B- Low Processing Labor Packaging Labor Cost per input unit $ 1.70 $ 2.60 $ 13.00 $ 18.20 Input needed per finished product 7.00 gallons 4.00 gallons 0.62 hours 0.20 hours Overhead is assigned based on a traditional costing system that uses direct labor hours to assign the overhead cost to each product. The budgeted variable overhead rate is $8.30 per direct labor hour (processing labor and packaging labor). The total budgeted fixed overhead cost is $1,424,750. The company also expects to incur $500,000 of administrative costs (assume that these costs are all fixed). At the end of the reporting period, Chemco, Inc. reported that they sold 98,000 containers of High Grade for $50.75 per container and 162,000 containers of Low Grade for $32.30 per container. Information related to actual input prices and input usages are as follows: Cost per Input used per input unit finished product Chemical A - High $ 1.73 7.27 gallons Chemical B-Low $ 2.55 4.06 gallons Processing Labor $ 0.68 hours Packaging Labor $ 0.19 hours 12.80 18.35 Actual variable overhead and actual fixed overhead costs were $1,886,508 and $1,437,710, respectively. Actual administrative costs were $497,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts